As we head into the fall months, Abilene’s housing market continues to evolve, and both buyers and sellers are seeing opportunities. Here’s a breakdown of what we’re seeing in the local market as well as insights from national trends.

Inventory Levels: What’s Happening?

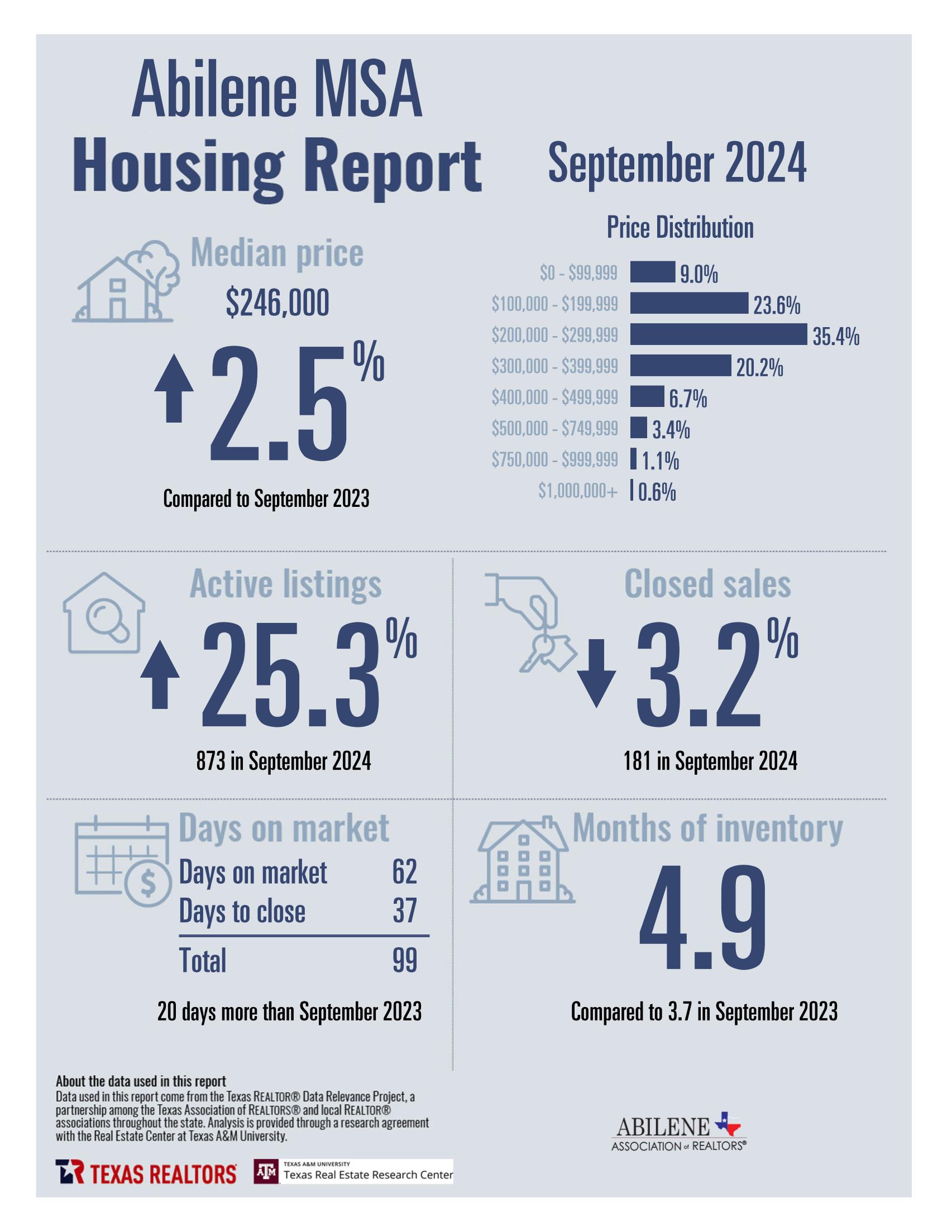

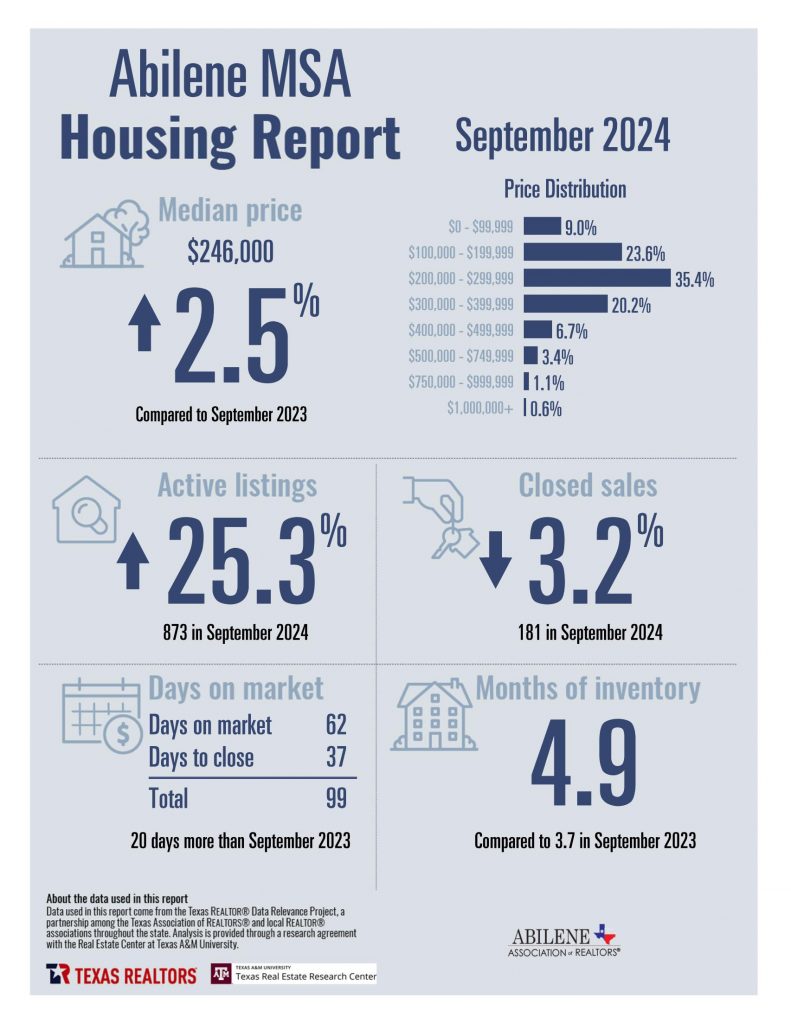

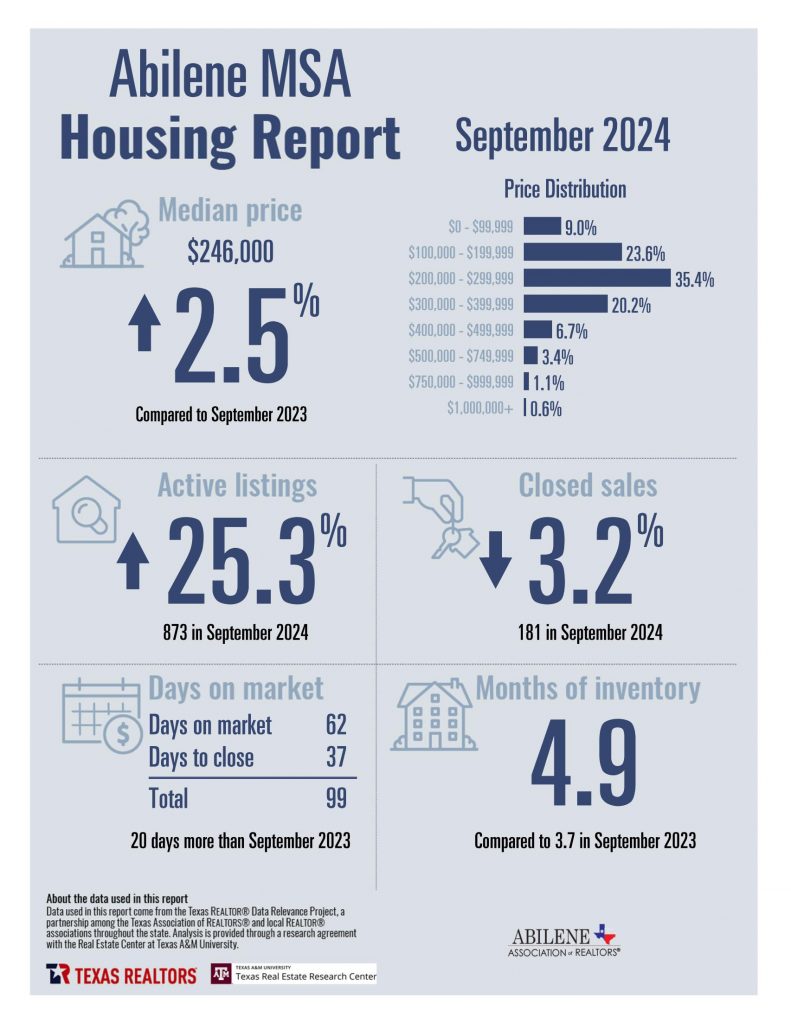

Inventory levels in Abilene have reached new highs, climbing from 3.9 months back in March 2024 to 4.9 months in September. This increase in supply is due to both a rise in listing activity and a slowdown in buyer demand. While it may sound like a challenge, this shift represents a more balanced market, giving buyers more options and time to make decisions, while also signaling to sellers the need for strategic pricing and expectations.

If you’ve been hesitant to make a move, now is a great time to reassess whether buying or selling fits your needs. Our expert team at BHGRE Senter, REALTORS® is here to help guide you through these changes and ensure you have all the information necessary to make the right decision for your unique situation.

National Mortgage Rate Insights

