When You Inherit a House: What Comes Next?

What to Do With the Things Your Parents Leave Behind

Guidance for Families Navigating Life’s Next Chapter

Losing a parent is emotional enough. Sorting through what they leave behind can feel overwhelming.

Beyond the legal paperwork and property decisions, there’s the deeply personal question: What do I do with all of this?

Whether you’ve inherited a home, a collection of keepsakes, or an entire household full of furniture and memories, you’re not alone. Many families in Abilene and across The Big Country walk through this season every year.

This post is inspired by an article from Better Homes & Gardens titled “What to Do With the Stuff Your Parents Leave You” (BHG.com), and we’ve adapted it with practical guidance for families navigating real estate decisions locally.

Start With Space — and Time

One of the biggest mistakes families make is rushing.

If possible, give yourself breathing room before making permanent decisions. Emotional attachment can cloud judgment — and sometimes what feels priceless in the moment becomes overwhelming months later.

If the home is involved, understanding your timeline matters:

-

Is the property vacant?

-

Is there a mortgage?

-

Are multiple heirs involved?

-

Is there a need to sell quickly?

Getting clarity on the real estate side can reduce stress while you sort through personal items.

Sort in Phases, Not All at Once

Instead of tackling the entire house at once, break it into categories:

-

Keep – Items with deep sentimental or functional value

-

Share – Family members who may want specific pieces

-

Donate – Items that could benefit local organizations

-

Sell – Furniture, collectibles, or tools with resale value

-

Dispose – Items beyond repair or usefulness

In Abilene, many families choose to donate to local charities, churches, or nonprofits. That’s a meaningful way to honor your parents’ legacy while blessing someone else.

Don’t Let Guilt Drive Decisions

This is important.

Keeping everything out of obligation can create long-term stress. Your parents likely wouldn’t want their belongings to become a burden.

Memories live in stories, traditions, and relationships — not just physical objects.

Consider:

-

Photographing items before letting them go

-

Keeping one meaningful piece instead of an entire collection

-

Creating a shared digital album for family members

When Real Estate Is Involved

Often, the biggest decision isn’t about the belongings — it’s about the home itself.

Common questions we hear from families:

-

Should we sell as-is?

-

Should we update it before listing?

-

How do we price it fairly?

-

What if siblings disagree?

-

How do we handle the contents during the sale?

There isn’t a one-size-fits-all answer. Every property and family situation is different.

What we’ve learned after decades of serving Abilene families is this:

Clear communication and realistic expectations make all the difference.

Sometimes the best decision is to simplify the property and sell it in its current condition. Other times, strategic updates create meaningful value. The key is understanding the market and making informed decisions — not emotional ones.

Honoring Legacy While Moving Forward

Sorting through a parent’s belongings is more than a logistical task — it’s part of grieving and honoring a life well lived.

Take your time. Ask for help. Lean on family.

And when it comes to the property itself, get guidance from someone who understands both the emotional weight and the market realities.

If you’re navigating this season and just need clarity — not pressure — we’re here to help.

Source

This article was inspired by Better Homes & Gardens, “What to Do With the Stuff Your Parents Leave You,” originally published on BHG.com.

Home Trends We’re Leaving Behind in 2025

What’s Changing — and What Buyers Actually Want Now

Design trends come and go, but the homes that sell best are the ones that balance style, function, and livability. As we head into 2025, we’re seeing a clear shift in what today’s buyers value — and what’s starting to feel dated.

Whether you’re planning to sell, renovate, or simply stay current, here are several home trends we’re seeing fade, along with what’s taking their place.

1. Overly Gray Interiors

For years, gray was the safe choice. Now, buyers are ready for warmth again.

What’s changing:

All-gray floors, walls, and finishes can feel cold and impersonal, especially when overused.

What buyers prefer instead:

Warm neutrals like soft beiges, taupes, and earthy tones. Natural wood finishes and subtle color variation help homes feel more inviting — and easier to imagine living in.

2. Stark White Kitchens

White kitchens aren’t disappearing entirely, but the ultra-sterile look is losing momentum.

What’s changing:

Bright white cabinets paired with white counters and minimal contrast can read flat.

What buyers prefer instead:

Kitchens with depth — think warmer whites, light wood accents, mixed metals, or subtle color on islands. Buyers want kitchens that feel lived-in, not showroom-only.

3. Open Shelving Overload

Open shelving had its moment — but practicality is winning out.

What’s changing:

Too much open shelving creates visual clutter and requires constant styling.

What buyers prefer instead:

A balanced approach. A few open shelves for character, paired with plenty of closed storage to keep everyday life functional and tidy.

4. Barn Doors Everywhere

Once trendy, now increasingly polarizing.

What’s changing:

Barn doors don’t offer much privacy or sound control, and buyers are noticing.

What buyers prefer instead:

Pocket doors, traditional hinged doors, or modern sliding options that blend better with the architecture of the home.

5. Matching Everything

Uniform finishes from room to room are starting to feel dated.

What’s changing:

Homes where every light fixture, cabinet pull, and finish matches exactly can feel overly staged.

What buyers prefer instead:

Thoughtful variety. Mixed metals, layered textures, and subtle contrasts add character while still feeling cohesive.

6. Oversized Statement Features

Big, bold features can overwhelm a space.

What’s changing:

Extreme accent walls, dramatic colors, or overly trendy fixtures can turn buyers off.

What buyers prefer instead:

Timeless design choices with personality — details that enhance the home rather than dominate it.

What This Means for Sellers

You don’t need a full renovation to stay competitive. Small, strategic updates — warming up colors, simplifying finishes, and focusing on function — can go a long way.

The goal isn’t to chase trends. It’s to create a space that feels welcoming, practical, and easy for buyers to picture as their own.

Local Insight Matters

National design trends are helpful, but real estate is always local. What works in one market doesn’t always translate the same way in another.

That’s where having a knowledgeable local REALTOR® matters — someone who understands not just what’s popular, but what actually sells in our market.

If you’re considering selling, updating, or just want advice on where to focus your efforts, our team is always happy to help.

Nobody Knows Abilene Better.

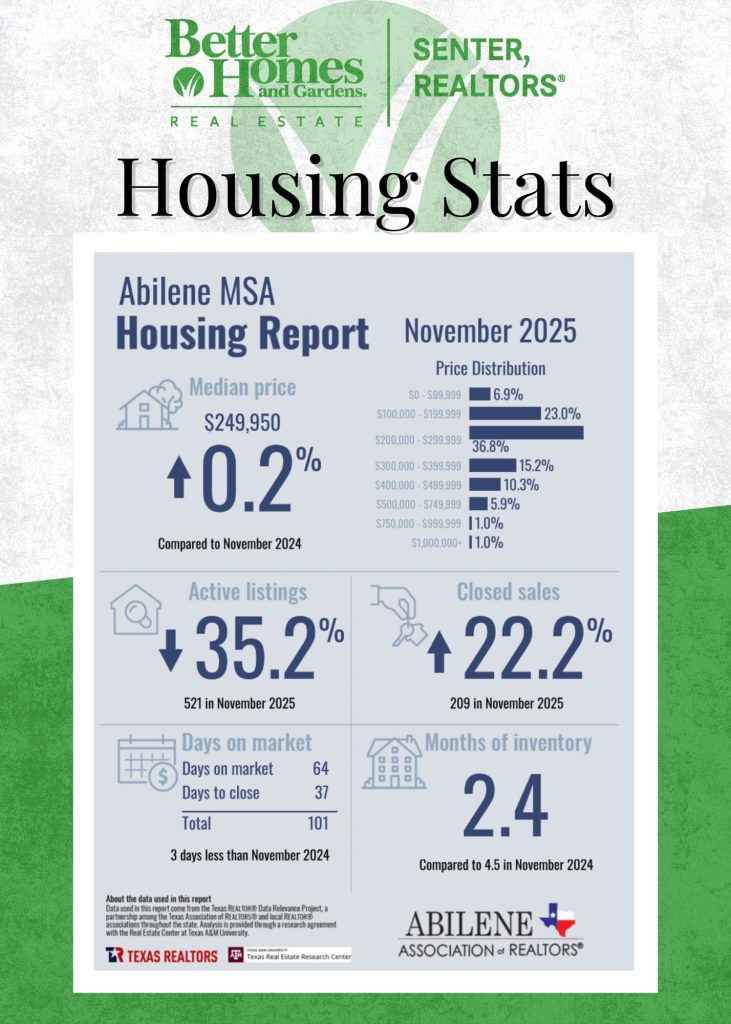

Abilene Market Update: November 2025

Abilene’s Market Is Telling a Clear Story—If You Know How to Read It

If you’ve been hearing mixed messages about the housing market, you’re not alone. National headlines can feel contradictory, and even locally, the market can seem confusing at first glance. But when you slow down and look at the numbers—and more importantly, how buyers are actually behaving—a clear picture starts to emerge.

