It’s time to take a close look at the current state of the Abilene housing market. The past year has brought both challenges and opportunities, with shifting interest rates and home prices impacting the landscape. In this article, we’ll explore some of the key trends that are shaping the Abilene housing market and what they mean for buyers, sellers, and homeowners.

The Burden of Rising Interest Rates

One of the dominant forces influencing the Abilene housing market right now is the relentless climb of interest rates. While many anticipated a gradual retreat, we’ve observed quite the opposite. Interest rates have surged past the 7.5% mark, a level not seen in quite some time. The impact is substantial, especially for potential homebuyers. Those who are currently homeowners face a dilemma: they’d like to move to a new home, but the financial calculus between their existing low-rate mortgage and the potential higher costs in a new home doesn’t make sense. While we have seen interest rates in this range before, and indeed much higher, home prices were also substantially lower at that time as well.

Inventory and Pent-Up Demand

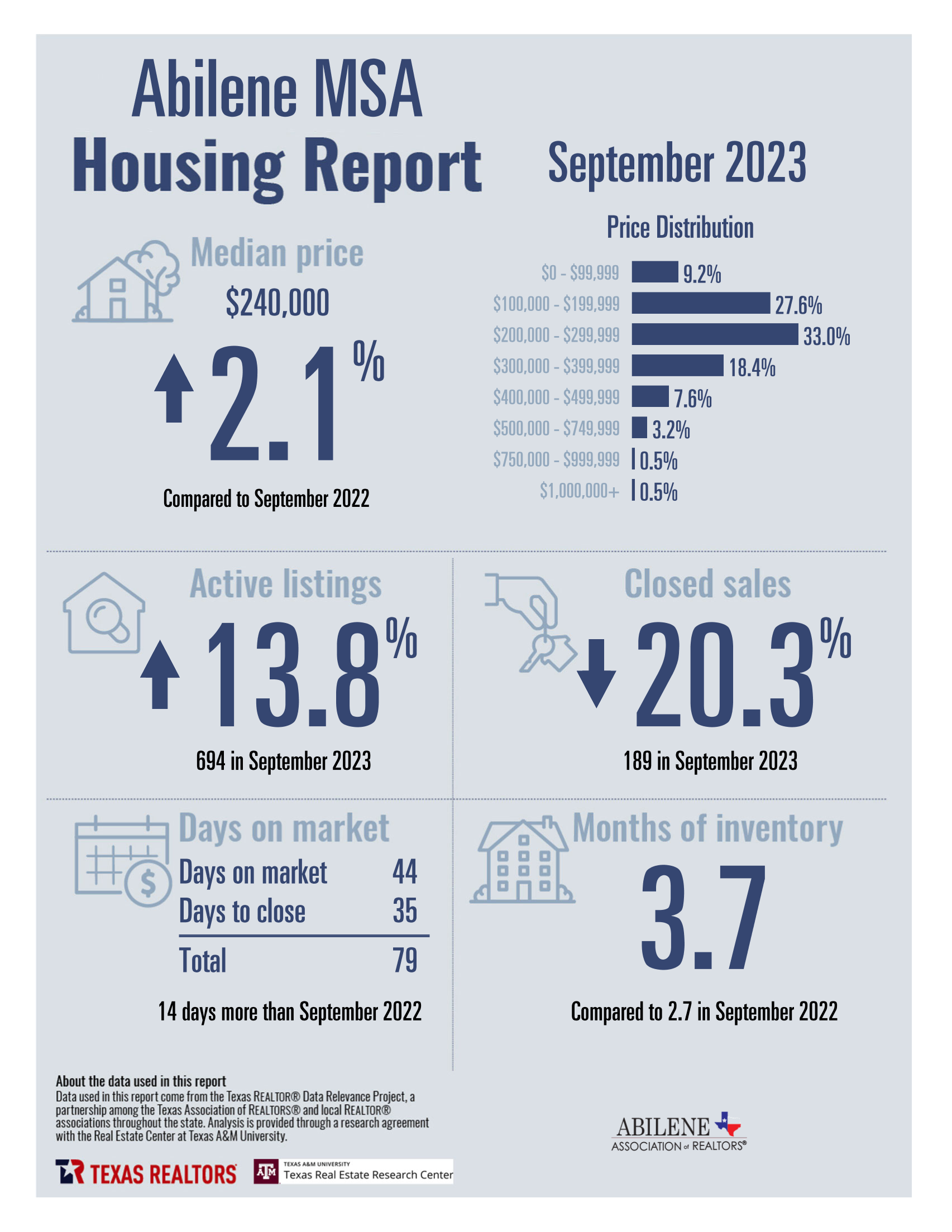

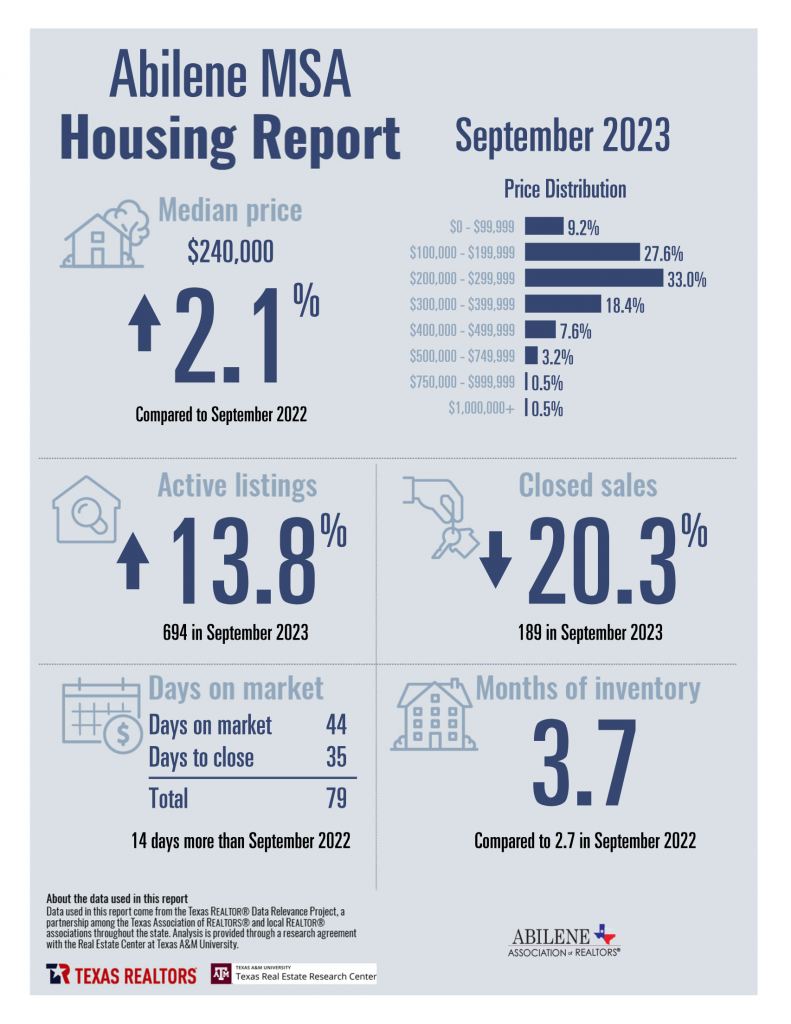

Currently, the housing market is blessed with what’s considered a relatively healthy inventory. This inventory is vital because when interest rates finally do start to recede, we’ll likely see a surge in demand. The pent-up demand from hesitant buyers waiting for more favorable rates will enter the market, and inventory will play a crucial role in meeting that demand.

Home Prices and the Path Forward

Home prices in Abilene have been relatively stable throughout the year, which aligns with many expectations. However, we anticipate that home prices will gradually return to a more historical norm, increasing by approximately 3% per year. This will be especially true if lower interest rates reignite buyer demand.

A Buyer’s Market with Opportunities

At present, Abilene is experiencing what can be classified as a buyer’s market. If you have the means and intent to buy a property, there are deals to be had. Seller concessions are at their highest point in years, providing buyers with valuable advantages, all while prices have remained largely unchanged from 2022.

