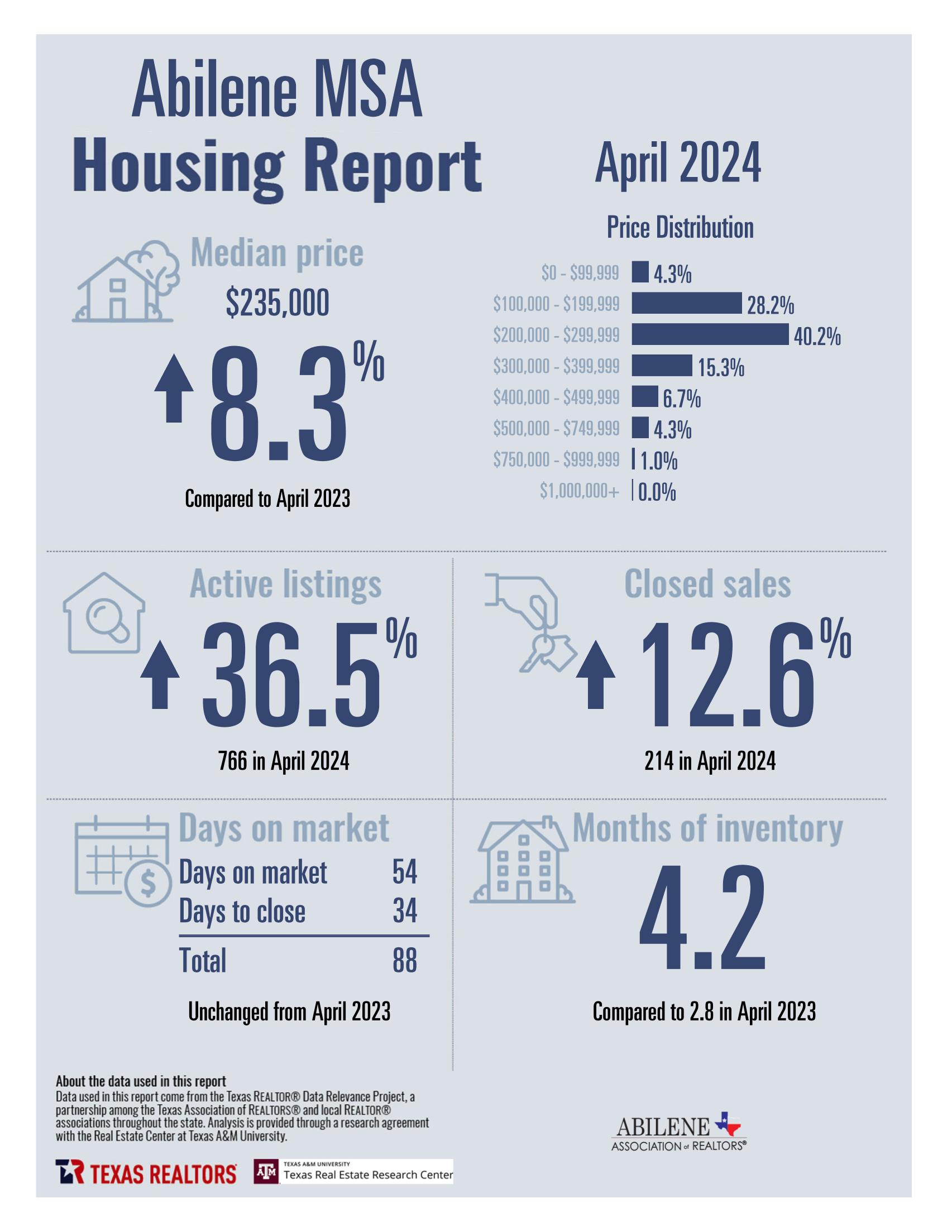

Abilene Housing Insights: April 2024

Spring has sprung, and the Abilene housing market is reflecting that with a much-anticipated boost in activity. After a sluggish first quarter, April has brought a refreshing uptick, signaling a strong start to the spring selling season. While rising interest rates and home prices continue to challenge buyers, the inventory of available homes is at one of the highest levels we’ve seen in the past eight years.

Market Dynamics

The increased volume of listings has tipped the scales in favor of buyers across most market segments. Sellers are offering concessions and implementing price reductions daily to stay competitive. Affordability remains a key concern for buyers, with the costs of taxes and insurance adding to the financial burden. Despite these challenges, the current market offers some excellent opportunities for those who can afford to buy.

Advice for Sellers

Given the rapid growth in inventory, it is crucial for sellers to maintain regular communication with their agents. Pricing your property correctly is more important than ever; an overpriced listing can quickly become stagnant in such a competitive market. Sellers should be prepared to make adjustments as needed to attract potential buyers.

Tips for Buyers

For prospective buyers, understanding the true cost of homeownership is essential. While owning a home is still one of the best ways to build wealth over time, the rising prices and increased costs of taxes, insurance, and maintenance can add up quickly. Buyers need to budget carefully and be aware of all the associated expenses to avoid any unpleasant surprises.

Expert Guidance

Navigating the ever-changing real estate market can be daunting. That’s why having the support of a full-time professional is invaluable. At BHGRE Senter, REALTORS, our team of dedicated agents brings decades of experience and a commitment to serving our clients. We provide the guidance and advice needed to succeed in today’s market.

Whether you’re looking to buy or sell, we’re here to help. Contact us today at (325) 695-8000 and let us assist you in making the most of the current market conditions.

Key Takeaways:

- April saw a strong start to the spring selling season after a slow first quarter.

- High inventory levels have created a buyer’s market in many areas.

- Seller concessions and price reductions are common as sellers strive to remain competitive.

- Affordability remains a challenge, but opportunities abound for those who can navigate the costs.

- Regular communication with your agent is crucial for sellers to adjust pricing strategies.

- Buyers need to be aware of the full costs of ownership, including taxes and insurance.

- BHGRE Senter, REALTORS offers expert guidance to help you succeed in this market.

Call us today if we can help you buy or sell! (325) 695-8000

Abilene Housing Insights: March 2024

The Abilene real estate market continues to stabilize, settling into a new normal as we navigate the changing landscape. While home prices have seen a decrease compared to March 2023, overall prices have remained relatively higher in 2024 so far. We anticipate a modest price increase of 1-2.5% by the end of the year.

For Sellers: It’s essential for sellers to receive expert advice, insight, and guidance to remain competitive in the current market. Making informed decisions about whether selling is the right move for you at this time is crucial. Despite high concessions being offered in the market to buyers, many sellers still hold substantial equity in their homes, thanks to the price increases over the last few years. With the right strategies, homes can still sell quickly. Our REALTORS® offer free initial consultations to help you navigate pricing, concessions, staging, and more.

When it comes to listings sold per person across Abilene and the surrounding areas, our team at Better Homes and Gardens Real Estate Senter, REALTORS® stands out in terms of productivity. Let us assist you too!