Understanding the larger economic factors affecting mortgage rates is crucial for anyone buying or selling. Here’s a summary of the key points from recent articles and expert insights:

- Mortgage Rates, October 2024: While mortgage rates have fluctuated throughout the year, they are currently more than a full point lower than this time last year. According to the National Association of REALTORS® (NAR), despite some upward pressure on rates recently, there’s hope that we’ll continue to see a decline as we close out 2024. Current forecasts predict mortgage rates to hover around 6% by year’s end, potentially dropping to 5.8% in 2025 .

- Key Takeaway: Mortgage rates may not be as low as we saw in 2020-2021 (when they dipped below 3%), but they are still much better than recent highs. Many homeowners are refinancing, while buyers are still finding opportunities.

Fed’s Influence on Mortgage Rates

There’s a common misconception that the Federal Reserve directly sets mortgage rates. In reality, while the Fed influences rates, mortgage rates largely follow the yield on 10-year Treasury bonds. This year, mortgage rates have fluctuated due to expectations around the Fed’s decisions, but have settled into a more predictable range. While 3% mortgage rates are likely a thing of the past, the current outlook suggests that rates will hover between 5.5% and 6% as we move forward into 2025 .

Jobs Data and Its Impact on Housing

The U.S. job market is showing signs of softening, which could impact future rate cuts. According to Lawrence Yun, NAR’s chief economist, a weaker job market often leads to lower rates. The September jobs report showed an average monthly addition of 116,000 jobs over the last quarter, which signals a slowdown in economic growth. However, the impact on home prices may be minimal as long as interest rates continue to drop, keeping homes within reach for most buyers .

In Summary: Opportunities in a Balanced Market

While 2022 and 2023 were heavily skewed toward sellers, 2024 is offering a more balanced market. Buyers have more time and inventory to choose from, while sellers are adjusting to market conditions that require careful pricing strategies. Whether you’re buying, selling, or just curious about the market, it’s a good time to explore your options.

Ready to take the next step? Contact us at BHGRE Senter, REALTORS® for a free consultation today.

Sources:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link