The November 2025 Abilene MSA Housing Report confirms what we’ve been seeing on the ground for months: this is not one market—it’s several happening at the same time.

What the Numbers Are Telling Us

Here are a few highlights from the latest data:

-

Median home price: $249,950 (up slightly year-over-year)

-

Active listings: Down 35.2% compared to last November

-

Closed sales: Up 22.2%

-

Months of inventory: 2.4, down from 4.5 last year

-

Total days on market: 101 (3 days faster than last year)

In plain English: inventory is tight, homes are selling faster, and demand has picked up—especially where pricing aligns with what buyers can actually afford.

That last part matters more than ever.

A Seller’s Market… In the Right Price Ranges

Homes in Abilene’s high-demand price ranges—particularly entry-level and mid-range properties—are firmly in a seller’s market. Well-priced homes in these brackets are moving quickly, often with multiple showings early and strong buyer interest.

At the same time, most luxury segments are operating in a buyer’s market.

That doesn’t mean luxury homes can’t sell. It means buyers in that space are more selective, more analytical, and far less willing to “stretch” just because a property is available. They’re comparing options, negotiating harder, and factoring in long-term costs with more scrutiny than ever before.

This split market is one of the biggest mistakes sellers make right now—assuming that what’s true at one price point applies to all.

It doesn’t.

Buyers Are More Educated—and More Cautious

National data backs this up. According to recent insights from the National Association of REALTORS®, buyers are slowly re-entering the market as interest rates stabilize—but they’re doing so with more preparation and discipline.

Today’s buyers:

-

Research extensively before touring

-

Understand risk and total cost of ownership

-

Are less emotional and more numbers-driven

-

Expect homes to justify their price, not the other way around

This shift rewards sellers who price realistically and penalizes those who chase aspirational numbers.

Why Strategy Matters More Than Ever

In this environment, success isn’t about luck or timing—it’s about strategy from day one.

That includes:

-

Accurate pricing rooted in current buyer behavior

-

Marketing that creates urgency early, not months later

-

Honest guidance instead of inflated expectations

-

Understanding which market segment your property is actually competing in

We’ve been very open about this lately because the results are hard to ignore. Over the past several weeks, our office has seen a high percentage of listings go under contract quickly—many in well under the area average days on market.

That doesn’t happen by accident.

How We’re Seeing It Play Out at Senter

Our philosophy has always been straightforward: price near the top of the real market and let demand do its job. Not the hopeful market. Not last year’s market. The current one.

Every listing we take receives a full marketing rollout designed to reach today’s educated buyers where they actually are. And we don’t charge extra for that. No add-on fees. No surprise “marketing packages.” Just consistent execution and honest advice.

That approach matters even more in a split market like this one—where the difference between selling quickly and sitting for months often comes down to clarity and discipline early on.

The Bottom Line

Abilene’s market is healthy, active, and moving—but it’s also smarter and more selective than it’s been in years.

-

Sellers in high-demand price ranges who price correctly are in a strong position

-

Luxury sellers need precision, not optimism

-

Buyers are back, but they’re informed and intentional

-

The margin for error is smaller than it used to be

Whether you’re buying, selling, or just watching the market, understanding which market you’re in makes all the difference.

And that’s where experienced, local guidance still matters.

Nobody Knows Abilene Real Estate Better.

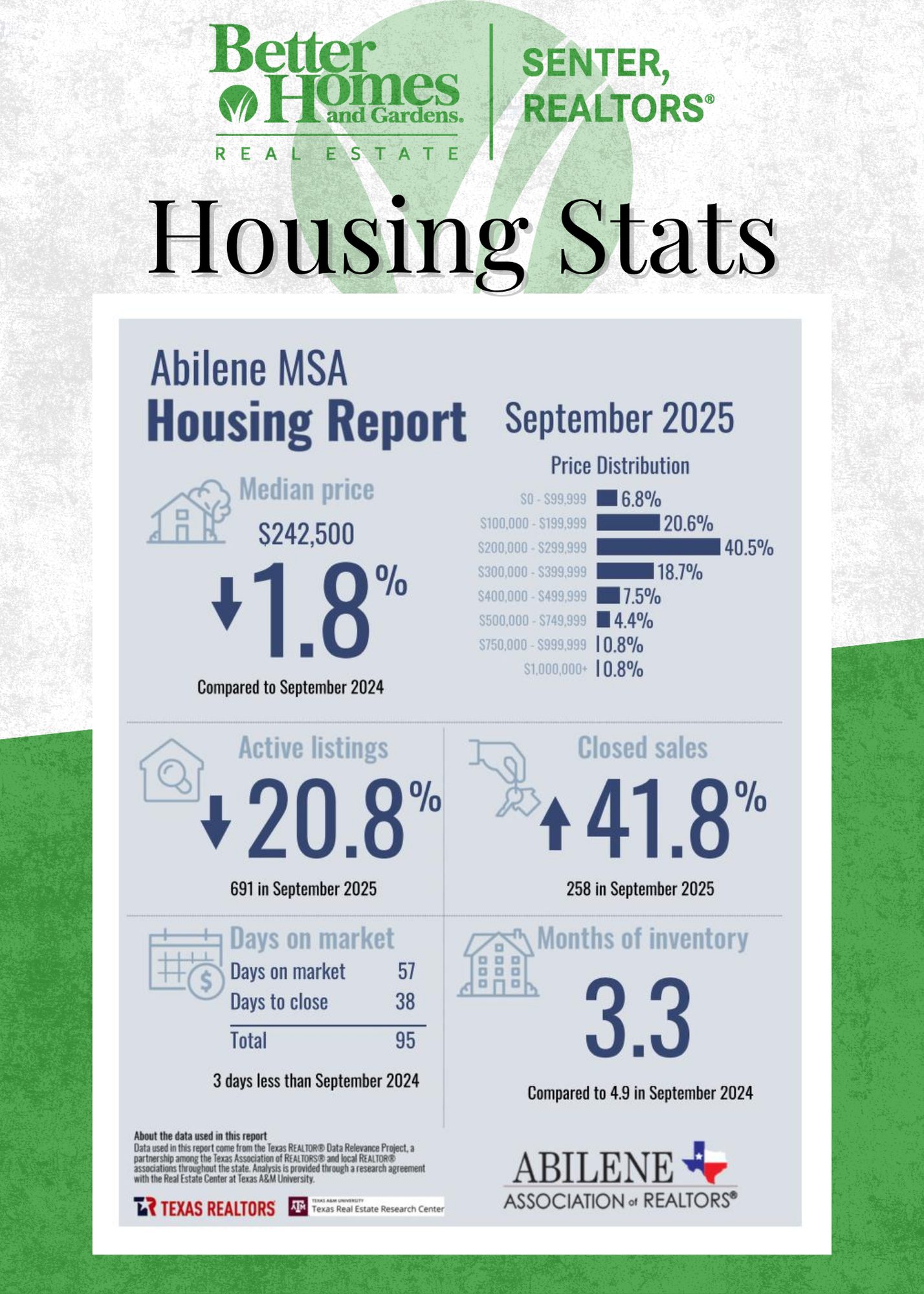

Abilene Market Update: September 2025

Abilene Housing Insights: September 2025

The Abilene housing market showed a strong rebound in September, though the big percentage swings tell a story of recovery more than runaway growth. After two consecutive years of slower sales, 2025 is showing renewed momentum—especially in that ever-popular $200,000–$300,000 price range.

Sales Surge from a Soft Baseline

Closed sales jumped 41.8% compared to September 2024, with 258 homes sold. While that headline number looks dramatic, it’s important to remember that 2023 and 2024 were unusually quiet months. The market is now returning closer to pre-slowdown activity levels rather than entering a new boom cycle.

At the same time, active listings fell 20.8%, leaving buyers with fewer choices and helping move some stagnant inventory from the summer months.

Pricing Levels Hold Steady

The median price landed at $242,500, a modest 1.8% decrease year-over-year. That’s not a sign of weakness—just balance. After several years of steady price increases, this small adjustment reflects both stabilization and the concentration of sales in mid-range price points.

More than 40% of all sales were in the $200K–$300K range, continuing a multi-year trend where smaller new construction homes and updated existing properties dominate buyer demand.