For Buyers: For buyers, the market offers more concessions than we’ve seen in the last five years. Interest rates have remained relatively stable over the past three months, but we expect slight reductions by year’s end. Inventory levels are the highest they’ve been since 2018, providing buyers with more options and less competition for the perfect home. Our full-time experts are here to guide you through the buying process and help you craft a winning offer.

Importance of Advertising: As market inventory increases, the need for effective advertising becomes more pronounced. While many homes sold quickly in 2022 and 2023 with minimal advertising, this is no longer the case. Listing on Zillow is important, but it only covers around 56-58% of real estate website traffic. Reaching potential buyers across different platforms, including social media and beyond, is essential. Our 10-day paid advertising campaigns for every listing have played a key role in our strong performance.

We’re Here to Help: With nearly 70 years of experience, we are your Abilene-grown, family-owned, residential and commercial real estate experts. Reach out to your favorite BHGRE Senter agent today, and let us help you on your path to success!

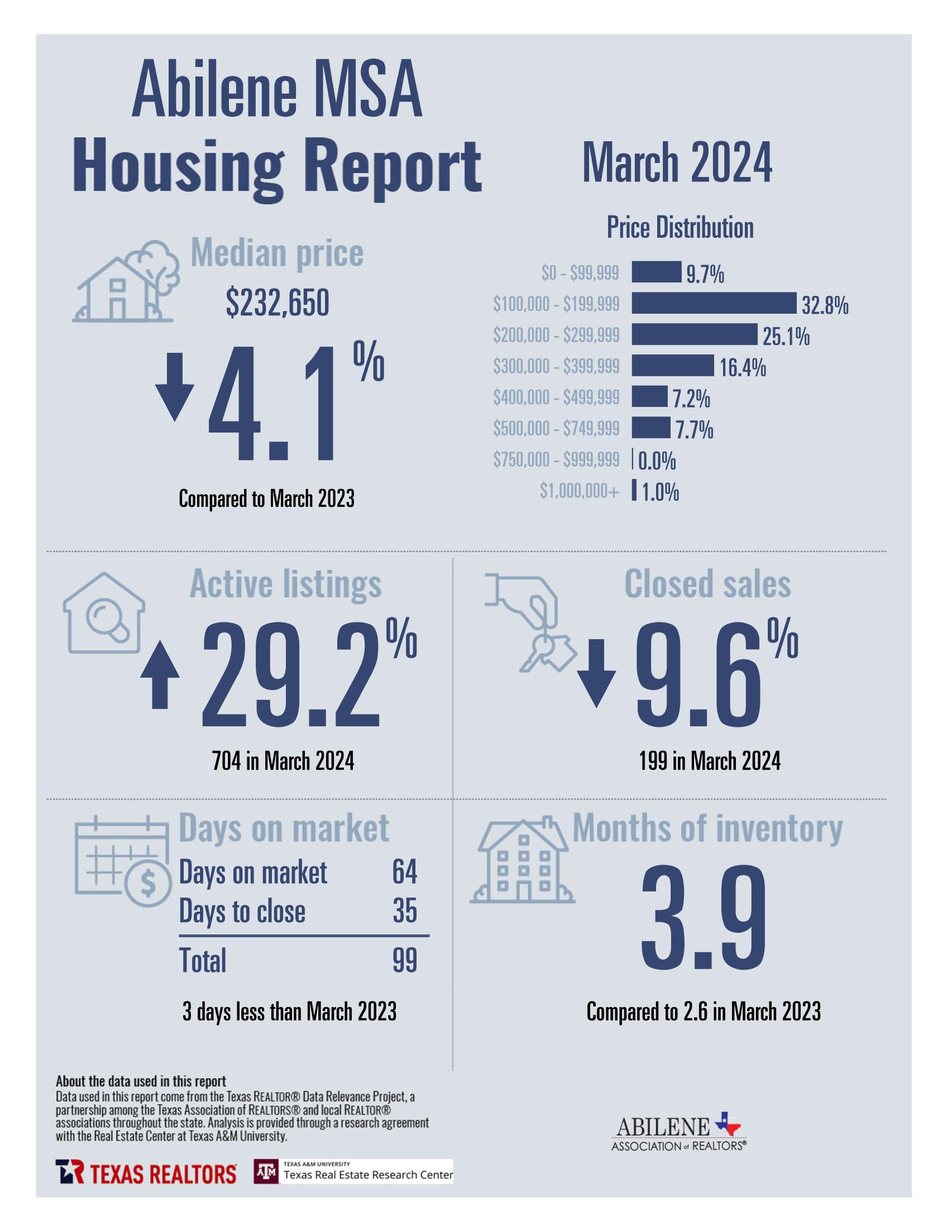

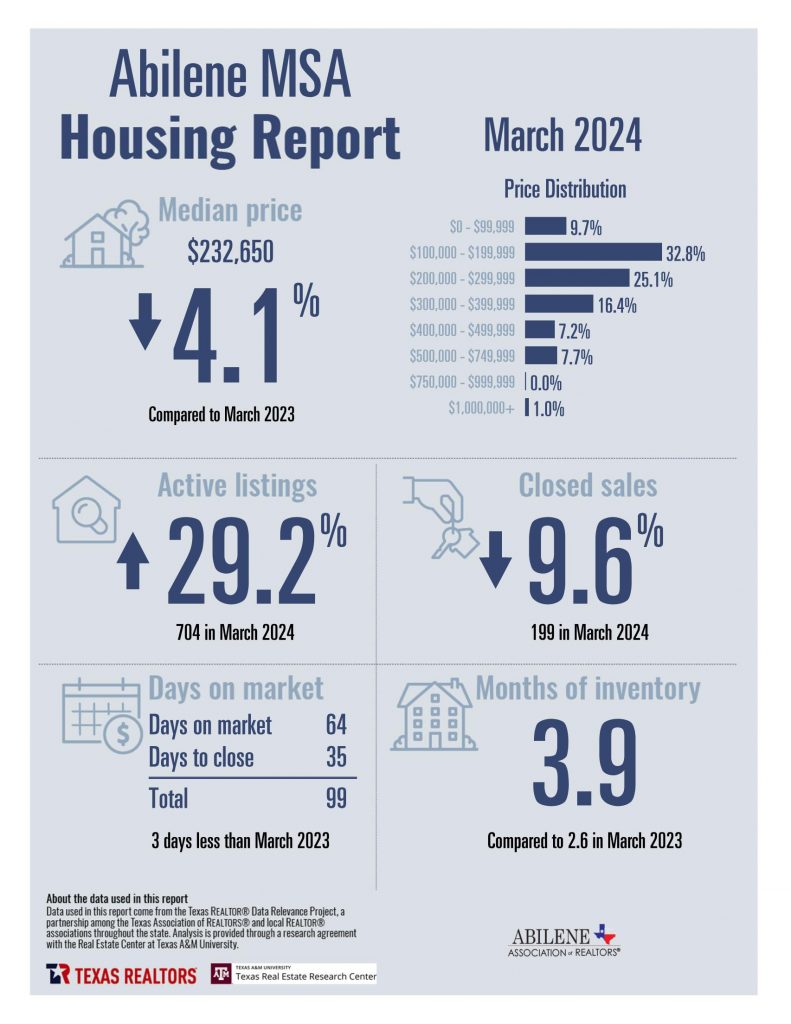

March 2024 Stats

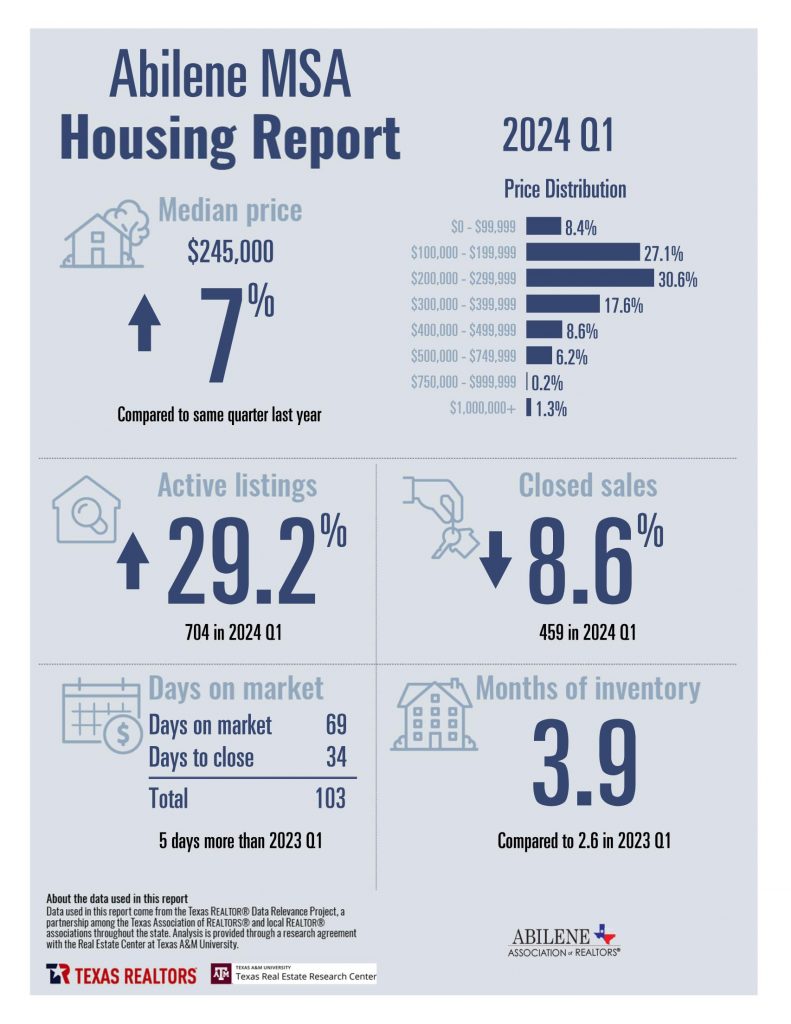

Q1 2024 Stats

Abilene Housing Insights: February 2024

Market Activity Trends

Activity is picking up but remains below February 2023 levels. With pending contracts indicating a positive trajectory, March is anticipated to witness a significant uptick, traditionally signaling the onset of the spring selling season. This year holds even greater promise due to favorable interest rates and market conditions.

Pricing Dynamics

Lower interest rates and robust new construction sales have supported high housing prices, following the correction prompted by elevated interest rates in 2023. Prices are expected to experience a modest upward trend until year-end, mirroring the anticipated decline in interest rates, possibly reaching the high 5 percent range by Q4.

Buyer’s Market Dynamics

Despite prevailing buyer-friendly conditions in most of the Taylor County market area, exceptions exist, emphasizing the indispensable role of seasoned REALTORS. Crafting the right pricing strategy, offering property concessions, and implementing a robust marketing plan with targeted advertising are now more crucial than ever.

Importance of Marketing

With the average marketing time hovering around 100 days, effective marketing and advertising have never been more important. Unlike previous years, where listings often sold with minimal marketing, the current climate necessitates a proactive approach. BHGRE Senter, REALTORS, offers comprehensive paid marketing packages integral to achieving successful outcomes for clients.

In summary, while the Abilene housing market presents challenges, informed decision-making and strategic guidance from experienced professionals remain pivotal in navigating evolving dynamics and achieving optimal results in real estate transactions. Contact Us if our full-time and experienced experts can help you buy or sell!

