Market Overview: Embracing the New Normal

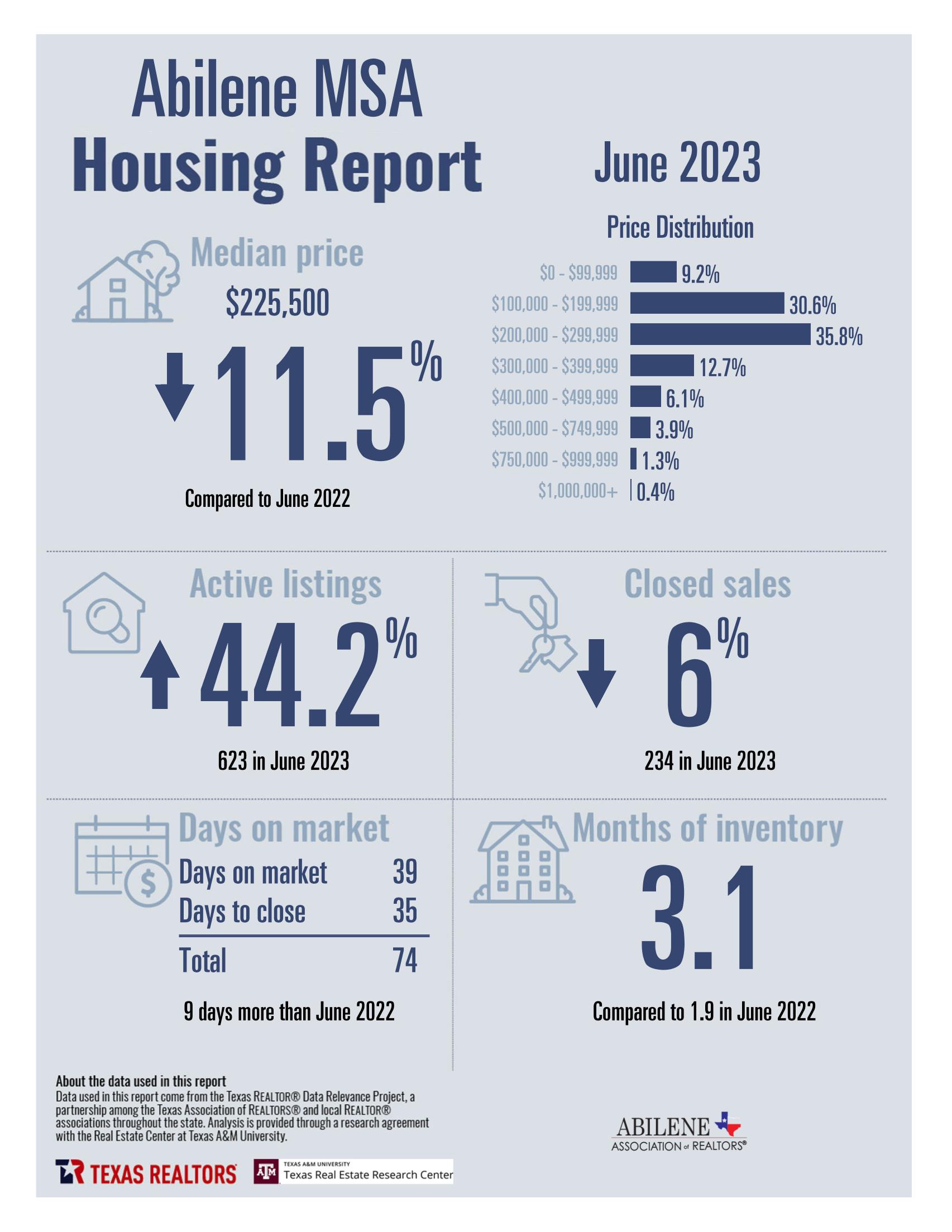

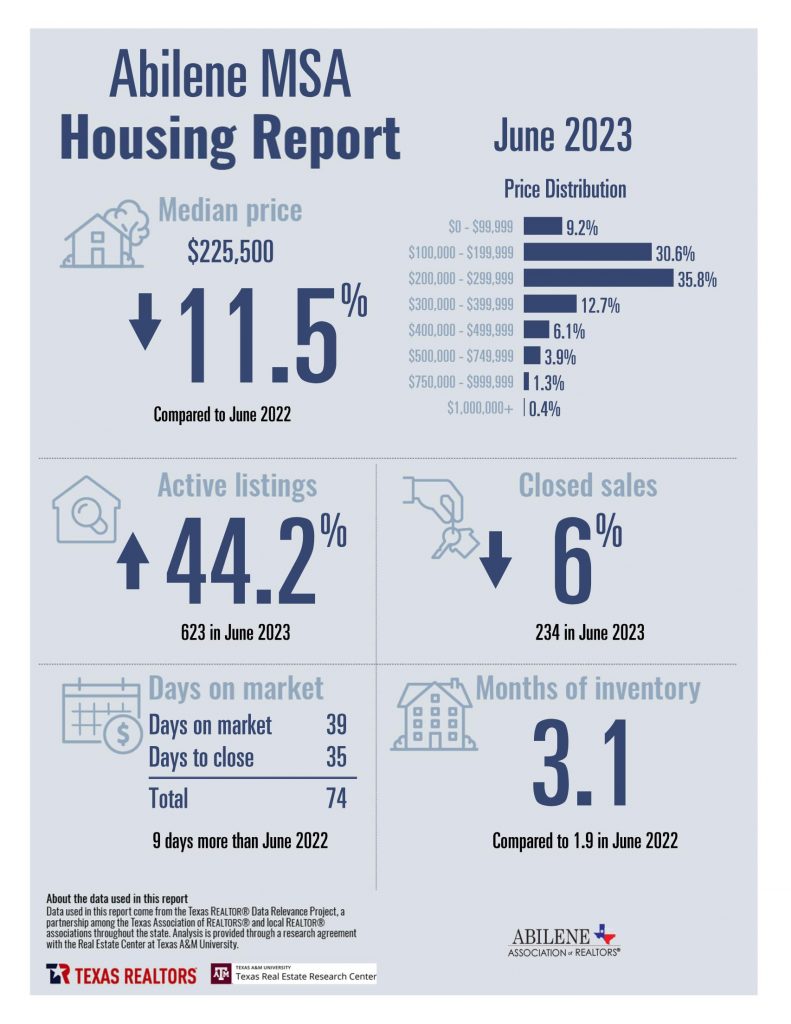

As we move through June, the real estate market is showing signs of returning to a pre-pandemic state. A critical milestone has been reached with over 3 months of housing inventory available for sale, marking the first time since 2019. While we must adjust to the new pricing paradigm, the market remains mostly healthy, with activity levels in balance.

Median sales prices have dipped by 8-10% from 2022, while inventory has surged by over 60% in the first half of 2023. As we navigate this changing landscape, we observe a balanced market, with certain segments favoring buyers and others favoring sellers. Demand for homes under $250,000 is high, but supply remains insufficient. Buyers in this range should anticipate paying top dollar without much seller concession.

For homes above the $300,000 threshold, seller concessions and small negotiations off list price become more common. The market shifts quickly, and this is where your REALTOR shines. Engage in open discussions, plan strategically, and make necessary adjustments to ensure a successful sale.

Interest Rates & Affordability

Interest rates have been a critical factor influencing buyer demand, and while they are expected to retreat by the year-end, they have remained high in June. This has impacted affordability, leading some buyers to reassess their options. However, for those considering a slightly higher-priced property, now is the time to seize the opportunity. Take advantage of current concessions and look into future refinancing options.

Though prices have experienced a slight pullback this year, additional decreases are not anticipated. On the contrary, prices are projected to continue rising, especially once interest rates decline. As we adapt to this evolving market, it’s essential to stay informed and work closely with your real estate professional for a successful and rewarding experience.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link