Abilene Housing Market Update – January 2025

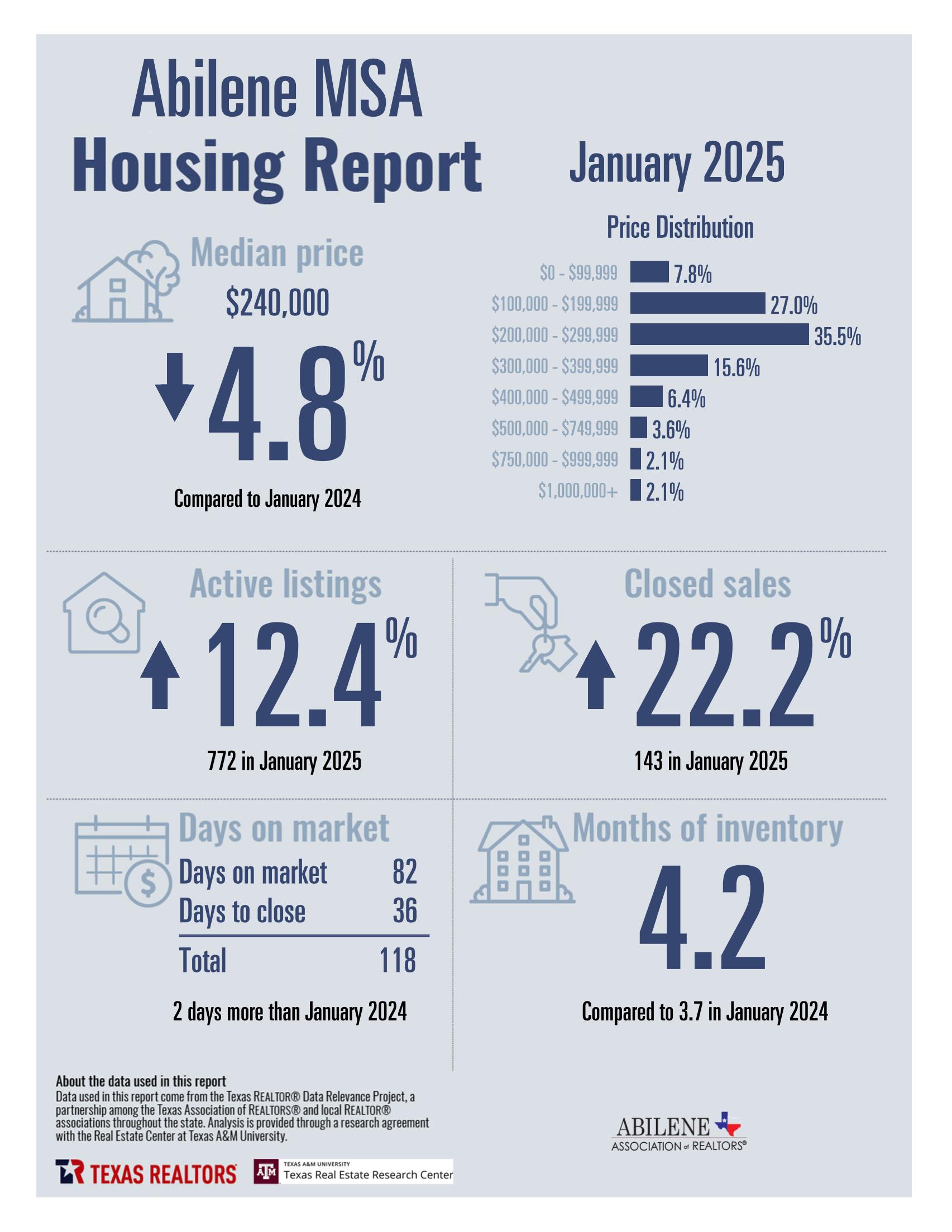

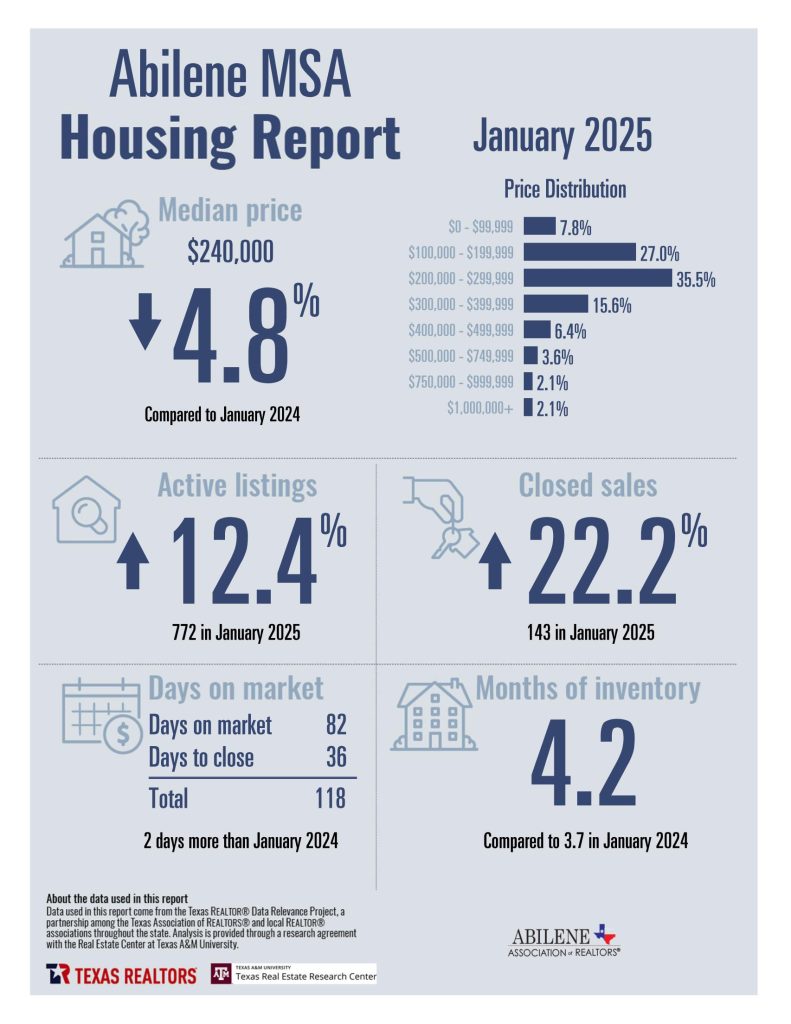

January marked a steady start to the 2025 Abilene housing market, showing signs of recovery but still working through key challenges. While year-over-year stats show a significant increase in sales, it’s crucial to put those numbers in perspective—sales in both 2023 and 2024 were over 35% lower than previous years.

This means that while the market is improving, it’s still navigating economic shifts, higher mortgage rates, and buyer hesitation.

Interest Rates & Market Outlook

One of the biggest factors impacting the market is mortgage rates, which have remained stubbornly high despite some small recent decreases. Inflation concerns and global economic uncertainties make it difficult to predict when rates will meaningfully decline.

📌 Read more on the latest interest rate insights from NAR Chief Economist Dr. Lawrence Yun:

➡️ Instant Reaction – CPI, February 12, 2025

📌 See how mortgage rate trends are shaping up:

➡️ Instant Reaction – Mortgage Rates, February 13, 2025

Should You Wait for Lower Interest Rates?

It’s important to set realistic expectations—we won’t see the ultra-low rates from the COVID era again anytime soon (if ever). Even when rates do drop, home prices will likely keep rising due to demand.

📊 Here’s a real example of how waiting may not save you money:

- A $250,000 loan with 10% down at 7% interest is only $25/month more than the same loan at $260,000 with 6.5% interest.

- Waiting could mean paying more for the home itself, wiping out potential savings on interest rates.

⏳ Waiting doesn’t always mean saving—if you’re considering buying, let’s talk about locking in the best deal before home prices climb further!

Inventory Growth = More Options for Buyers

A major positive shift is the significant increase in inventory throughout 2024 and early 2025. Buyers now have far more options across multiple price ranges—a sharp contrast to the extreme competition of 2022 and 2023.

🏡 For buyers, this means:

✅ Less competition & fewer bidding wars

✅ More choices in every price range

✅ Greater negotiating power on price & terms

If you’ve been waiting for a balanced market, now is a great time to buy!

Sellers: Still a Strong Market for You

While home prices have slightly retreated from their all-time highs in 2023, most homeowners are still sitting on significant equity gains from the past several years.

📈 Selling now means:

✔️ High buyer demand as more buyers return to the market

✔️ Strong home values due to limited long-term inventory growth

✔️ Opportunity to move before rates drop & competition increases

Whether you’re buying or selling, understanding the market is key—and we’re here to help.

🏡 Let’s Talk Real Estate!

Have questions about buying or selling in 2025? Let’s connect and build a custom strategy for your real estate goals!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link