Another inventory record has been hit this month as we continue to see lower buyer demand in the market. Following the trend of the last several months, buyer demand has been tempered by persistently high interest rates. Additionally, as the early fall months often coincide with back-to-school season, real estate activity tends to slow down during this time. However, there’s reason to be optimistic about an uptick in October and some moderate improvement in the September stats as well.

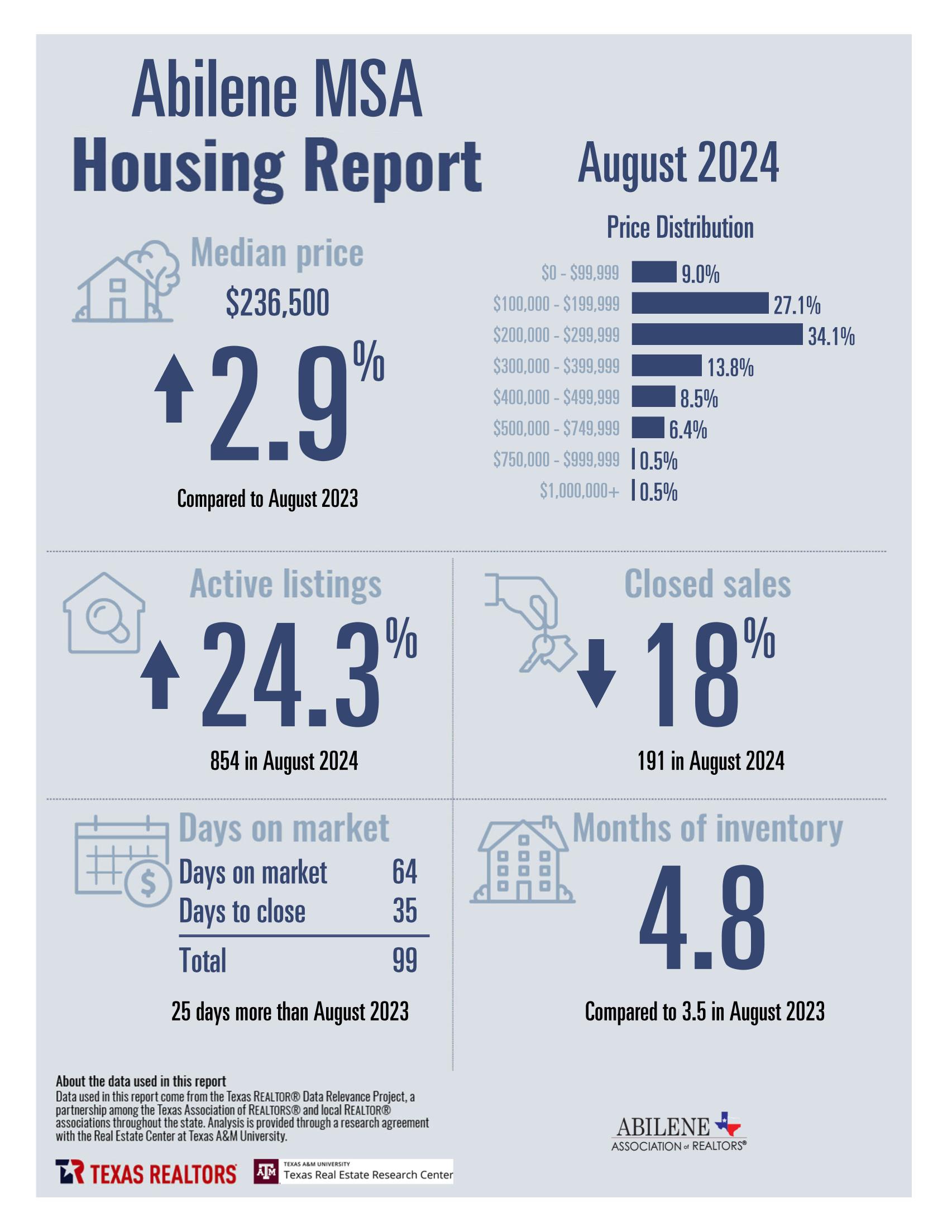

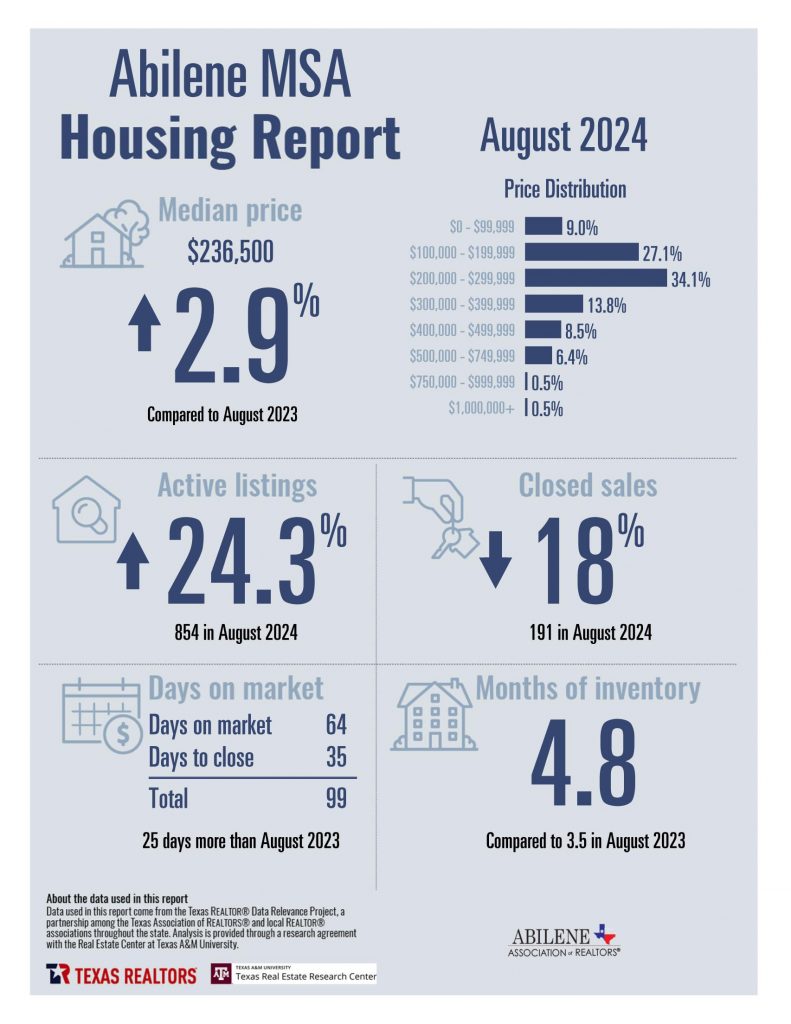

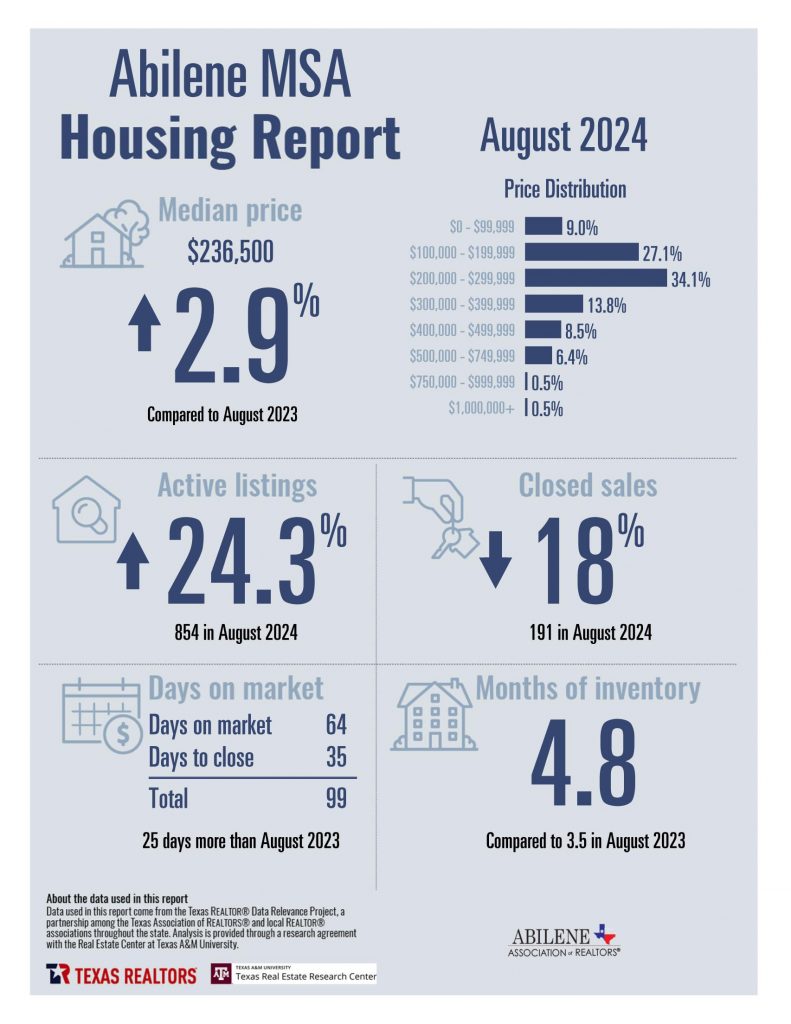

Inventory and Buyer’s Market Conditions

Currently, we are solidly in a buyer’s market. As we inch closer to 5 months of inventory based on current demand, sellers need to be strategic in pricing their homes and responding to the market. One of the most important things for sellers to keep in mind is that it can take 90+ days just to get a home under contract in this environment. Proper pricing, presentation, and flexibility are crucial in maintaining competitiveness.

Interest Rates and Buyer Opportunity

On a positive note, interest rates have pulled back significantly in recent weeks, and small reductions are expected as we approach the end of the year. This could create renewed interest from potential buyers, particularly those who were previously hesitant due to rising rates.

Let’s dive into some of the latest insights from the National Association of REALTORS (NAR) and what leading economists are predicting for the months ahead.