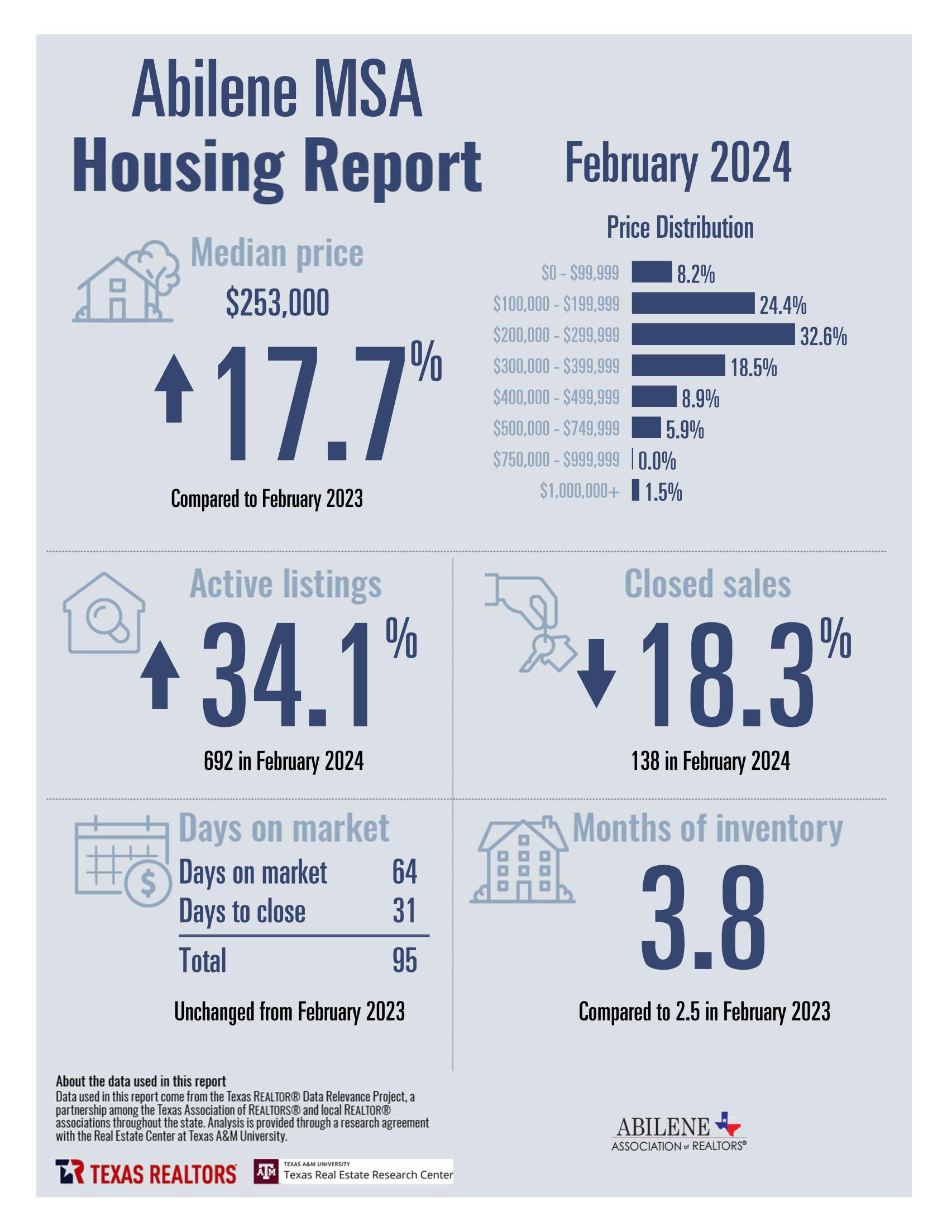

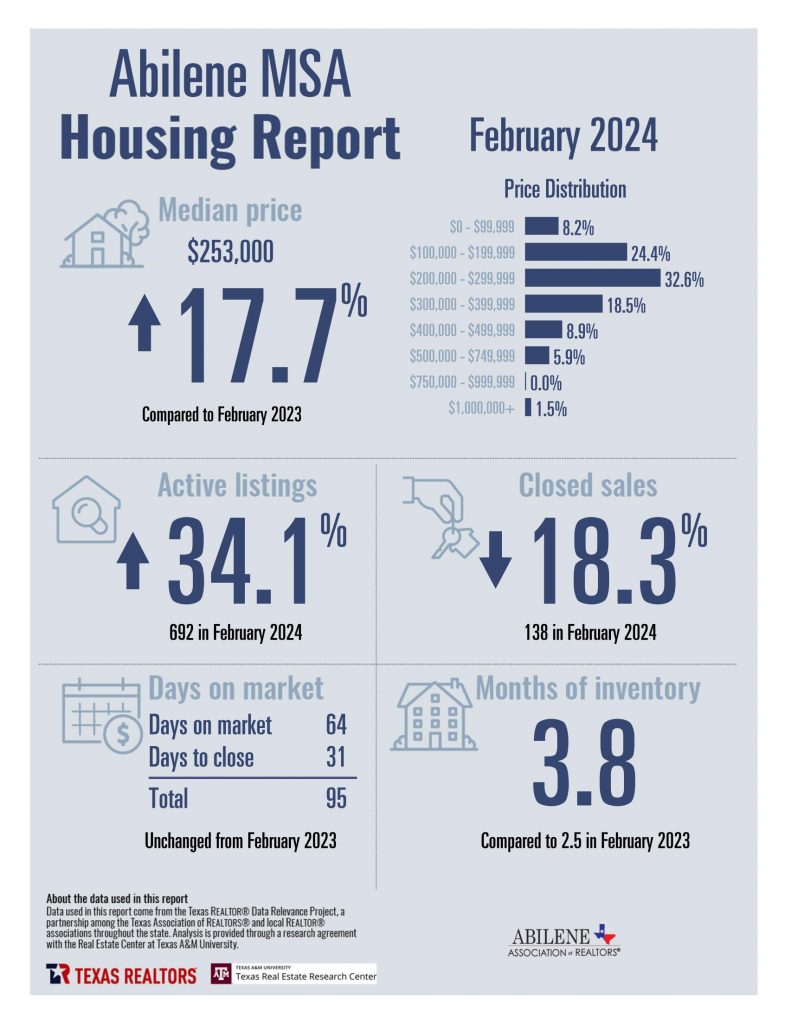

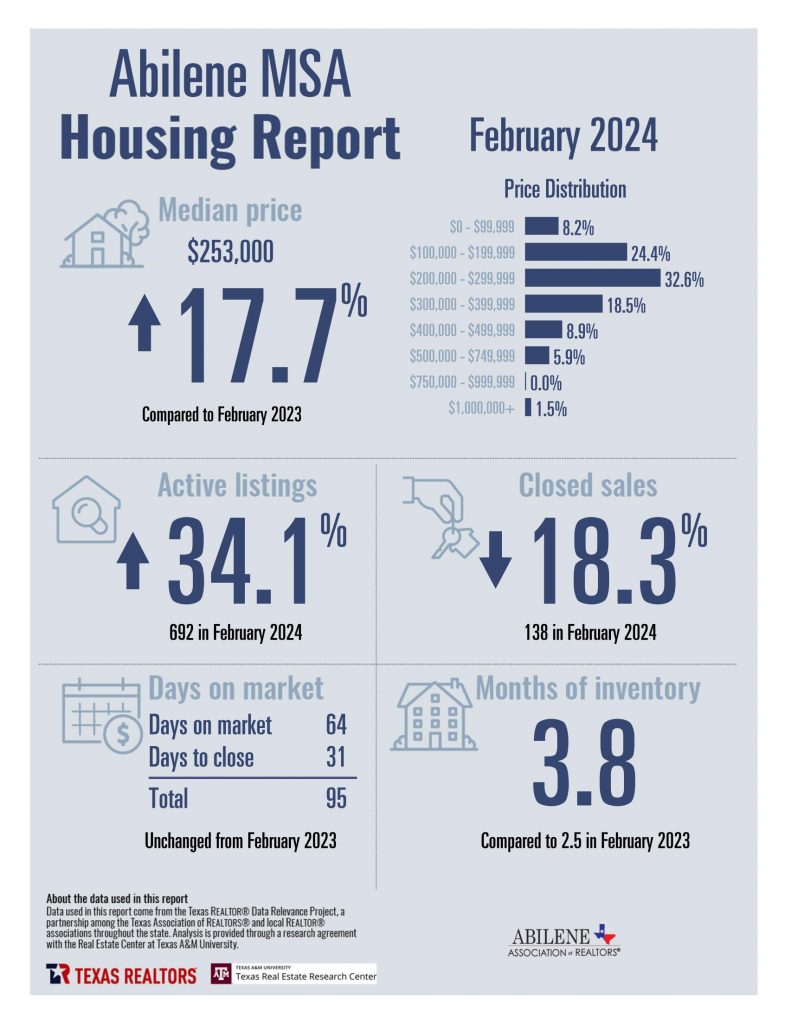

Abilene Area Housing Market Stats

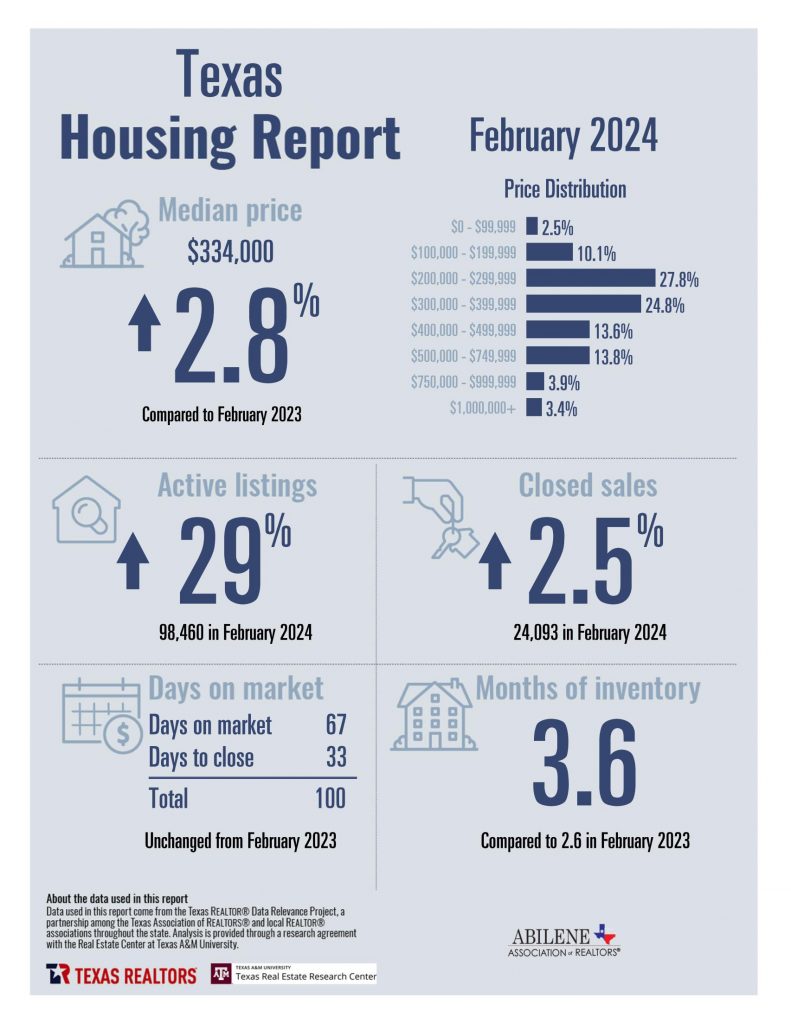

State of Texas Housing Stats

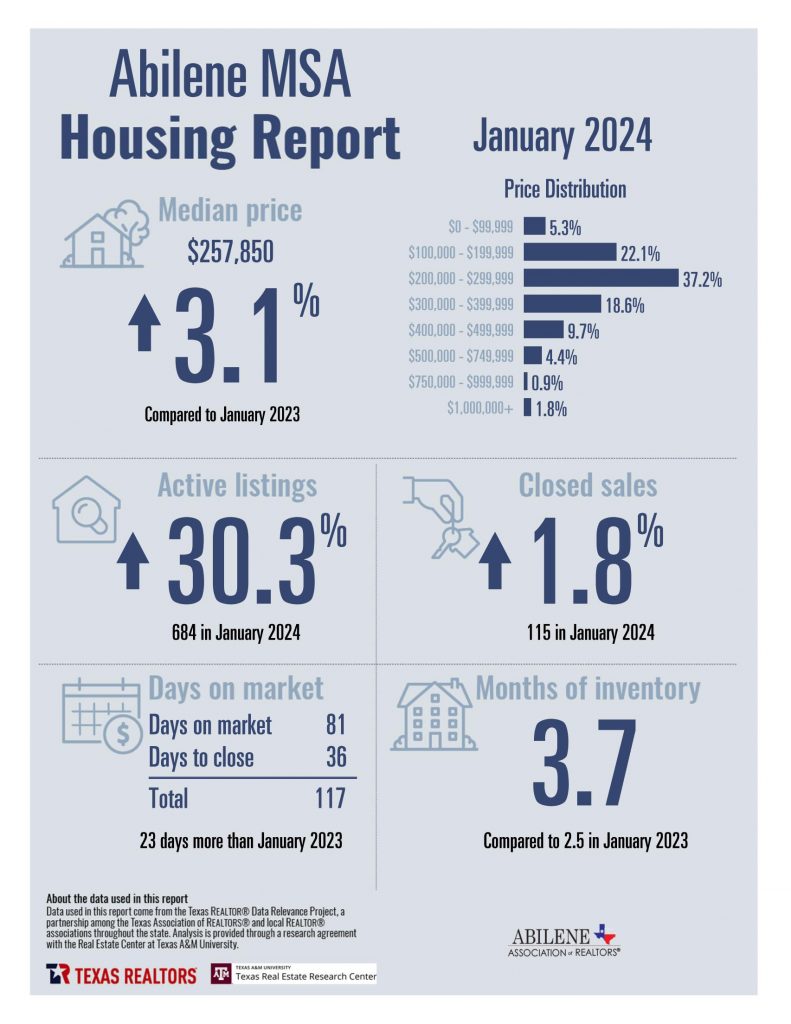

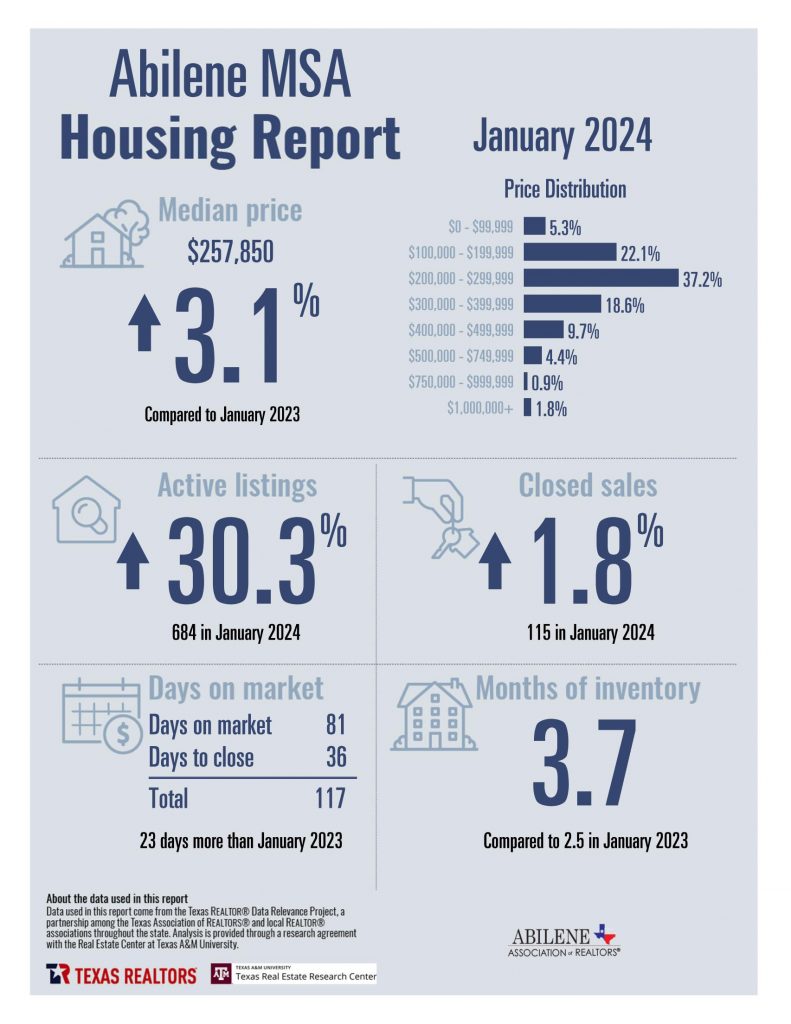

Abilene Housing Insights: January 2024

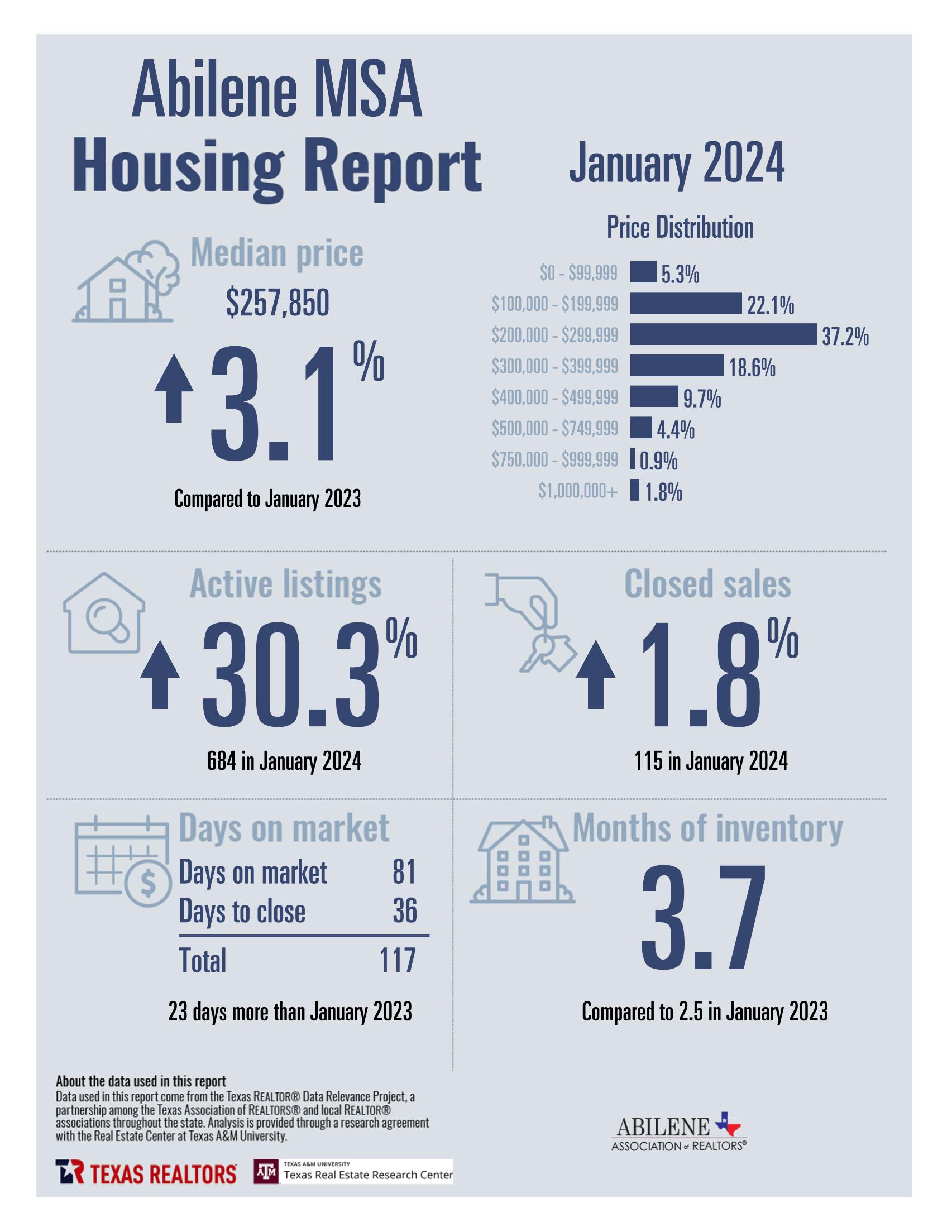

As January unfolded, it brought with it the gentle stirring of a new year in Abilene’s housing market. While the 115 closed sales is significantly less than many previous months, it’s a reflection of a shifting landscape from the seller’s market that characterized much of 2023. Indeed, last year saw a notable decline in sales volume compared to 2022, signaling a change in the tide.

Adjusting Expectations in a Changing Market

