July 2023 Housing Insights: Navigating a Shifting Market

As we delve into the midyear point of 2023, the housing market continues to be a realm of dynamic shifts and evolving trends. Let’s take a closer look at the latest insights that define the current landscape.

Interest Rates and Market Expectations

The anticipation of a potential dip in mortgage interest rates has remained on the minds of many. Unfortunately, this optimism has yet to materialize, as interest rates have maintained their position. However, market analysts project a gradual decline in rates as we approach the end of the year. If you’re considering a home purchase or refinancing, keeping a close watch on the weekly updates, particularly those released on Thursdays, could prove beneficial in your decision-making process.

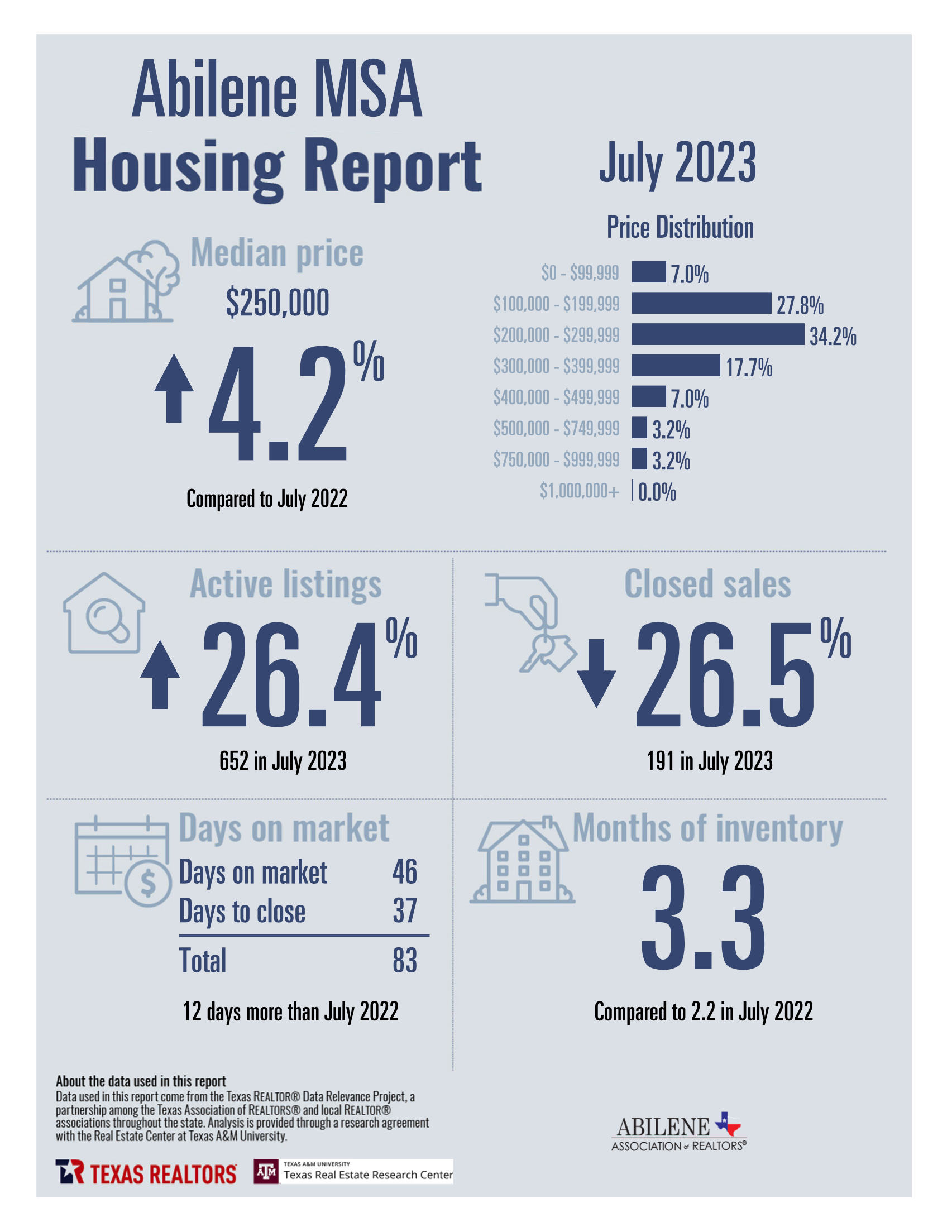

Buyer Demand and Closed Sales

The impact of elevated interest rates has had a discernible effect on buyer demand. A notable drop in closed sales compared to the same period last year underscores the role of interest rates in shaping consumer behavior. This shift, while dampening demand across the board, has paved the way for an interesting opportunity within specific price ranges.

Limited Opportunity for more Affordable Homes

Despite a seemingly healthy inventory exceeding 600 homes, a more thorough examination exposes a nuanced reality: only about 150 of these homes are positioned within the $200,000-300,000 price bracket. Diving further into this segment reveals a noteworthy observation, with only half of these homes nestled within the $200,000-250,000 range. Consequently, the options available to buyers in this price range remain somewhat restricted. As the most active price range, buyers should anticipate limited concessions and brisk selling times, underscoring the urgency of informed and swift decision-making.

Expanding Options in the $300,000-500,000 Range

For those exploring homes in slightly higher price ranges, the current market dynamic offers unique possibilities. As we extend our gaze to the $300,000-500,000 price bracket, the market scene takes a different turn. Here, a robust inventory of over 200 homes awaits potential buyers. This abundance presents a favorable situation for buyers, with room for negotiation and potential seller concessions. It’s an encouraging prospect for those eyeing properties in this range.

Financial Considerations: Taxes and Insurance

A notable challenge for many prospective buyers is the upward trajectory of both property taxes and homeowners insurance. While the recent homestead tax exemption limits endorsed by the Texas Legislature do offer some relief, numerous homeowners are finding themselves faced with increased tax obligations and higher annual insurance premiums. This combination of factors, along with prevailing high interest rates, has introduced certain complexities in qualifying for home mortgage loans.

Trusting Experience in a Dynamic Market

As the real estate landscape continues to evolve, having a seasoned guide by your side becomes increasingly valuable. Our team of dedicated agents brings decades of experience to the table, empowering you to navigate the shifting currents of the market with confidence. If you’re ready to turn your real estate goals into reality, connect with your preferred Roadrunner agent to embark on this exciting journey. Your dreams, backed by our expertise, are bound to find the perfect home.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link