Instant Reaction: Mortgage Rates – September 12, 2024

By: Jessica Lautz The average 30-year fixed mortgage rate from Freddie Mac fell to 6.20% this week, down from 6.35% the week prior. At 6.20%, a monthly mortgage payment on a $400,000 home with 20% down would be $1,960. For buyers with 10% down, the monthly payment would be around $2,205.

Positive Takeaways:

- Interest rates are down 1.59% from their peak in October 2023, offering a significant saving for buyers.

- A $400,000 mortgage today would save you $341 monthly, or $4,092 annually compared to last October’s rates.

- Inflation is at its lowest level since February 2021, and the Federal Reserve is expected to cut the Fed Funds rate imminently.

Challenges:

- Despite the expected rate cuts, mortgage rates may not decrease further, as these cuts have already been accounted for in the current market.

- While mortgage applications have increased, nearly 47% of these applications are refinancings, not new home purchases, signaling continued caution from potential buyers.

Instant Reaction: Jobs Report – September 6, 2024

By: Lawrence Yun The net monthly job additions averaged 116,000 over the past three months through August, which is a relatively light figure. This could suggest the potential for job losses if the economy faces an unexpected downturn. However, the good news is that the Federal Reserve is expected to cut interest rates as early as mid-September, with more rate cuts anticipated in 2025.

The average mortgage rate is already reflecting these anticipated cuts, currently sitting at 6.3%, down from the 7-8% levels we’ve seen over the past 18 months. FHA and VA loans are seeing rates even lower, under 6%.

What This Means for the Housing Market:

Historically, a weakening job market does not necessarily mean a drop in home prices or sales—especially if it’s accompanied by falling interest rates. With over 90% of the workforce still employed and many considering their jobs secure, falling mortgage rates could exert more influence on the housing market than employment numbers. This could be the case once again if rates continue to drop, spurring homebuyer activity.

Conclusion

In summary, while we are still navigating a buyer’s market, there are promising signs on the horizon. Interest rates are gradually easing, providing an opportunity for buyers who have been waiting on the sidelines. Sellers, however, must remain proactive in pricing their properties correctly and adjusting to market conditions as we move into the fall season.

As always, BHGRE Senter, REALTORS is here to help you navigate these shifts in the market—whether you’re looking to buy or sell. With decades of local expertise and a full-time commitment to our clients, we are ready to provide you with the guidance you need for success.

If you’re considering making a move, give us a call today! Let’s make the most of the current market conditions together.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link