Rates, Uncertainty, and Buyer Behavior

A brief pullback in mortgage rates early in the month helped spark initial buyer interest. However, economic uncertainty surrounding the potential government shutdown tempered momentum in the back half of September. Many buyers are choosing to pause until there’s more clarity—though well-priced homes are still moving quickly.

Average days on market dropped slightly to 57, with total contract-to-close times of 95 days, showing that motivated buyers and realistic sellers are still getting deals done efficiently.

What It Means for Abilene

Overall, September 2025 reflects a market in transition—moving out of the post-pandemic slowdown and settling into a more sustainable pace. Inventory remains tighter than last year, prices are stable, and activity in the core $200K–$300K bracket continues to anchor the market.

For both buyers and sellers, it’s a time when strategy and preparation matter more than ever. Those who understand the market’s balance between opportunity and caution will find success heading into the final quarter of the year.

💚 Nobody Knows Homes Better.

For a deeper look at your neighborhood or a custom market analysis, contact one of our experienced agents at senterrealtors.com

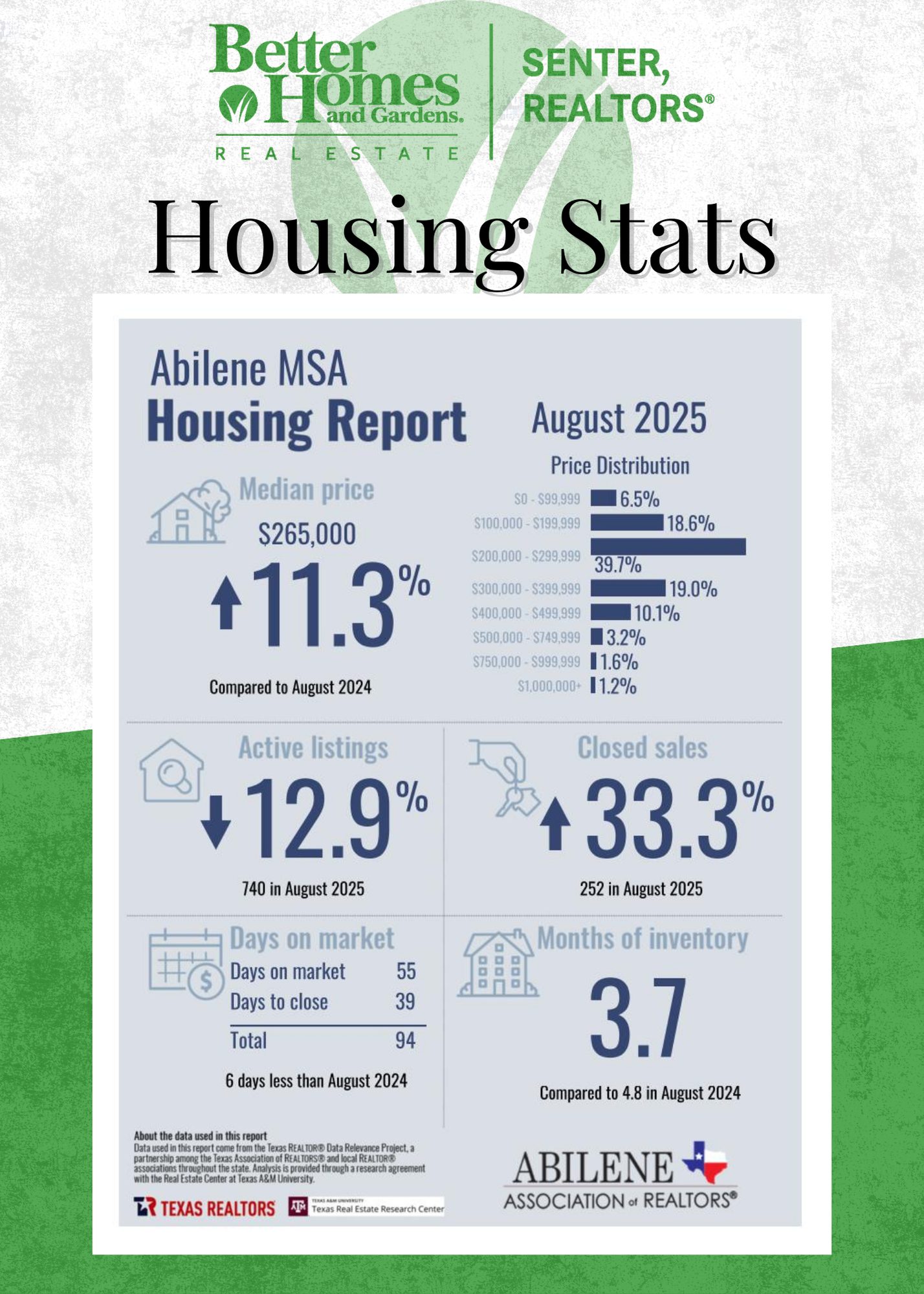

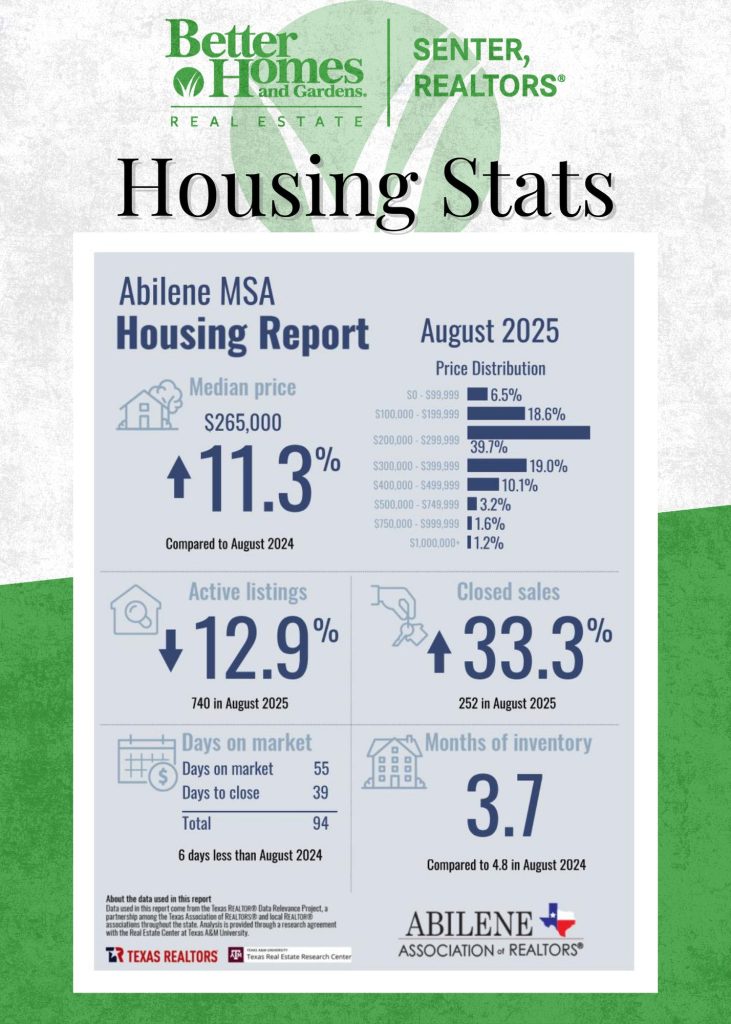

Abilene Market Update: August 2025

Abilene Housing Insights: August 2025

The Abilene housing market showed strong momentum in August, but context is key. Last year’s numbers were unusually soft, so this year’s big percentage jumps don’t tell the whole story. Even so, the data reveals important trends shaping today’s market.

Median Price Hits a New High

The median home price climbed to $265,000, up 11.3% from last August. That’s the highest median we’ve seen in Abilene. While rising prices reflect demand and inflationary pressure, it’s important to note where much of the activity is happening:

-

Nearly 40% of all sales were in the $200,000–$299,999 range.

-

Many of these are smaller new-build homes in the upper $200s, helping meet supply needs in a popular price bracket.

So while the median is high, the bulk of our market remains in that mid-range where affordability and demand intersect.

Inventory Tightens

Active listings fell 12.9% year-over-year, down to 740 homes. With just 3.7 months of inventory, the market is slightly more balanced and favors buyers in all higher price ranges. Compared to the 4.8 months available last August, buyers now face less choice and stronger competition – especially in the more affordable price ranges.

Sales Surge, But Perspective Matters

Closed sales rose 33.3% from last year, totaling 252 transactions. That looks dramatic, but remember: August 2024 was slow. Much of this year’s growth is catching up from a weak baseline rather than signaling a sudden market boom.

