As the housing market in Abilene experiences notable shifts, it’s crucial to stay informed and adapt to the evolving conditions. In this blog, we’ll discuss the changing market trends and provide valuable guidance for both sellers and buyers.

Market Analysis:

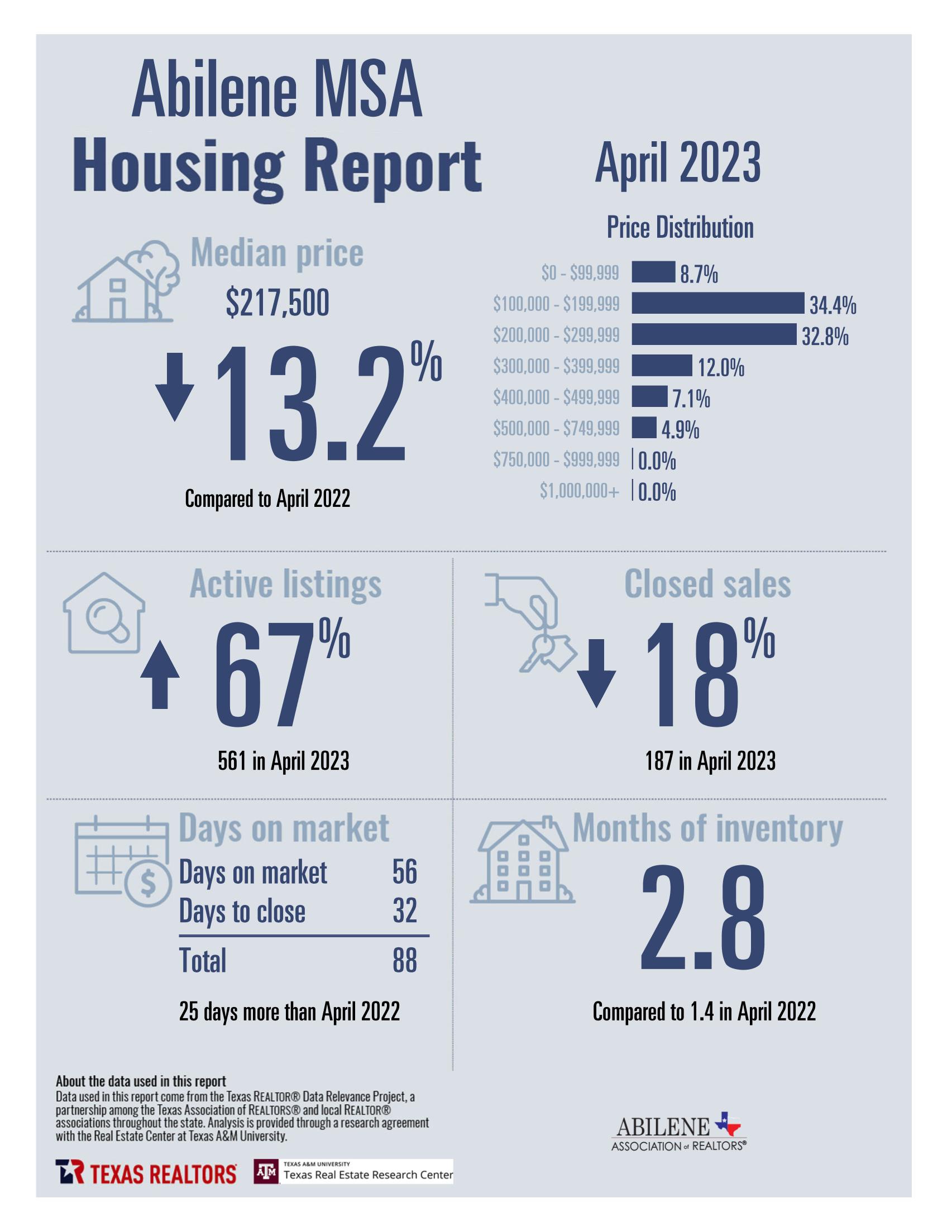

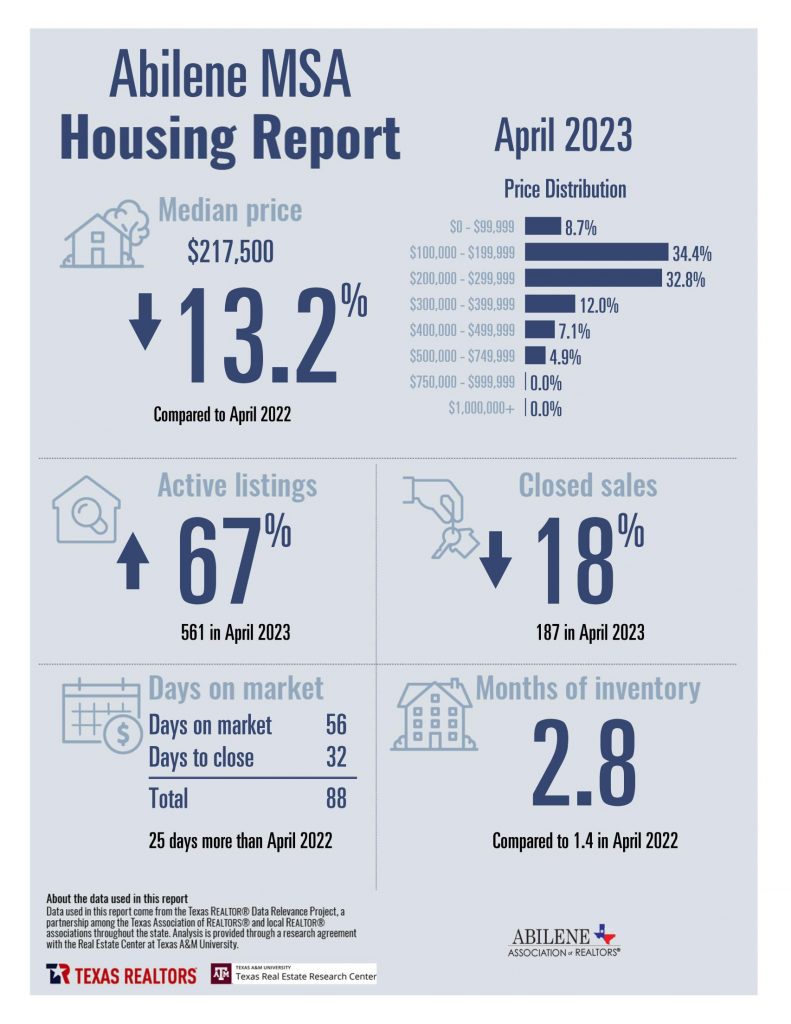

1. Increased listing inventory: We’ve observed a substantial rise in available listings, indicating a more competitive market environment.

2. Slight pullback in sales prices: While prices have experienced a minor adjustment, it’s important to note that certain price ranges continue to demonstrate resilience.

3. Impact of interest rates and banking turmoil: Buyer activity may have been tempered by fluctuations in interest rates and banking uncertainties.

Seller Recommendations:

1. Align expectations with market conditions: If your home falls outside the updated and well-maintained criteria within the desirable price range, it’s time to reassess pricing and be realistic about your selling prospects.

2. Prioritize curb appeal and updates: Enhancing your home’s curb appeal and making necessary updates are key factors in attracting buyers in the current market. Work with your REALTOR to identify areas for improvement.

3. Price competitively: Setting the right price based on current market dynamics is crucial for attracting potential buyers and expediting the selling process.

Buyer Guidance:

1. Interest rate outlook: It is anticipated that interest rates will remain around 6% or potentially lower by year-end. However, it’s essential not to rely on substantial rate changes and base your financial planning accordingly.

2. Local lender recommendation: Work closely with a local lender recommended by your REALTOR to explore the diverse loan programs available. Establishing a strong relationship with a trusted lender can enhance your chances of securing favorable financing terms.

3. Property qualification and pre-approval: Avoid potential financing obstacles by obtaining a pre-qualified letter from a reputable local lender. Online pre-qualification may overlook critical information, whereas a thorough assessment from a trusted lender can strengthen your offer.

Conclusion:

Navigating the changing housing market requires adaptation and informed decision-making. By aligning expectations, enhancing your property’s appeal, and leveraging the expertise of your REALTOR and local lender, you can position yourself for success in this evolving market. Stay proactive, flexible, and responsive to emerging trends and opportunities. Contact us to get started!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link