As we wrap up the first half of 2024, let’s take a closer look at the Abilene housing market trends and key insights from top economists at the National Association of REALTORS®.

Market Trends:

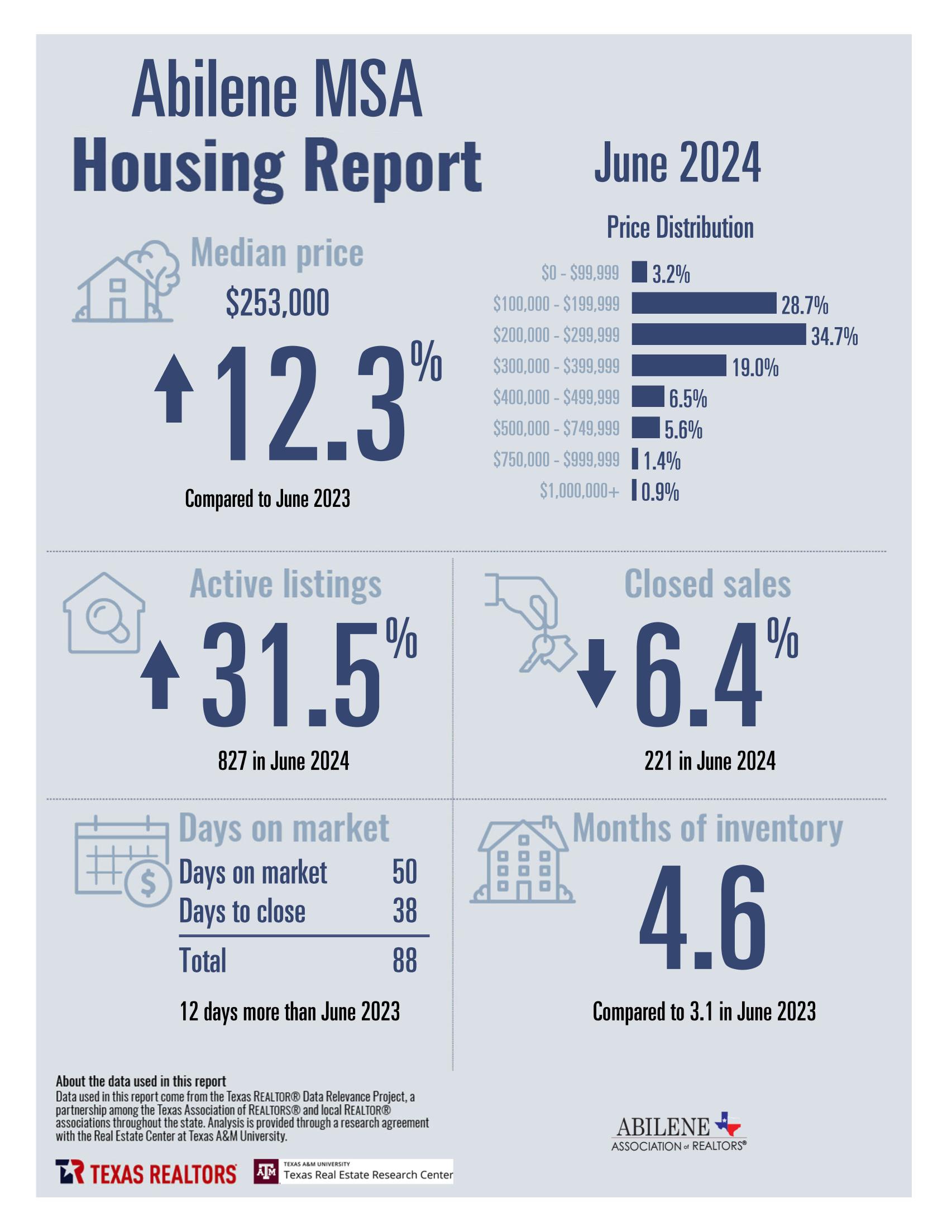

- Inventory Levels: We’ve seen a steady rise in inventory from 3.7 months and 684 total listings in January to 4.6 months and 827 total listings in June.

- Sales Activity: Year-over-year, sales have dipped by approximately 7% compared to 2023.

- Price Movements: Home prices have increased by 7-8% in most price ranges.

- Time to Close: The average time to close has been hovering around 90 days for several months now.

Looking Ahead: While significant changes are not anticipated in the immediate future, better terms may be on the horizon. Here’s what some of the leading voices in real estate economics are saying:

Lawrence Yun, Chief Economist at NAR:

- New Apartment Units: The completion of new apartment units reached a 50-year high in June, leading to a halt in rising rents in many cities. Interestingly, rents have decreased in cities like Austin, Nashville, Charlotte, and Phoenix due to an oversupply of rental units.

- Future Concerns: New multifamily housing starts are currently at a 10-year low due to high financing costs and low rent growth, which might lead to a rental housing shortage in the future. Single-family housing completions were above 1 million, but new starts were below this mark. Lower interest rates could potentially increase housing supply and lower future housing inflation.

Jessica Lautz, VP of Demographics and Behavioral Insights at NAR:

- Mortgage Rates: The 30-year fixed mortgage rate from Freddie Mac dropped to 6.89% recently from 6.95%. At this rate, with a 20% down payment, a monthly mortgage payment on a $400,000 home is $2,105; with a 10% down payment, it is $2,369.

- Inflation Insights: The CPI has retreated, with shelter costs showing slower gains. Fed Chair Jerome Powell indicated a potential path to lowering the Fed Funds rate if inflation continues to cool. However, Powell also noted that we likely won’t see the ultralow rates of the past decade return, meaning buyers waiting for historically low mortgage rates might be waiting for a long time.

Conclusion: As we navigate through 2024, the Abilene housing market continues to show resilience despite national trends. Whether you’re buying, selling, or investing, staying informed and working with experienced professionals like those at BHGRE Senter Realtors can make all the difference. Let’s keep an eye on these trends and insights as we move forward! Contact Us if you need assistance with your real estate goals today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link