Rising Inventory Levels

Rising Inventory Levels

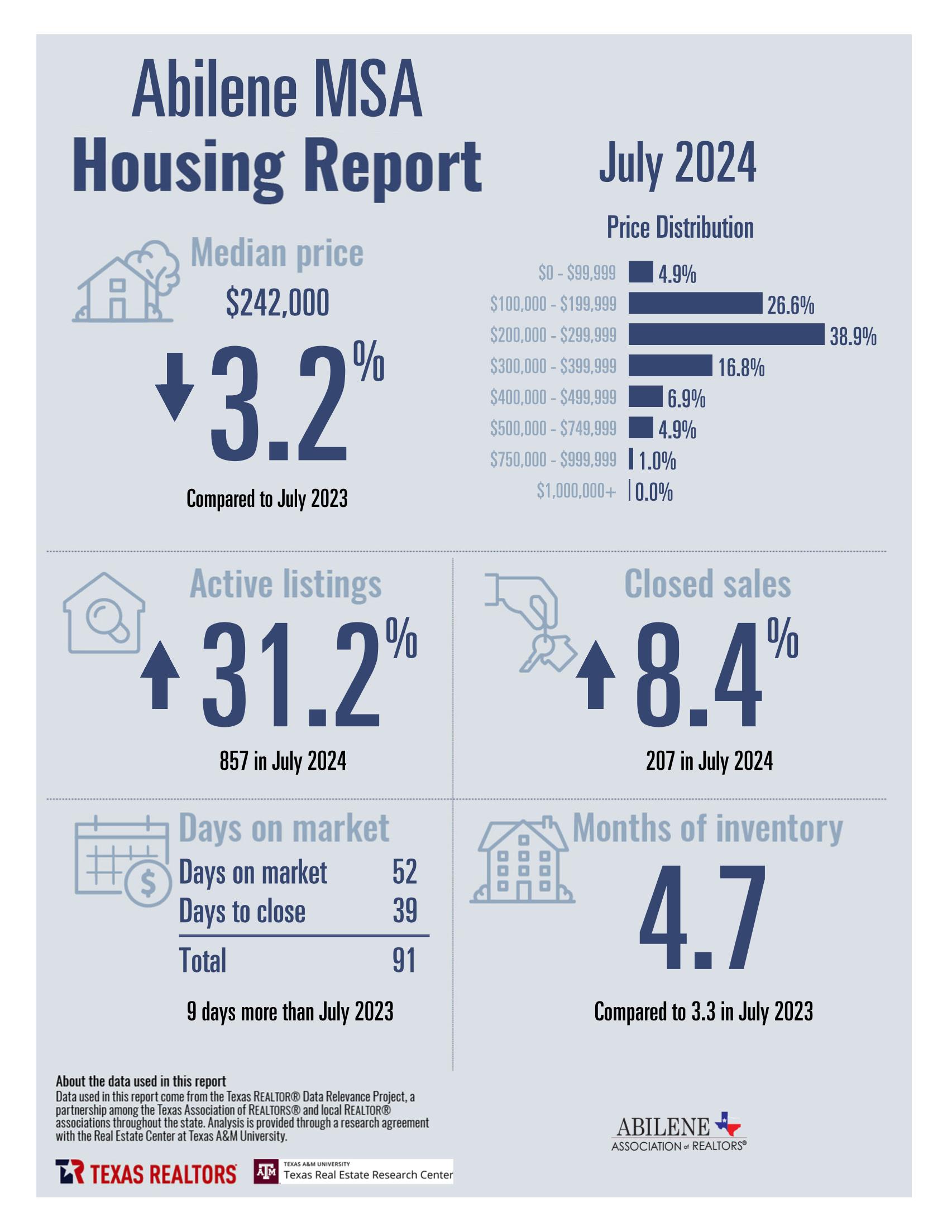

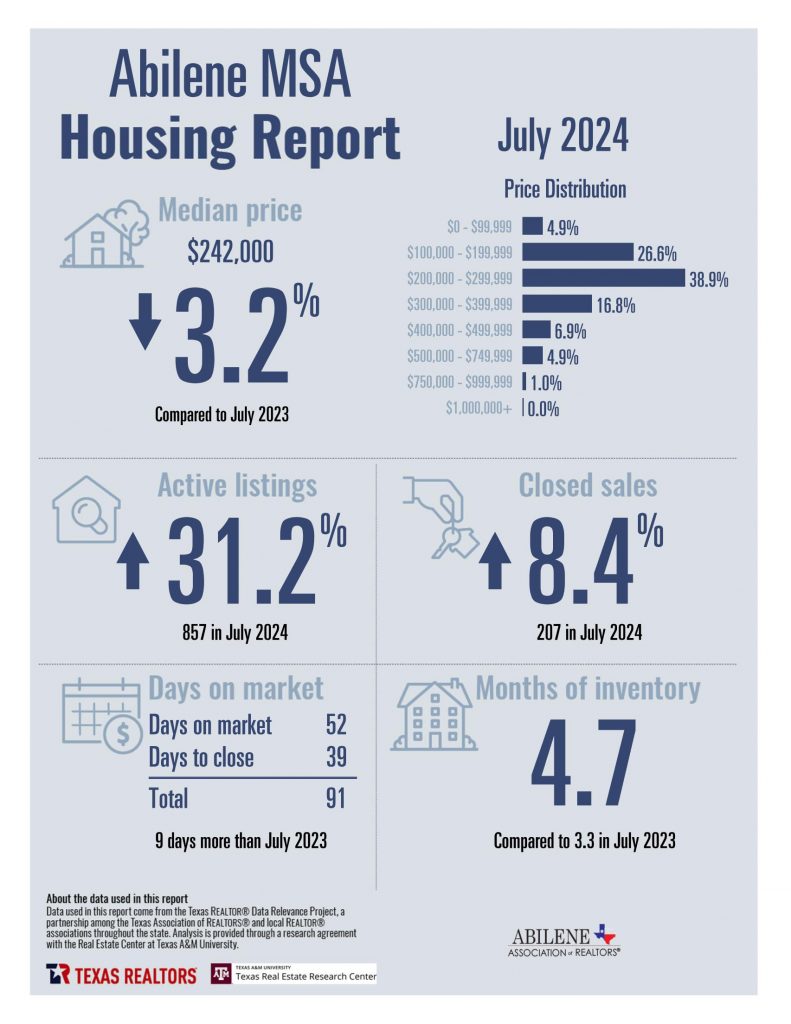

Inventory levels in Abilene continue to rise, increasing options for buyers across various price ranges. While higher interest rates were still a factor for much of July, we began to see a pull-back towards the end of the month, which continued into August.

Sales Trends & Market Comparison

It’s important to note that home sales were up in July 2024 compared to July 2023, but context is key. July 2023 saw a significant drop in sales, and although July 2024 showed improvement, the numbers were slightly down from June 2024. This signals a market that is still finding its footing.

Housing Affordability

Housing affordability is gradually improving but remains a challenge. Throughout 2024, affordability has tempered buyer demand, with property prices, insurance costs, and taxes being the main factors. Sellers should be aware of this trend when pricing their homes.

Seller Concessions & Buyer Assistance

Seller concessions continue to remain high in most price ranges. Buyers needing closing cost assistance can reliably expect to receive support from sellers. This is a strong advantage for buyers navigating today’s market.

New Construction vs. Pre-Owned Homes

The supply of new construction housing remains strong. Sellers in the pre-owned market should be mindful of how their property compares in terms of features and pricing. Price reductions are becoming common, particularly among overpriced pre-owned homes. Now more than ever, receiving expert guidance from a skilled listing agent is crucial.

Interest Rates & Economic Insights

Let’s dive into some insights from NAR economists on interest rates and what to expect moving forward.

