Abilene Housing Insights – March 2022

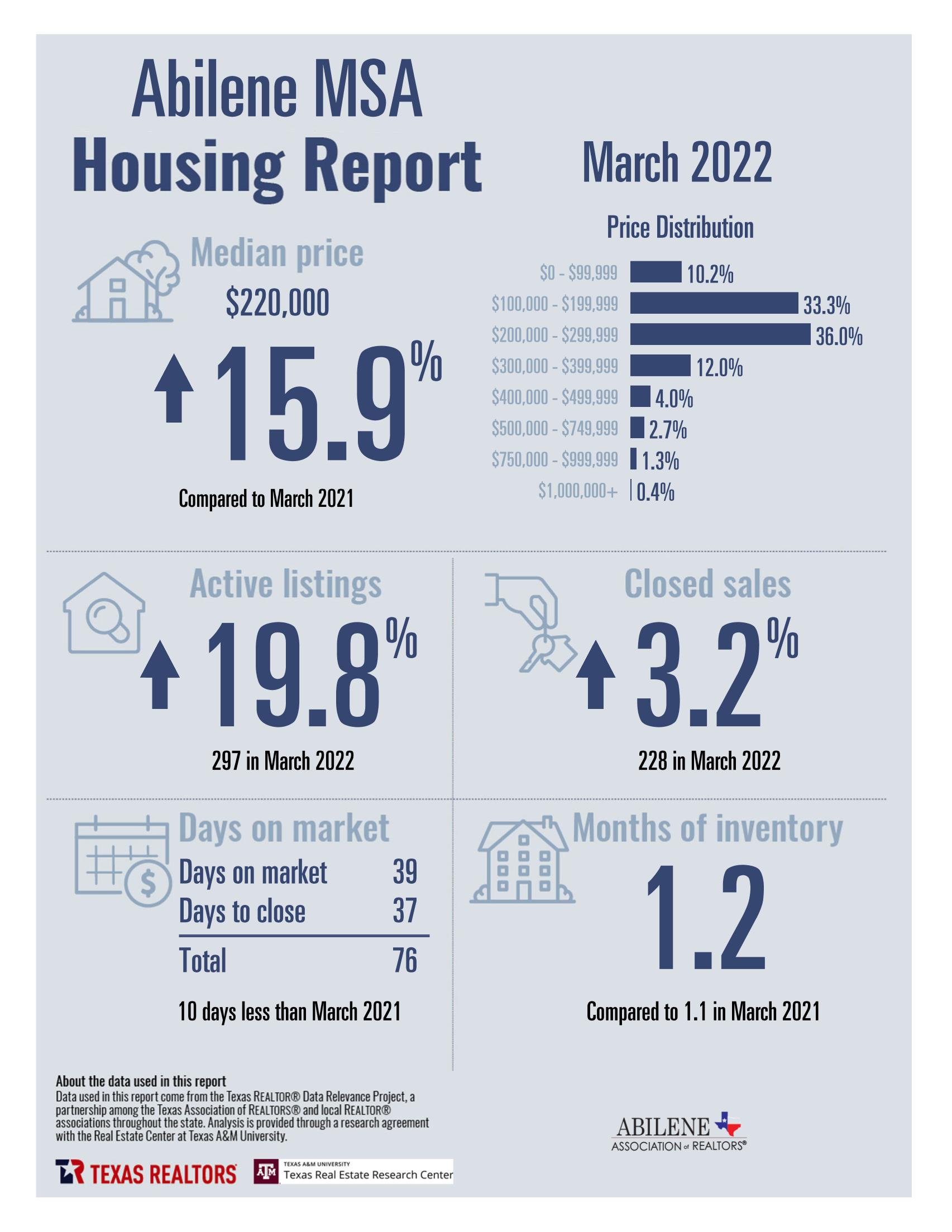

For those that tuned in last month you’ll remember we saw what I called an abnormal sales price increase simply due to low sales volume and as a function of the properties closed rather than any actual further increase in property values. You’ll see that reflected here with the median sales price dropping back into the ranges we’ve seen for last 8 months. While prices are up year over year that is because we did not see prices start to strongly increase until April of 2021. While prices are expected to rise through the end of the year it will be at a more typical rate of 4-5% as opposed to the 15-20% increases we saw through 2021.

The other big news impacting the housing market is of course the drastic increase in mortgage interest rates. Rising above 5% for the first time in several years, and that will continue to rise through the end of the year as the Fed takes measures to control inflation. While these are still great interest rates it is still a significant increase of the record low interest rates buyers were getting for Abilene homes for the past two years. The chief economist from NAR has also weighed in on the subject and you can see his quick take below:

One of the most important factors is that while agreeing with the general price increases that I support in the months to come he also predicts a reduction in overall sales of homes. I believe this will echo what we see for Abilene homes as well. Let’s not be confused though. It is 100% still a seller’s market and will remain so through the rest of the year. However, the balance is starting to tip and buyers can expect a slightly less frustrating process as we head into the summer. Rising interest rates combined with record high home prices will finally help slow down the unprecedented buyer demand we’ve seen for the past 12-15 months while buyers were rushing to take advantage of those record low mortgage rates.

The biggest advice I can give buyers is that you can’t lowball your offer. You need to come in strong if you want to expect to have your offer accepted. The biggest mistake I see sellers making in the market right now is overvaluing the impact of a sellers market on their home value. Sellers also can not be lazy with making their home show well. If the home doesn’t show well, and buyers can’t see good pictures of it online, your home will get passed over for those that are more favorable to them. While homes are selling at higher prices than they ever have you can still overprice your property. Buyers have shown a very strong preference towards purchasing homes that are move-in ready, and updated. They are willing to pay 5-15% above the asking price on those updated and ready to move-in homes. That same willingness is largely absent when it comes to non-updated homes and homes that need work.

There is opportunity there for the seller that is willing to do some work, and also for home flippers in general. The home buyer that has the willingness and ability to do some updates to some of the more tired properties will absolutely see the return on their investment in both short and long term scenarios. Buyer burnout is real. Both for REALTORS and the clients looking at homes for sale in Abilene. Be kind to your REALTORS and buyers! Our full-time REALTORS are standing by to show you any homes for sale or commercial properties in Abilene. Contact Us or call the office at (325) 665-5574 if we can guide you to your real estate goals!

I’ll see you next month for our next housing update!

-Shay Senter, BHGRE Senter, REALTORS President

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link