Mortgage Rates Driving Behavior

Rates continue to shape buyer and seller decisions. Activity spikes when rates ease, then slows again as they climb. This push-pull is a defining feature of today’s market, and likely will remain so heading into 2026.

What It Means for You

-

Buyers: Be ready to act quickly, especially in the $200K–$300K range. New builds are fueling supply here, but competition remains.

-

Sellers: Rising median prices and tighter inventory make this a strong moment to list, but smart pricing remains critical to attract serious buyers.

Abilene’s housing market is adjusting to higher rates, tighter inventory, and steady demand. The headline numbers are big, but the real story is balance: affordability still drives much of our activity, even as the median price reaches record levels.

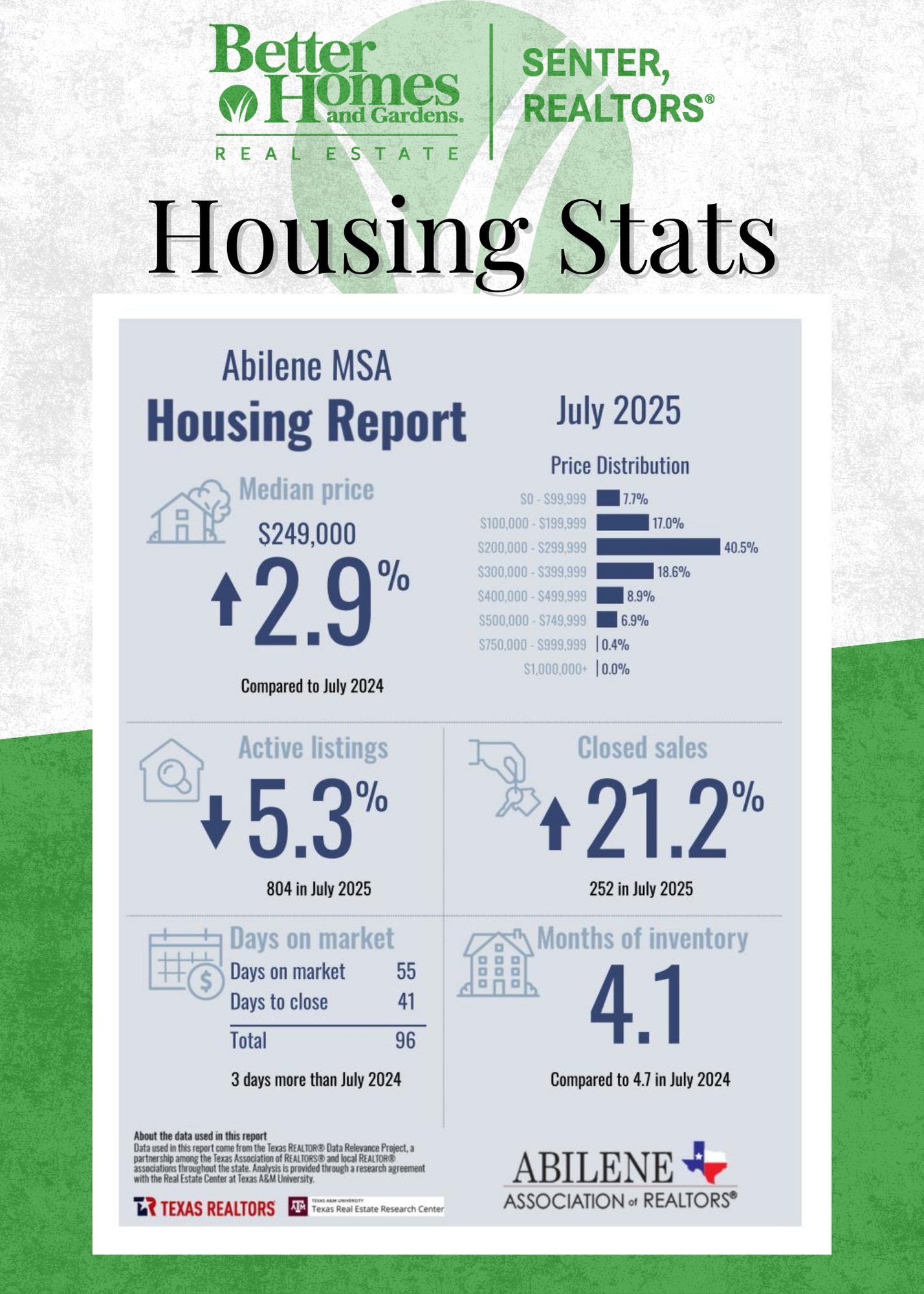

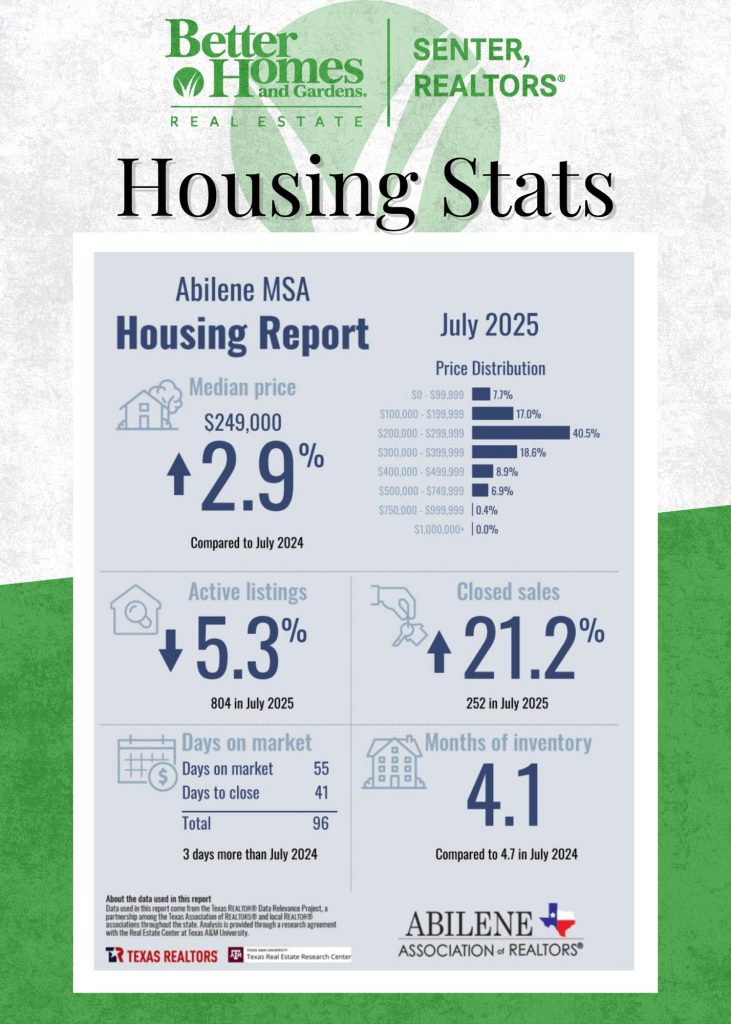

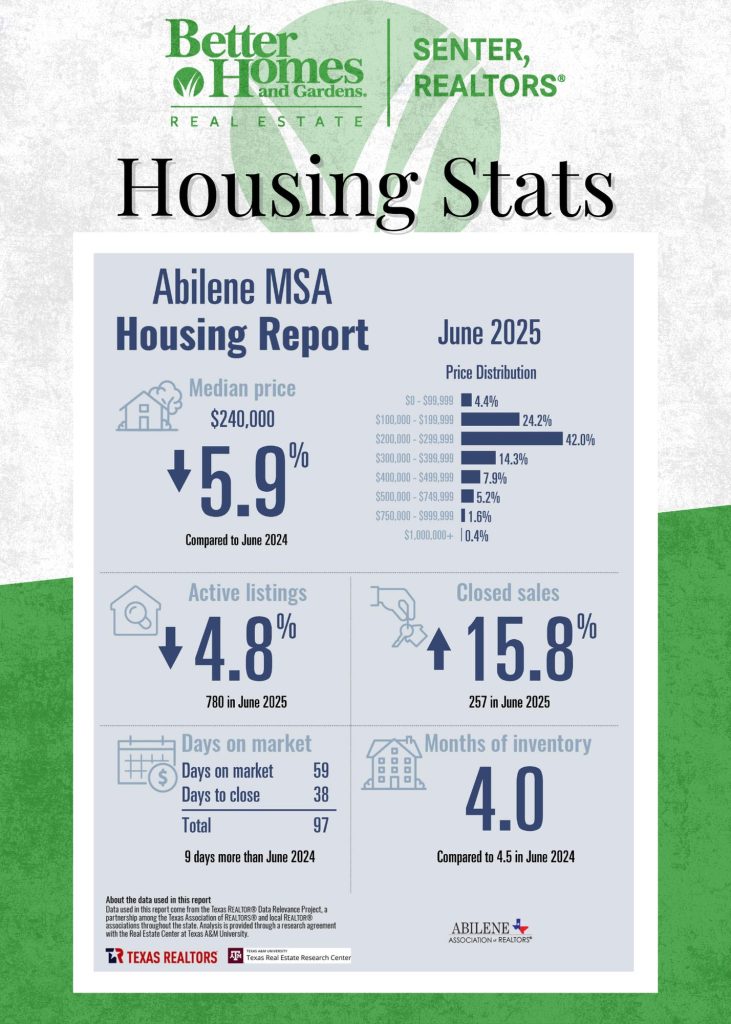

Abilene Market Update: June/July 2025

Abilene Housing Market Update – June & July 2025

Sorry for the late update! I’ve been traveling, and a run-in with a dumpster-loving bear in Colorado left me with a broken hand and surgery recovery. Thankfully, I’m on the mend — just with a little more character added to my story! 🐻✋