Buyers stepping into the arena are met with the reality of higher prices and interest rates, but there’s a silver lining in the form of seller concessions. These concessions can offer significant savings at the closing table and provide welcome relief. However, sellers must also adapt to the evolving market conditions, as evidenced by the increasing average time on the market, which soared to 117 days in January 2024. While this figure may fluctuate in the coming months, it underscores the importance of managing expectations and planning accordingly for a longer selling timeline.

Navigating the Price Range Conundrum

One notable shift is the scarcity of homes in the $100,000-199,000 price range, which has reached its lowest closed percent in January. This can be attributed to the rising prices across the board, transforming it into the new “investor bracket.” However, despite the challenges posed by potential renovations and repairs, there are still hidden gems waiting to be discovered. Additionally, buyers qualifying for homes in this range often qualify beyond this range. Many buyers opt for properties with more features or space, leveraging their purchasing power to meet their evolving needs.

Embracing the New Normal

As we settle into the new normal, it’s crucial to dispel unfounded speculation and focus on practical decision-making. With major market shifts already behind us, waiting for further changes may yield little benefit. Instead, anticipate a steady annual rise in prices and the possibility of interest rates dipping into the low 6% range by year’s end. At Better Homes and Gardens Real Estate Senter, REALTORS, our team stands ready to offer expert guidance tailored to your unique circumstances. Whether you’re a buyer or a seller, trust us to navigate the nuances of the Abilene housing market and help you achieve your goals.

Contact any of our agents today to embark on your real estate journey with clarity and assurance.

Get to Know BHGRE Senter, REALTORS!