Instant Reaction: Mortgage Rates (August 8, 2024)

By Jessica Lautz

- Facts: The 30-year fixed mortgage rate from Freddie Mac dropped to 6.47% this week, down from 6.73% last week. At this rate, with 20% down, a monthly mortgage payment on a $400,000 home is $2,016. This is $285 less per month than in October 2023 when rates were 7.79%, saving homeowners $3,420 annually.

- Positive: This week’s mortgage rates are the lowest since May 2023, marking the biggest one-week drop in nine months. Mortgage applications are on the rise, presenting an opportunity for buyers who had been waiting on the sidelines.

- Negative: While this drop in rates is positive, it’s just one aspect of housing affordability. Home prices remain high, and the rates provided are a weekly average.

Instant Reaction: CPI (August 14, 2024)

By Lawrence Yun

- Inflation Trends: Inflation is calming, setting the stage for the Federal Reserve to begin cutting rates in September. Consumer prices rose by 2.9% in July, with expectations to reach the desired 2% in the coming months. The Fed has indicated it may begin cutting rates as inflation nears 2%, rather than waiting for it to hit that target.

- Shelter Costs: Shelter costs have decelerated to 5.0%, still high but trending down, thanks to a temporary oversupply of new apartment units. However, auto insurance has skyrocketed, up 19% from last year, which could negatively impact property insurance costs.

- Rate-Cutting Cycle: The rate-cutting process is expected to continue through 2025, with six to eight rounds likely. The new normal for mortgage rates may settle around 6%, a notable change from pre-COVID levels of around 4%.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link