Now, let’s get into the market…

Market Overview

Overall, prices remain steady, with the usual summer surge as families settle in before the school year. This pattern is typical for June and July, but there are a few key takeaways worth noting:

-

The sweet spot: Homes in the $240,000–$280,000 range, especially those with nice updates, continue to fly off the market with multiple offers. This price point is where demand is strongest.

-

Higher-end slowdown: Luxury and higher-end homes are seeing softer pricing and longer days on market. This is giving buyers more negotiating power than we’ve seen in a while.

The Interest Rate Effect

Interest rates remain the biggest headwind, keeping some buyers cautious. However, recent economic news has been positive, and I’m very interested to see what the September stats reveal. My next update should be right on time and could bring important shifts in the story the numbers are telling.

Why It Matters

Whether you’re buying or selling, understanding which price segments are hot and which are cooling is key to making smart moves. For sellers, pricing strategy matters more than ever. For buyers, opportunities are opening up at the higher end while competition stays tight in the median range.

Local Expertise You Can Count On

Curious about your home’s value or buying opportunities in today’s market? Reach out to any of our Roadrunner Agents. With decades of experience and trusted local expertise, we’re here to help you make confident decisions.

📊 Check out the housing summaries below for both June and July 2025 for a quick snapshot of where the Abilene market stands.

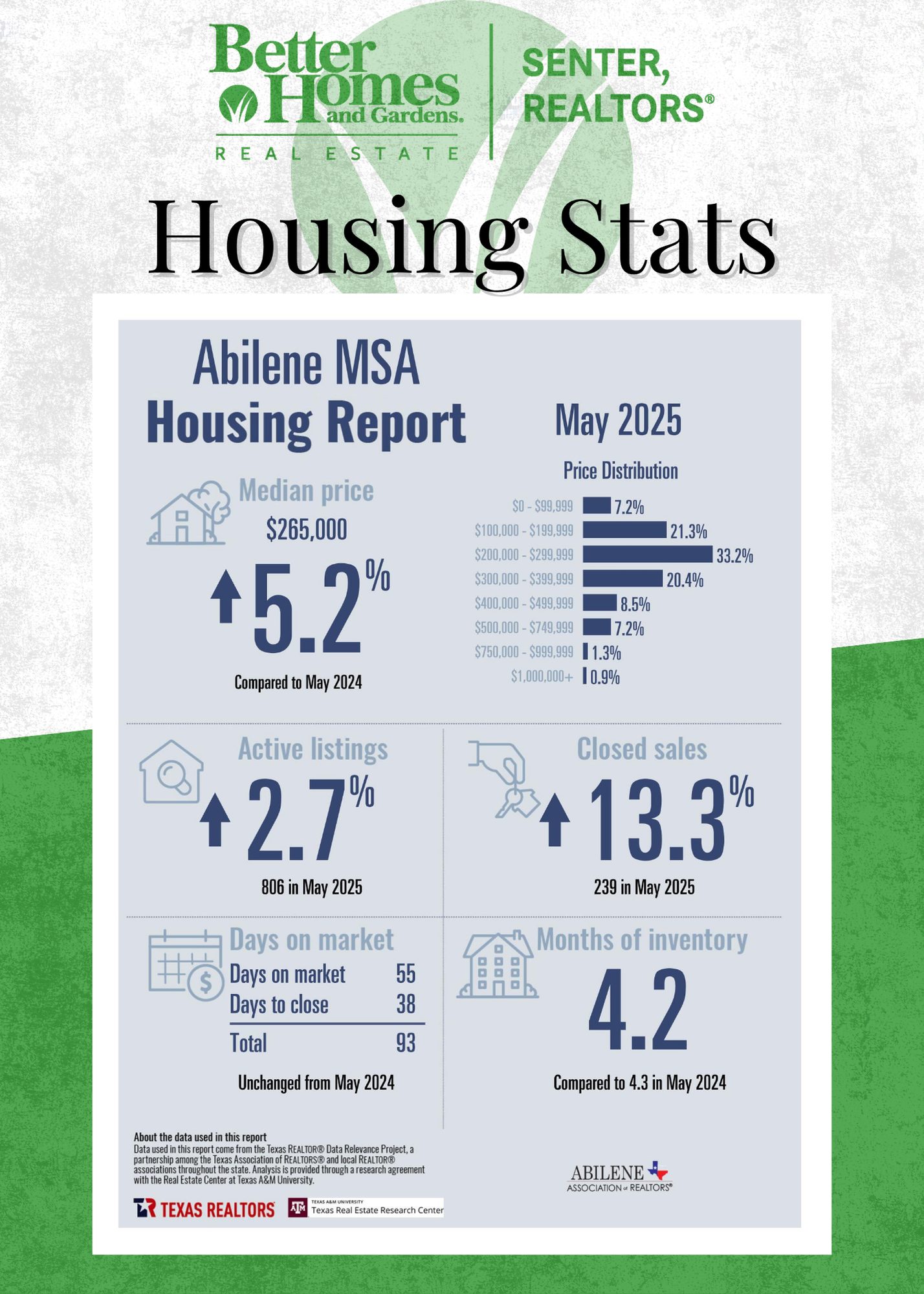

Abilene Market Update: May 2025

Abilene Housing Market Update: May 2025

May brought a noticeable boost in local real estate activity — but what’s really driving the numbers?

📈 Sales Volume Is Up — But Keep It in Perspective

Closed sales jumped 13.3% year-over-year, largely due to a sluggish May in 2024. Buyer activity is stronger in part because sellers are getting more aggressive with pricing and concessions, especially in the mid-to-lower price ranges. With 806 active listings (up 2.7%), buyers have more inventory to choose from — and they’re using that leverage.

🏠 Median Sales Price Rises, But…

At $265,000, the median price is up 5.2% compared to last year. However, many sellers are seeing price-per-square-foot values slightly down compared to what homes were getting 6–12 months ago. List-to-sale expectations must adjust accordingly.

💡 BHGRE Senter Performance Shines

Across the Abilene MLS, the average listing is taking 61 days to go under contract. At BHGRE Senter, we’re proud to report a median of just 23 days. That’s less than half the time — a direct result of precise pricing strategies and strong marketing execution.

🌐 Economic Factors in Play

According to the National Association of REALTORS® 2025 Economic Trends report, economic growth has slowed to a forecasted 1.7% for the year, while inflation remains sticky at 2.7%. Mortgage rates continue to hover above 6%, in part due to tariff-related inflationary pressure and global uncertainty. These headwinds are keeping some buyers cautious, but price flexibility and value-driven listings are helping drive deals locally.

🛠 What This Means for Buyers & Sellers

Sellers: Pricing right from day one is critical — the days of overpricing and waiting are over.

Buyers: You’re in a more favorable position than you were last year, but mortgage affordability still matters. Working with an experienced agent can help you navigate the balance between value and opportunity.

📞 Thinking of buying or selling? Let’s talk.

At BHGRE Senter, REALTORS®, we’ve been guiding Abilene real estate since 1957. Nobody knows homes better.

2025 Buyer Trends: Updated, Not Outdated

🏡 What Buyers Want in 2025: Why Move-In Ready Matters More Than Ever

When it comes to buying a home in today’s market, one thing is crystal clear: buyers are prioritizing updated, move-in ready homes over properties that need work. Whether they’re first-time buyers or seasoned homeowners, people want homes that feel fresh, functional, and aligned with today’s design standards—not another project on their to-do list.

And it’s not just a passing trend. These preferences are being shaped by broader lifestyle shifts, economic considerations, and evolving design standards. Let’s take a look at what’s behind this movement—and how it impacts sellers in the Abilene market and beyond.