For nearly 70 years, Better Homes and Gardens Real Estate Senter, REALTORS has been the cornerstone of real estate excellence in Abilene. Our proud family-owned firm, deeply rooted in the community, has played a pivotal role in shaping the real estate landscape, serving both residential and commercial clients with distinction.

A Legacy of Trust and Success

Founded by “Citizen of the Year” award winner Bill Senter in 1957, our company has stood the test of time, passing on a rich legacy of excellence from one generation to the next. Bill Senter passed the torch in 1996 to his son, Scott Senter. Today, under the leadership of third-generation REALTOR Shay Senter and our partnership with Better Homes and Gardens Real Estate, we continue to uphold our commitment to excellence.

Why Choose Us?

At BHGRE Senter, REALTORS, we pride ourselves on delivering personal service, expert guidance, and exceptional value to our clients. With a team of specialists ready to support you at every step, you can trust us to leverage decades of market knowledge and expertise to turn your real estate goals into reality.

Our Services

Whether you’re buying, selling, or investing in real estate, we have you covered. Our comprehensive services include:

- Residential Real Estate: From first-time homebuyers to seasoned pros, our full-time REALTORS provide expert guidance and personalized service every step of the way.

- Commercial Real Estate: Our highly trained specialists offer peace of mind in commercial transactions, backed by decades of experience and significant market share.

- New Construction: Looking to build? We can connect you with builders and represent your interests, ensuring a hassle-free process from start to finish.

- Investing: Real estate investment remains one of the strongest asset classes, and we provide expert analysis, pricing guidance, and support for investors.

Why We Stand Out

At BHGRE Senter, REALTORS, we prioritize quality over quantity. By keeping our team small and focused on high performance, we consistently exceed market averages by 300% or more, providing our clients with unmatched service and results.

Experience the Difference

With over 22,000 families and businesses served, we’re honored to have been a part of so many important moments in our clients’ lives. Our commitment to personal service, expert guidance, and exceptional value remains as strong as ever.

Ready to Take the Next Step?

Contact Us today to experience the BHGRE Senter, REALTORS difference for yourself. Whether you’re buying, selling, or investing, let our experienced team guide you every step of the way.

