Abilene Housing Insights: August 2025

The Abilene housing market showed strong momentum in August, but context is key. Last year’s numbers were unusually soft, so this year’s big percentage jumps don’t tell the whole story. Even so, the data reveals important trends shaping today’s market.

Median Price Hits a New High

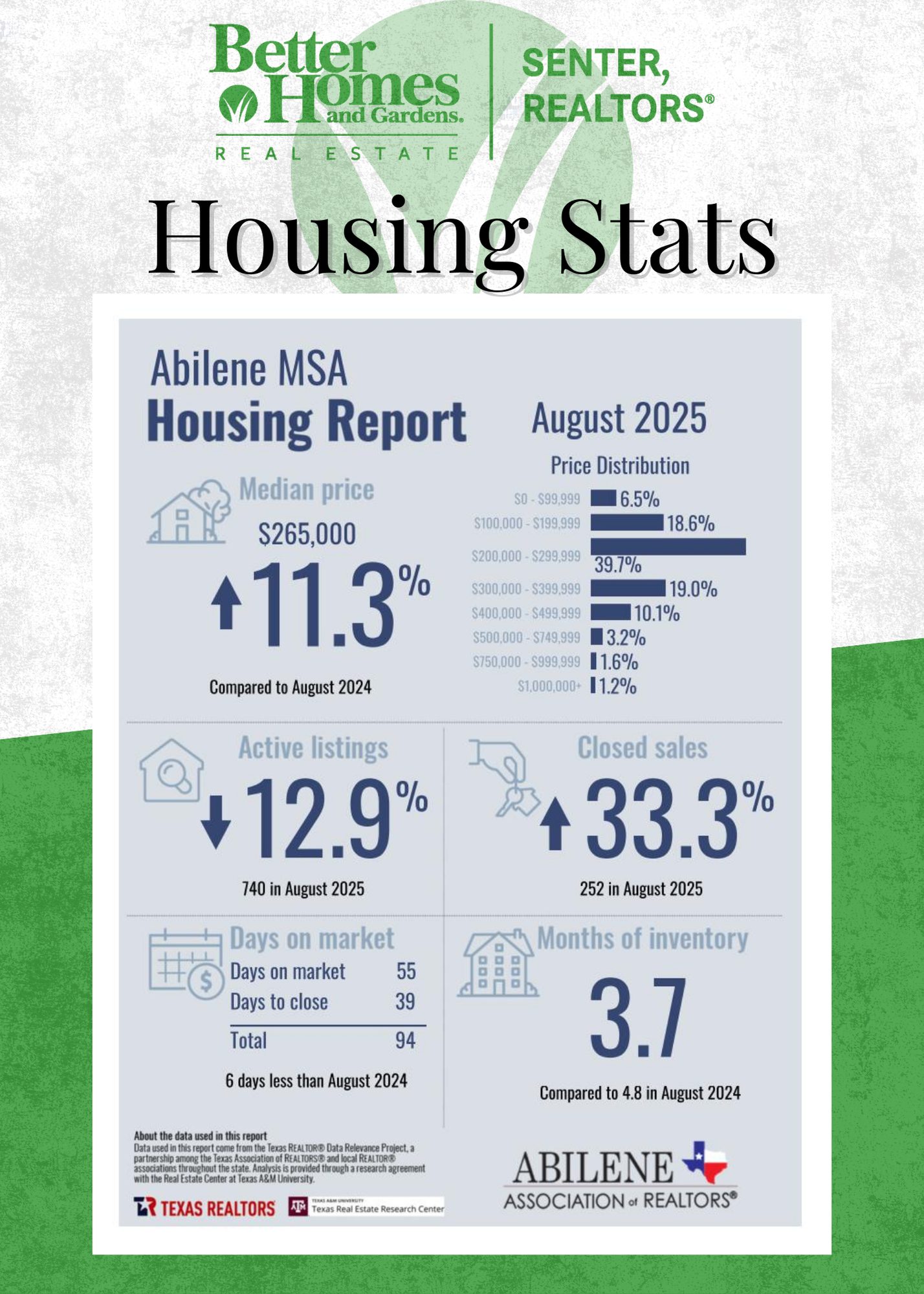

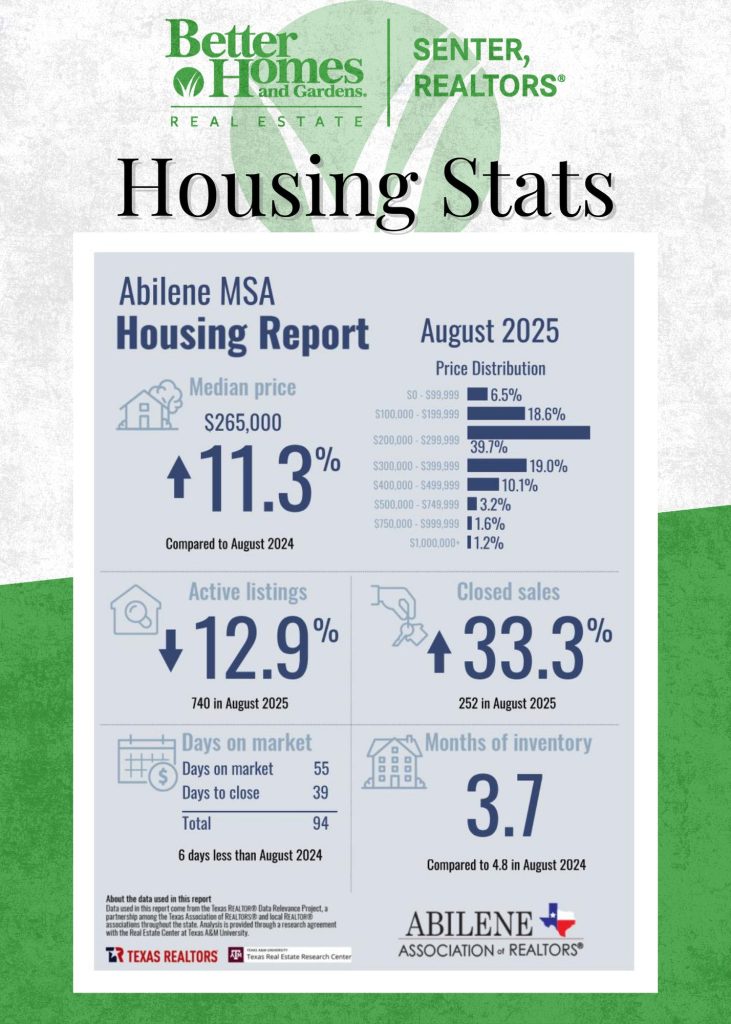

The median home price climbed to $265,000, up 11.3% from last August. That’s the highest median we’ve seen in Abilene. While rising prices reflect demand and inflationary pressure, it’s important to note where much of the activity is happening:

-

Nearly 40% of all sales were in the $200,000–$299,999 range.

-

Many of these are smaller new-build homes in the upper $200s, helping meet supply needs in a popular price bracket.

So while the median is high, the bulk of our market remains in that mid-range where affordability and demand intersect.

Inventory Tightens

Active listings fell 12.9% year-over-year, down to 740 homes. With just 3.7 months of inventory, the market is slightly more balanced and favors buyers in all higher price ranges. Compared to the 4.8 months available last August, buyers now face less choice and stronger competition – especially in the more affordable price ranges.

Sales Surge, But Perspective Matters

Closed sales rose 33.3% from last year, totaling 252 transactions. That looks dramatic, but remember: August 2024 was slow. Much of this year’s growth is catching up from a weak baseline rather than signaling a sudden market boom.

Mortgage Rates Driving Behavior

Rates continue to shape buyer and seller decisions. Activity spikes when rates ease, then slows again as they climb. This push-pull is a defining feature of today’s market, and likely will remain so heading into 2026.

What It Means for You

-

Buyers: Be ready to act quickly, especially in the $200K–$300K range. New builds are fueling supply here, but competition remains.

-

Sellers: Rising median prices and tighter inventory make this a strong moment to list, but smart pricing remains critical to attract serious buyers.

Abilene’s housing market is adjusting to higher rates, tighter inventory, and steady demand. The headline numbers are big, but the real story is balance: affordability still drives much of our activity, even as the median price reaches record levels.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link