💡 The Design Shift: From “Fixer-Upper” to “Finished and Fabulous”

Social media is overflowing with content that showcases picture-perfect homes and dreamy renovations. With a scroll through your feed, it’s easy to question if your home feels out of style. But according to design experts like NeKeia McSwain, it’s not necessarily what you have, but how you use it that counts.

Flexibility, quality, and personal touches are what truly set a home apart today:

-

Adaptable layouts that reflect how you live, not just what’s trendy.

-

Timeless updates like new flooring, modern lighting, and fresh paint.

-

Personal style and cultural influence over mass-produced, neutral minimalism.

This is great news for sellers—small, thoughtful improvements can make a big impact.

✨ Flooring Trends: Say Goodbye to Glossy and Gray

Flooring is one of the first things buyers notice, and 2025 is all about warmer, natural tones and sustainable materials. Experts predict a continued move away from:

-

Shiny, polished surfaces

-

Gray-washed wood or carpet

-

Cookie-cutter, builder-grade options

Instead, buyers are leaning into:

-

Matte finishes and brushed hardwoods

-

Patterned flooring like herringbone or wide planks

-

Eco-friendly materials like reclaimed wood and low-VOC finishes

These choices reflect a shift toward intentional design—homes that feel inviting, grounded, and built to last.

🔑 What It Means for Sellers

In today’s market, buyers aren’t just looking for square footage—they want style, comfort, and confidence. If your home is up-to-date, well-maintained, and move-in ready, you’re far more likely to:

-

Stand out in online listings

-

Attract stronger offers

-

Sell faster and with less negotiation

Even simple updates like replacing worn flooring, painting in warm neutrals, or staging with modern pieces can dramatically elevate your home’s appeal.

🏠 Selling in Abilene? We’re Here to Help.

At BHGRE Senter, REALTORS®, we’ve been helping Abilene area homeowners make smart moves for nearly 70 years. Our experienced agents understand what local buyers want—and we know how to help sellers make the right updates without overdoing it.

Let us guide you through a smooth, strategic selling process that gets results.

📞 Call us today or visit senterrealtors.com to connect with a local expert who understands the market and how to position your home to shine.

Need help deciding what updates will make the biggest impact?

Ask us about a personalized home prep consultation—no pressure, just honest guidance.