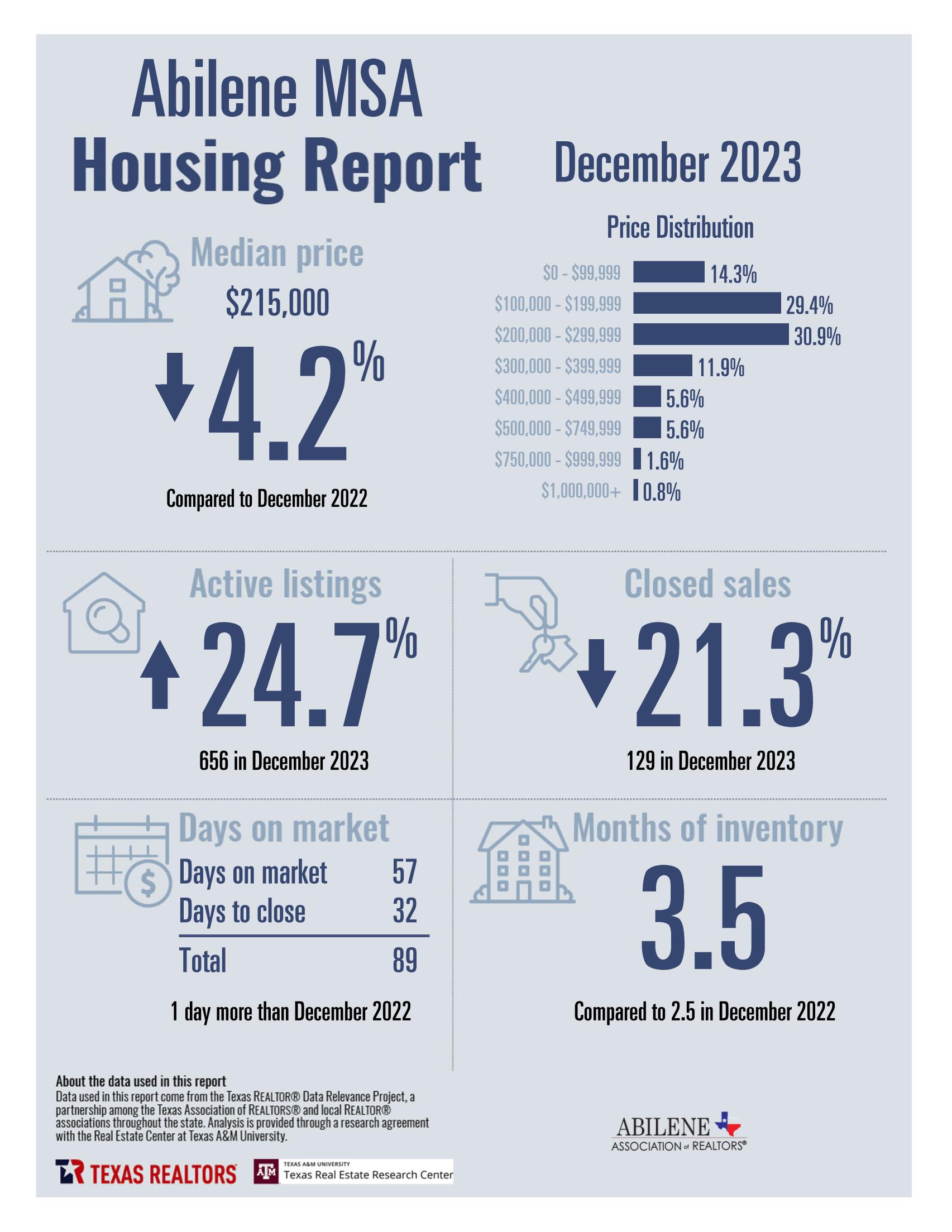

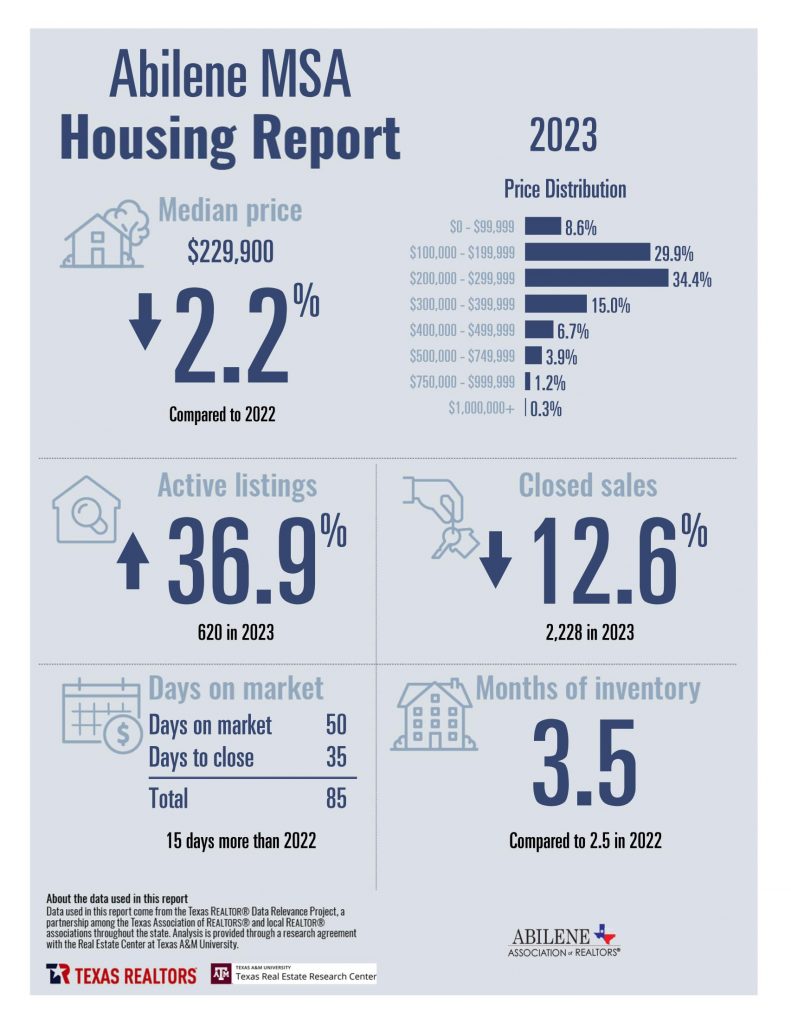

Abilene Housing Insights: December and Year-End 2023

Inventory Surge and Rate Resilience

As we bid farewell to 2023, it’s time to reflect on a real estate journey marked by highs, lows, and transformative shifts. The Abilene housing landscape witnessed a notable surge in inventory, with the consumption rate climbing from 1.3 months two years ago to the current 3.5 months. The interest rate rollercoaster, hitting historic highs before a November retreat, kept both buyers and sellers on their toes.

Price Pressures and Market Dynamics

The pressure on sales prices became evident, showcasing a considerable monthly dip and a more moderate annual decline. While the total number of annual sales hit the lowest point since 2016, sellers were forced to adjust expectations in terms of both pricing and the duration properties are on the market. Meanwhile, buyers contended with affordability challenges driven by rising interest rates and home prices over the past couple of years.

