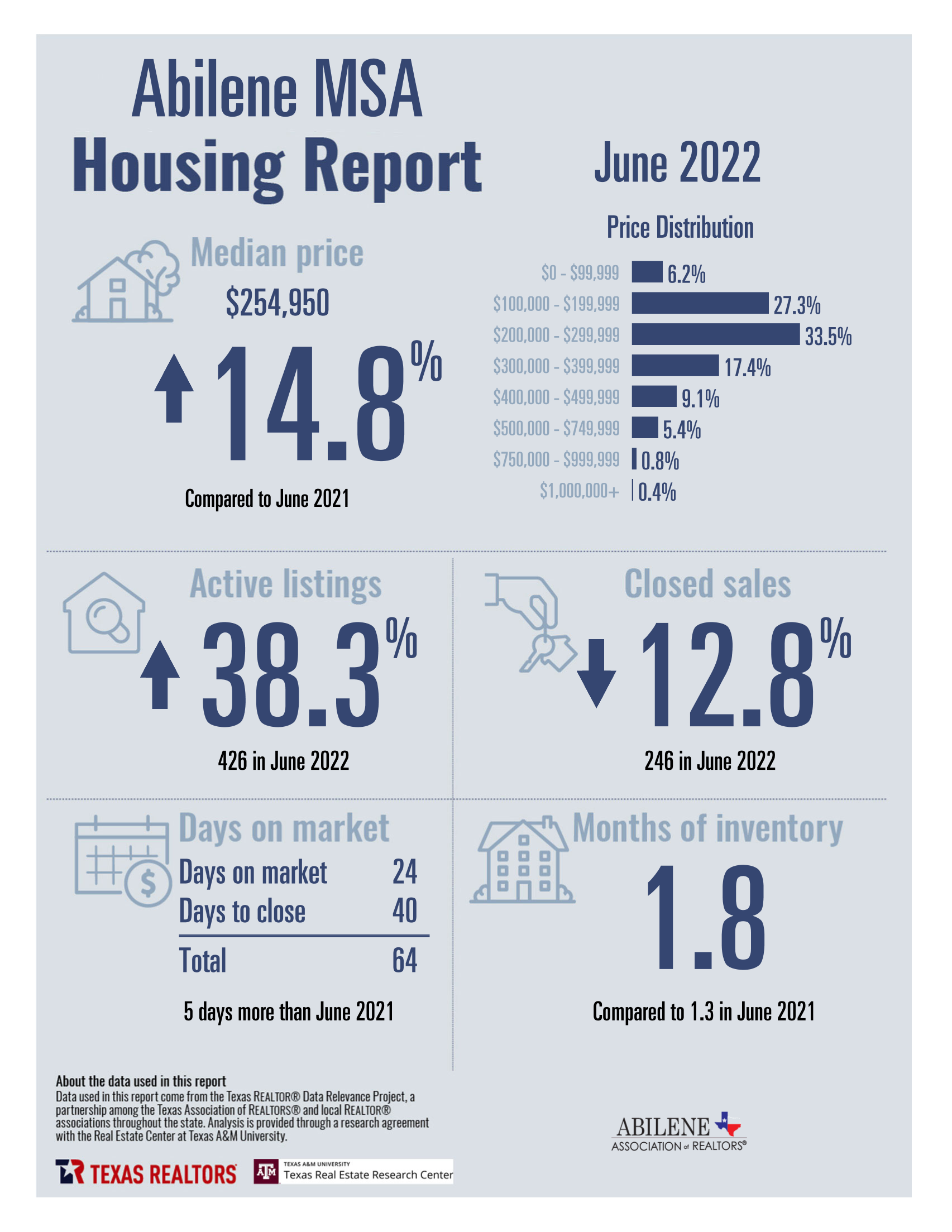

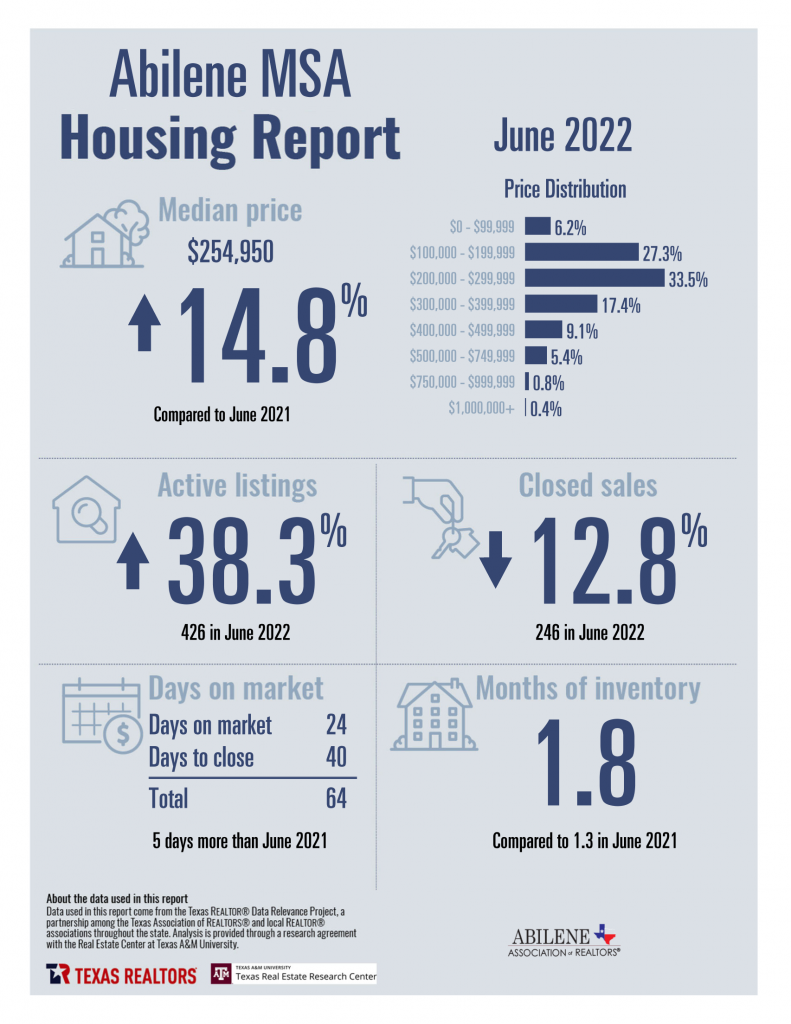

Inventory Recovery

The inventory recovery continues in full swing. We’ve come along ways from our low of less than 1 month of inventory. A healthy inventory is generally considered to be 2.5-3 months of inventory. We’re getting closer. Rising interest rates combined with home prices that continue to rise have slowed buyer demand. Small sections of the market with updated homes will continue to sell fast and usually at slightly above market price. The broader market is starting to resemble what we were all used to before the pandemic.

Inflation & Affordability

It’s not all great however as housing affordability has never been worse. According to research from the National Association of REALTORS a year ago families were typically earning 50% more than the average qualifying income for a mortgage. That number has seen a massive adjustment to families only earning 3% more than the average qualifying income for a mortgage.

The inflation in housing costs outpaces the general inflation issues we are all dealing with. However, it’s important to realize that the chances of this being a bubble are extremely unlikely. Housing prices are going to continue to increase in the years to come, just at a much more normal rate. If you are waiting to buy it’s unlikely you’re going to be any better off than you are now. You can always refinance if rates have a significant reduction in the future, but the housing prices are going to continue to increase.

We’re Here to Help!

If you are thinking about buying make sure you check out our buyer guide you can download for free by clicking here!

If you have any questions about the market, buying, selling, or commercial real estate in Abilene give us a call! One of our full-time professionals who specializes in that section of the market will be standing by to give you guidance and advice.

Until next time!

-Shay Senter, President BHGRE Senter, REALTORS

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link