📍 Nobody knows homes better.™

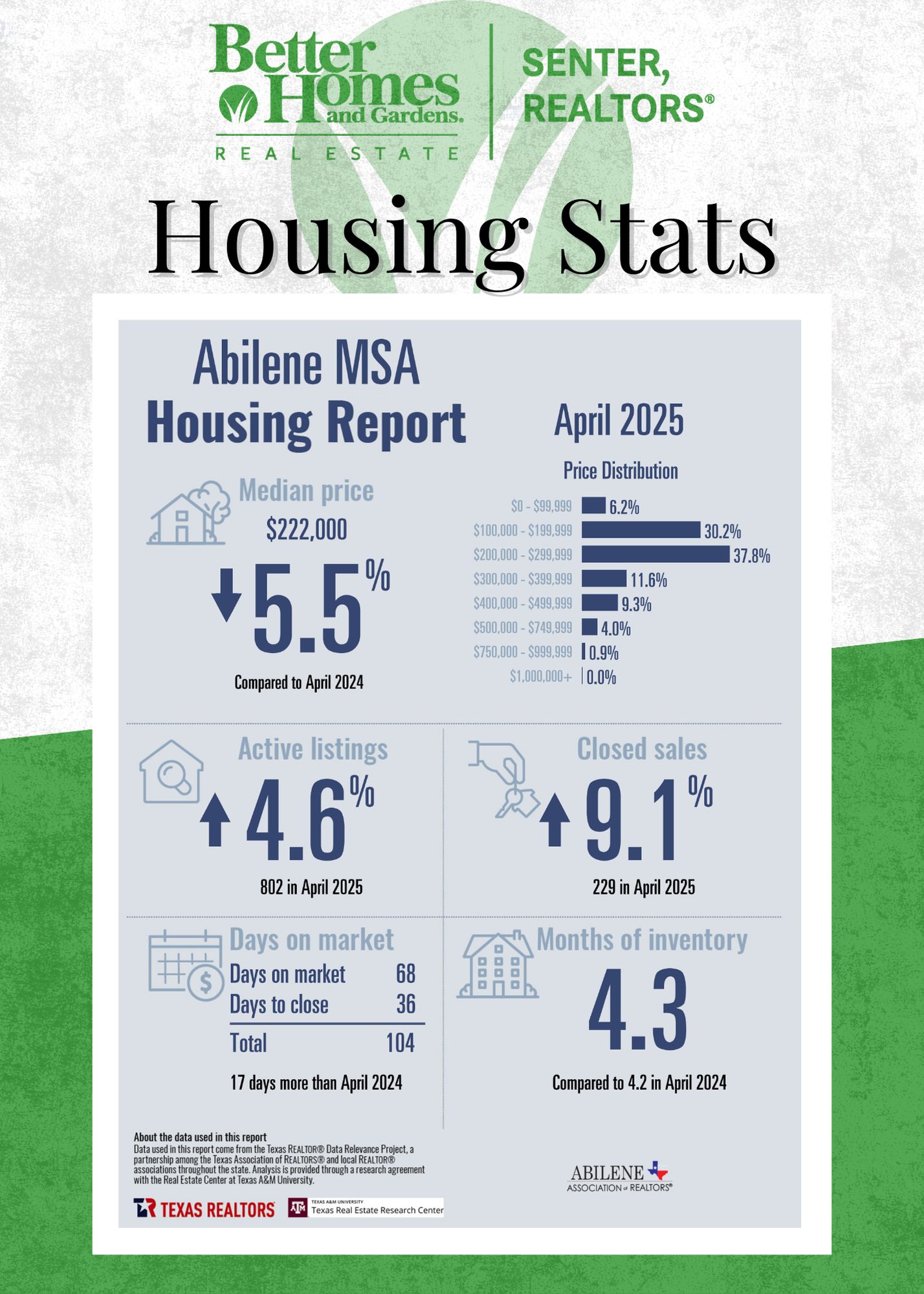

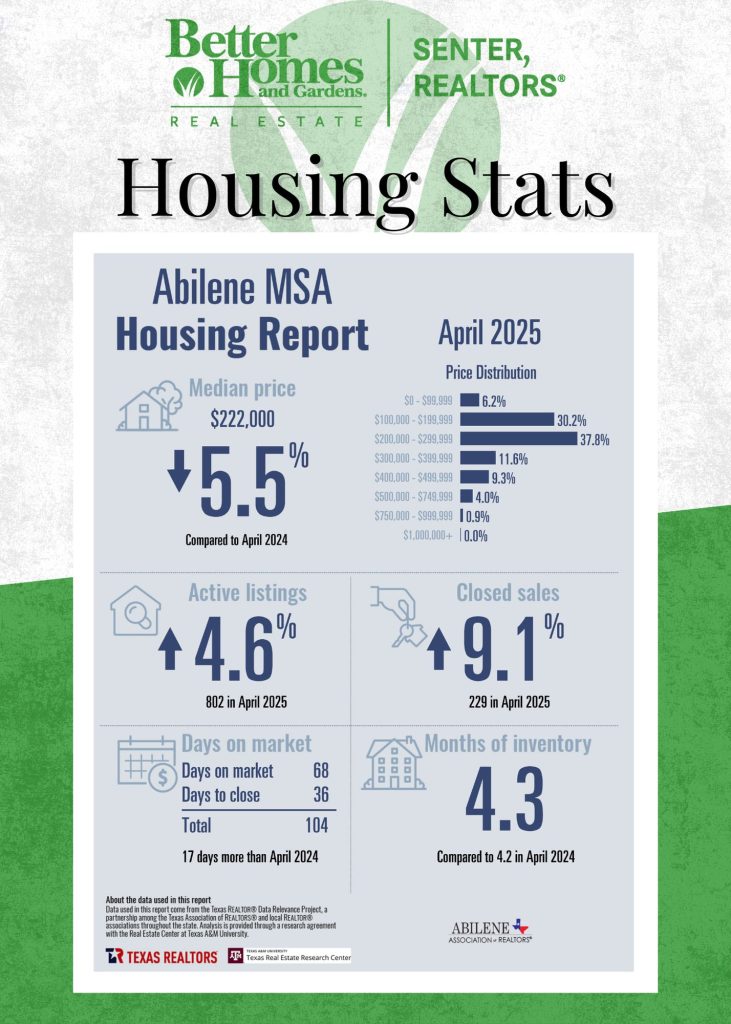

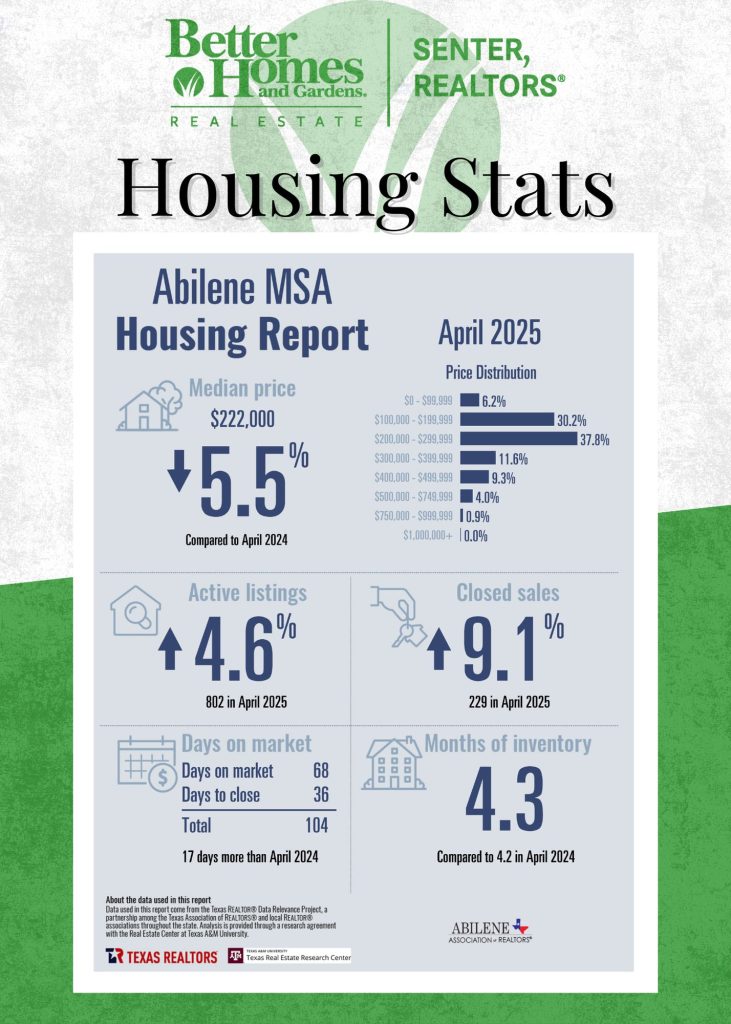

Abilene Market Update: April 2025

Abilene Housing Market Update – April 2025

Local Stats, National Trends & What They Mean for You

As we head deeper into Q2, the Abilene housing market is showing signs of healthy momentum. April brought an encouraging mix of increased sales activity, more inventory for buyers to choose from, and a shift in pricing that could present new opportunities for both buyers and sellers.

🔍 Abilene Market Snapshot – April 2025

-

Median Sales Price: $222,000 (↓ 5.5% YoY)

-

Closed Sales: 229 (↑ 9.1% YoY)

-

Active Listings: 802 (↑ 4.6% YoY)

-

Days on Market: 68 (17 days longer than April 2024)

-

Months of Inventory: 4.3

-

Median Price Per Sq. Ft.: $148.50 (↑ 0.4%)

-

Median Year Built: 1983

-

Close-to-Original List Price: 95.1%

What this means:

We’re seeing more homes on the market and stronger buyer activity compared to last year. While the median price has ticked down slightly, this doesn’t signal weakness—rather, it’s a sign that the market is normalizing after years of rapid appreciation. The uptick in inventory provides breathing room for buyers, while sellers can still benefit from steady demand and healthy list-to-sale ratios.

🏡 Pricing Breakdown

A look at April’s price distribution shows that affordability remains a driving force:

-

38% of sales fell in the $200K–$299K range

-

30% were between $100K–$199K

-

Less than 1% of homes sold above $750K

This aligns with national data from the NAR Housing Affordability Report, which notes that households earning $75,000 annually can afford fewer than 25% of for-sale homes nationwide. In Abilene, however, entry-level and mid-range homes remain within reach—making our market a bright spot in an otherwise affordability-challenged housing landscape.

📉 Economic Context: Rates, Inflation & Buyer Behavior

National inflation data from April showed signs of cooling, with the Consumer Price Index (CPI) easing in key housing categories. As a result, mortgage rates have held relatively steady after months of volatility. According to NAR’s May 1 update, rates are expected to remain between 6.5%–7% through mid-year, depending on inflation and Federal Reserve actions.

What this means for Abilene:

Steadier interest rates and growing inventory should help balance our local market. Buyers have more time and choice, while sellers who price strategically will still find motivated purchasers.

✨ The Power of Home Staging

The 2024 Profile of Home Staging from NAR reminds us why presentation matters. Key takeaways:

-

81% of buyers’ agents said staging made it easier for clients to visualize the property as their future home.

-

Staged homes sell faster and often for more—particularly in the living room, kitchen, and primary bedroom.

-

Sellers’ agents reported a 1–5% increase in offer prices on staged homes.

Local tip: With homes in Abilene spending 68 days on market, a well-staged property could help speed up the process and improve final sale price. If you’re planning to sell, our team can connect you with experienced staging professionals to give your listing a competitive edge.

💬 Final Thoughts

The April 2025 numbers paint a picture of a market in transition—not overheated, not stagnant, but active and balanced. Buyers are gaining confidence as inventory grows, while sellers who adapt to pricing trends and presentation are seeing strong results.

Whether you’re looking to buy, sell, or simply make sense of what’s happening in today’s market, we’re here to help. Better Homes and Gardens Real Estate Senter, REALTORS® has proudly served the Abilene area for nearly 70 years—and nobody knows this market better.

📲 Reach out to one of our local experts today or explore available listings here: https://senterrealtors.com/listings/our-active-listings