Future of Mortgage Rates

Looking ahead to 2024, while it’s expected that mortgage rates will be more favorable, it’s unlikely that we’ll ever see the exceptionally low 3-4% interest rates that characterized the market in the past. Long-term, buyers who secure homes with higher interest rates should prepare for a future with rates ranging between 5-6%. The pandemic-era rates are unlikely to return, but favorable opportunities still exist for those who act strategically.

Conclusion

Navigating the housing market in Abilene, especially with the current state of interest rates, can be a complex endeavor. For personalized advice and tailored guidance, we encourage you to reach out to our team of experts. With decades of experience in the real estate industry, we are here to help you make well-informed decisions that align with your unique situation and aspirations. Whether you’re a first-time buyer, a seller, or a homeowner looking to refinance, our team is committed to providing the expertise you need to thrive in this ever-changing market.

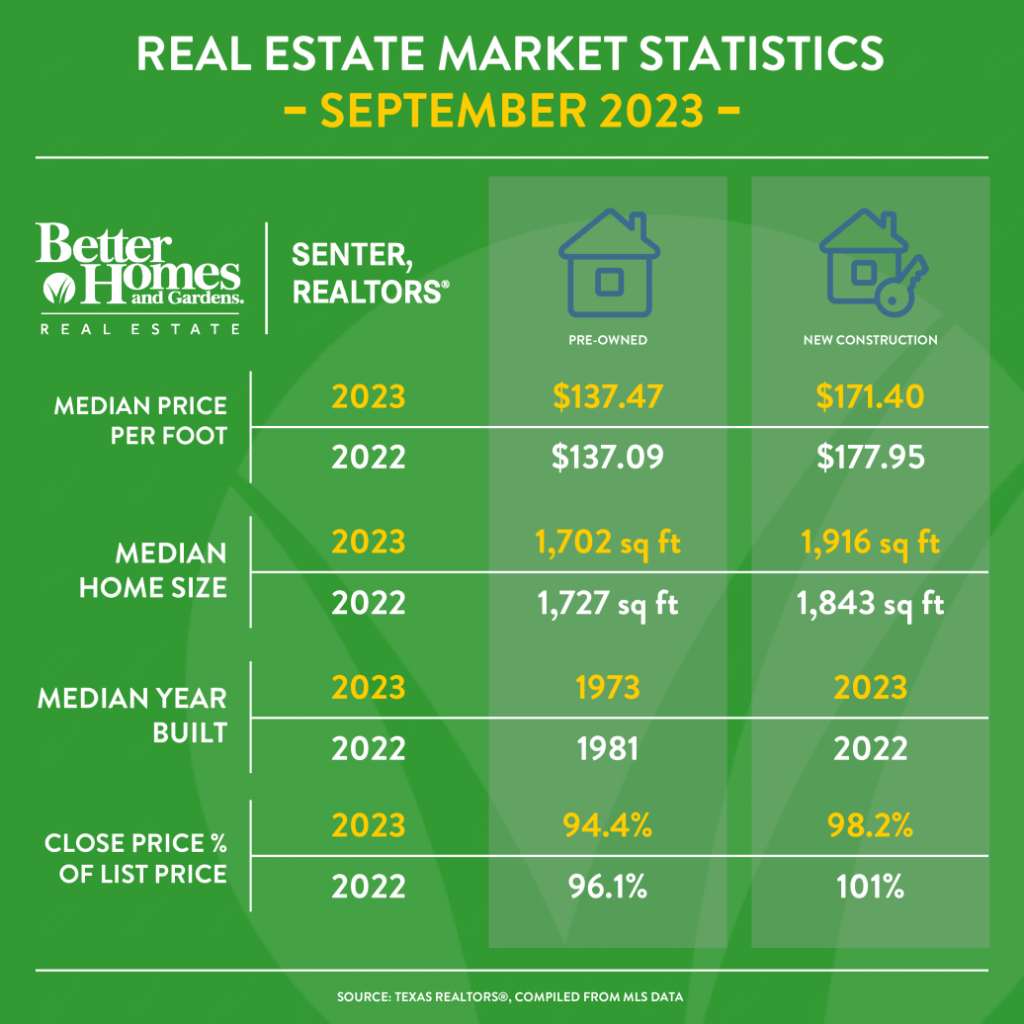

Pre-Owned vs New Construction

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link