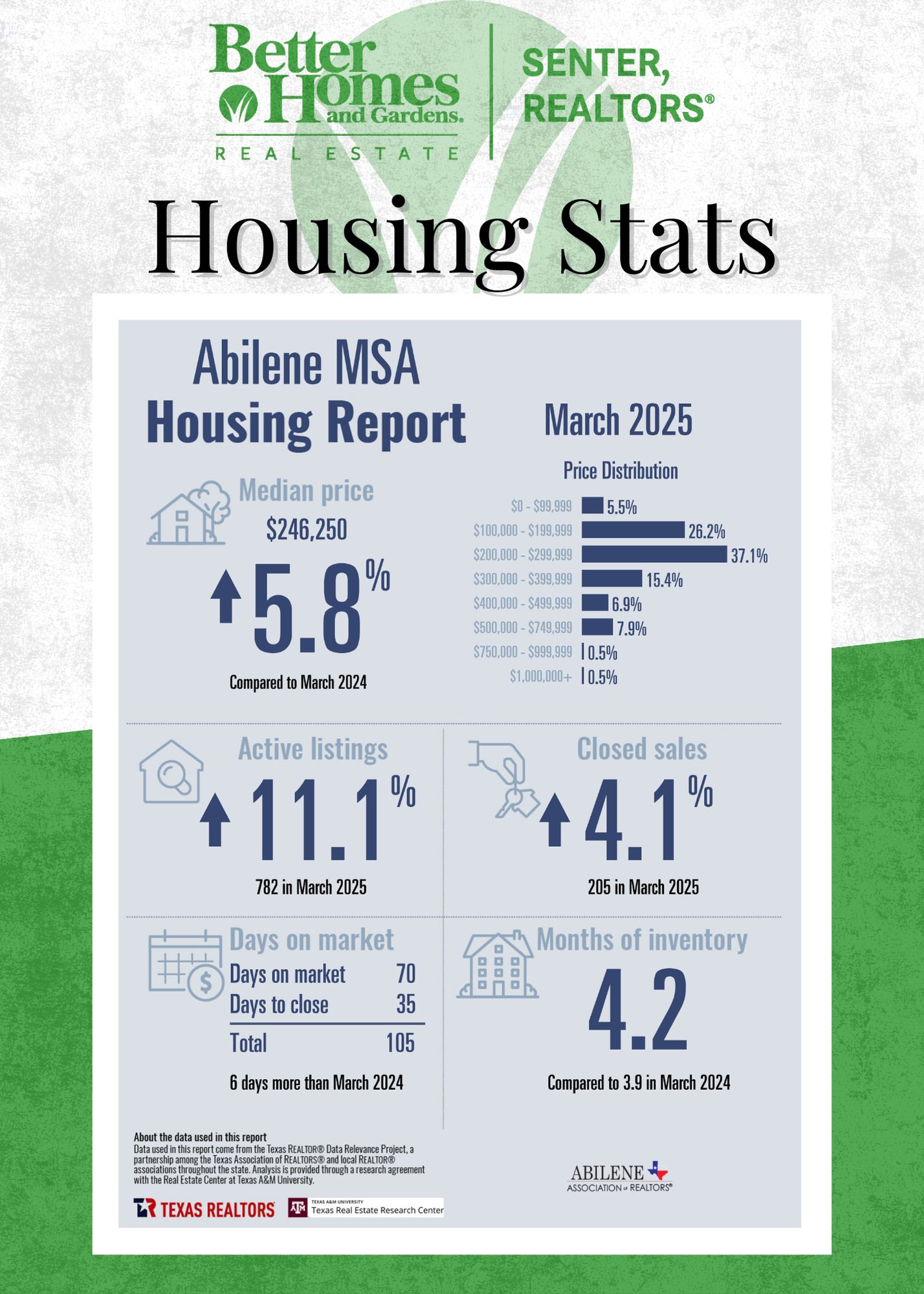

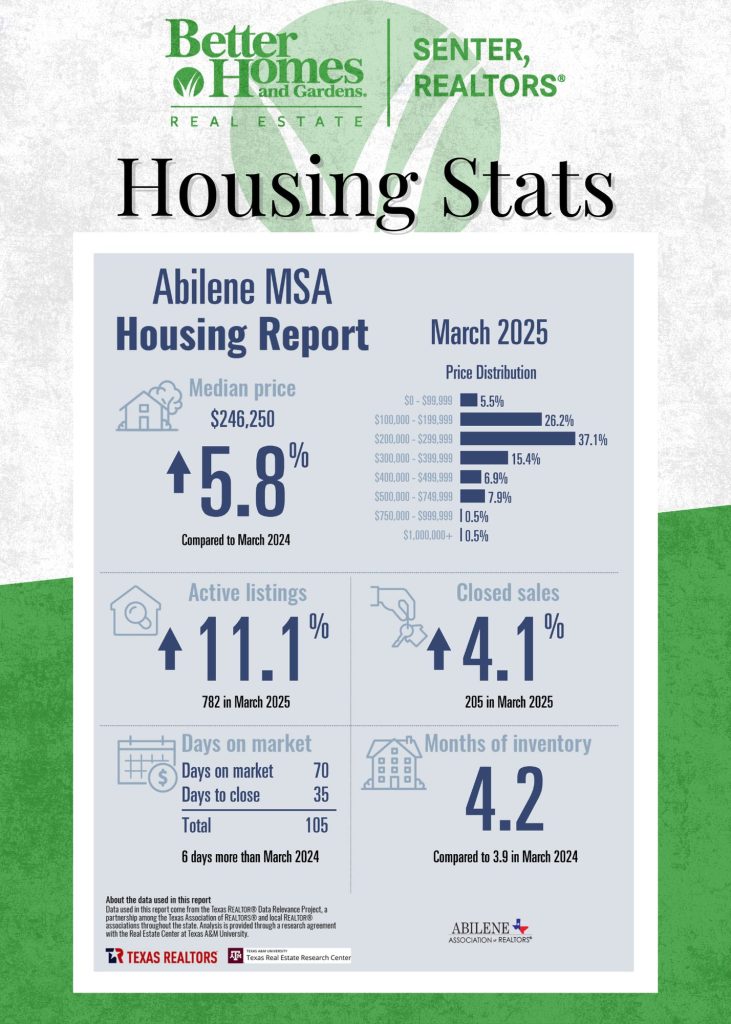

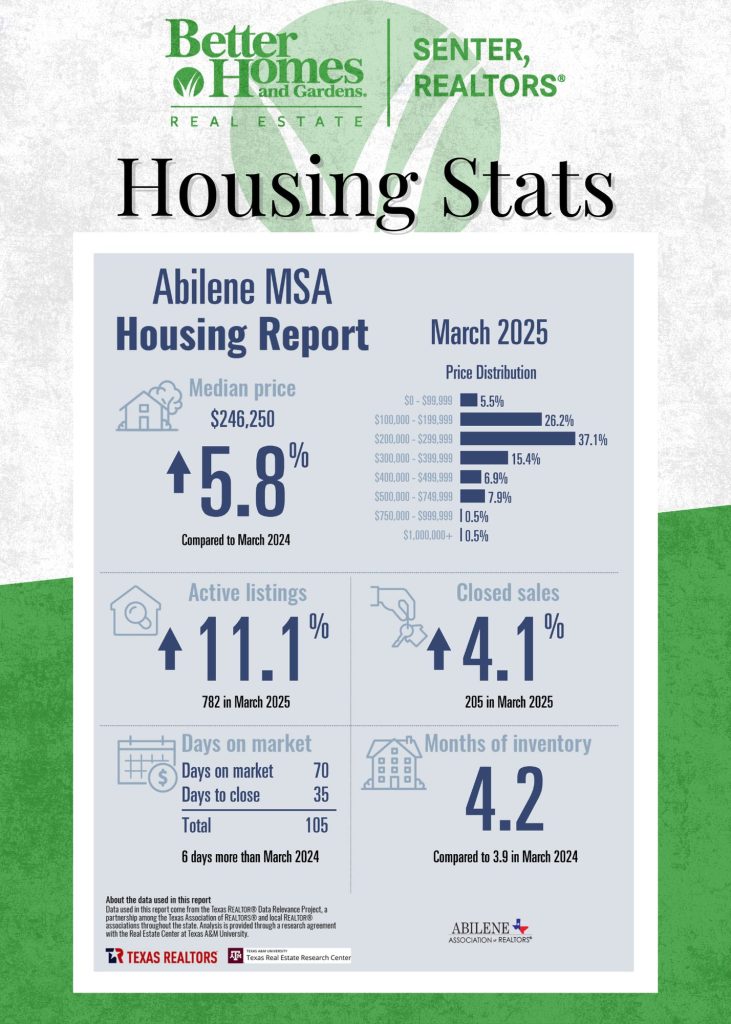

Abilene Market Update: March 2025

A Balanced Market Brings Stability & Opportunity

As spring breathes new life into West Texas, the real estate market in Abilene is picking up right on cue. March 2025 delivered a solid boost in activity, reflecting a continued trend of healthy, balanced conditions that offer promising opportunities for both buyers and sellers.

📈 Strong Seasonal Start

March showed a 4.1% increase in closed sales year-over-year and came in nearly 18% higher than the average of January and February this year. It’s a strong start to the spring selling season, and all indicators point toward steady activity in the months ahead.

🏠 Inventory Holds Steady

We’ve now had a full 12 consecutive months with 4+ months of inventory, a signal that the local market has officially rebalanced. This shift gives both buyers and sellers a fair playing field—gone are the extreme swings we saw during peak pandemic years. Current inventory sits at 4.2 months, up slightly from 3.9 in March 2024.

💰 Price Stability Reinforced

The median home price in March 2025 was $246,250, up 5.8% from a year ago, continuing a remarkably stable stretch. In fact, for the last 15 months, the median sales price in Abilene has hovered between $230,000 and $250,000. That consistency is great news for appraisals, financing, and long-term homeowner confidence.

🔍 Insight from the Experts

We know the national headlines can feel uncertain. With continued changes in interest rates and evolving economic policy, it’s critical to stay informed. We recommend checking out these recent expert insights from NAR’s economists:

💡 What This Means for Buyers & Sellers

-

Buyers: Inventory levels are more favorable, and with stable prices and upcoming rate adjustments expected, there’s a strong case for acting sooner rather than later.

-

Sellers: Activity remains strong. If you’ve owned your home for a few years, you’re likely sitting on a significant amount of equity. Well-prepared homes are still commanding strong attention and competitive offers. Reach out to us for a free market evaluation and equity check-in!

🏃♂️ Roadrunners in Action

A quick shoutout to our BHGRE Senter, REALTORS® team of Roadrunners—we walk the walk. In the past month and a half, the Abilene market has averaged two homes per day coming back on the market after contract fallout. Our team? Just four contracts fallen through this entire year so far. That’s the power of quality over quantity.

We ask the right questions. We vet every deal. And we make sure the contract you sign is one that closes.

If you’re looking to buy, sell, or just get clarity on your next real estate decision—reach out.

📞 (325) 695-8000

🌐 www.SenterRealtors.com

📍 Abilene owned. Legacy built.

Because Nobody Knows Homes Better.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link