Relief in Rates and Anticipated Rebound

Encouragingly, positive news on inflation brought relief to mortgage interest rates. Although they maintained stability through December, a steady, albeit slight, decline is anticipated as we approach spring. Home prices are poised to rebound, projecting a 2-4% annual appreciation, as mortgage rates create renewed interest and affordability in the market. Seller concessions, at their highest in years in 2023, are expected to decrease as demand strengthens in early 2024.

Shifting Dynamics and Expert Guidance

Navigating these market dynamics is no easy feat, especially given the volatility witnessed. Our team of full-time agents, armed with decades of market experience, stands ready to assist. Expect personalized service, consistent communication, and unparalleled value when you entrust our team to guide you toward your real estate goals. Contact us today to connect with a specialist tailored to your market needs.

Annual Summaries

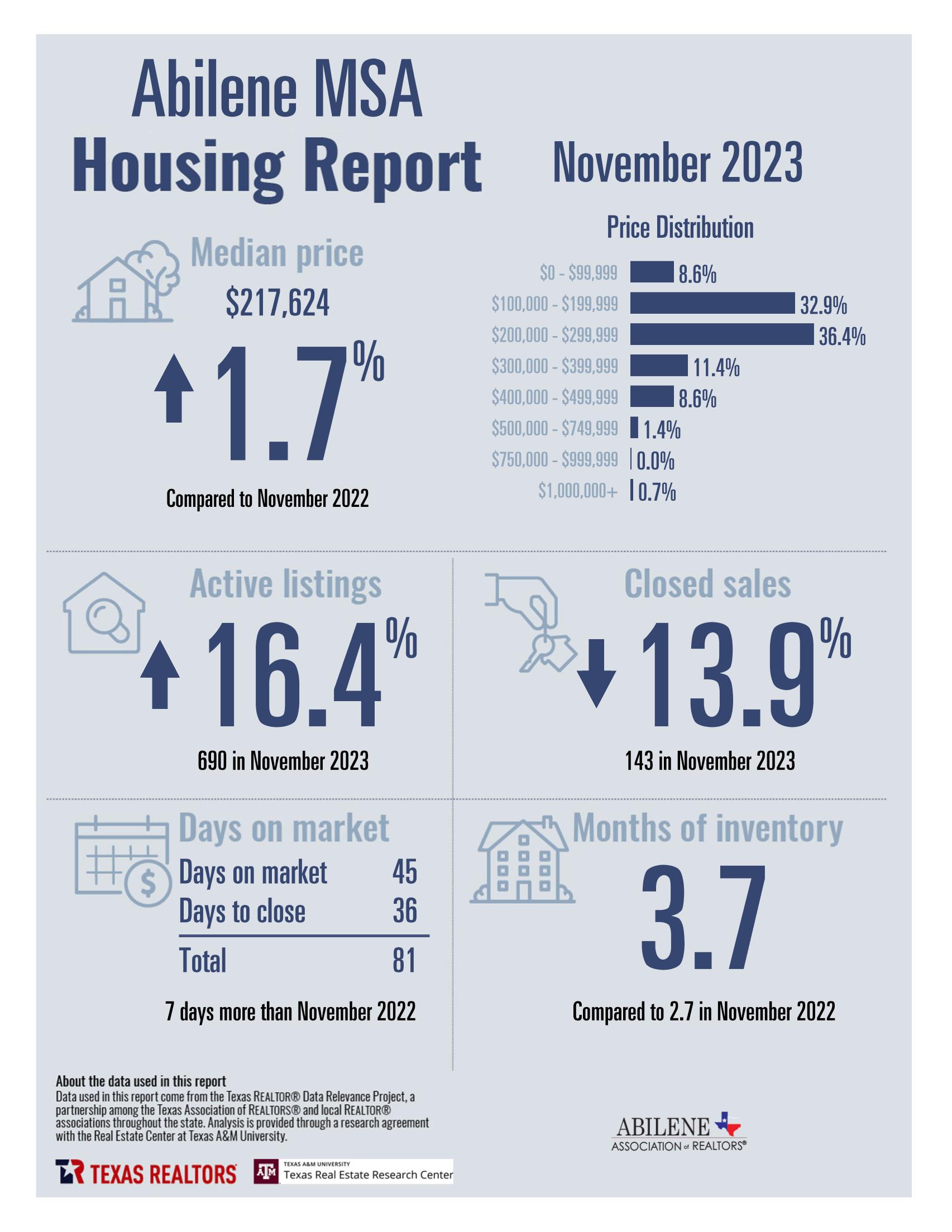

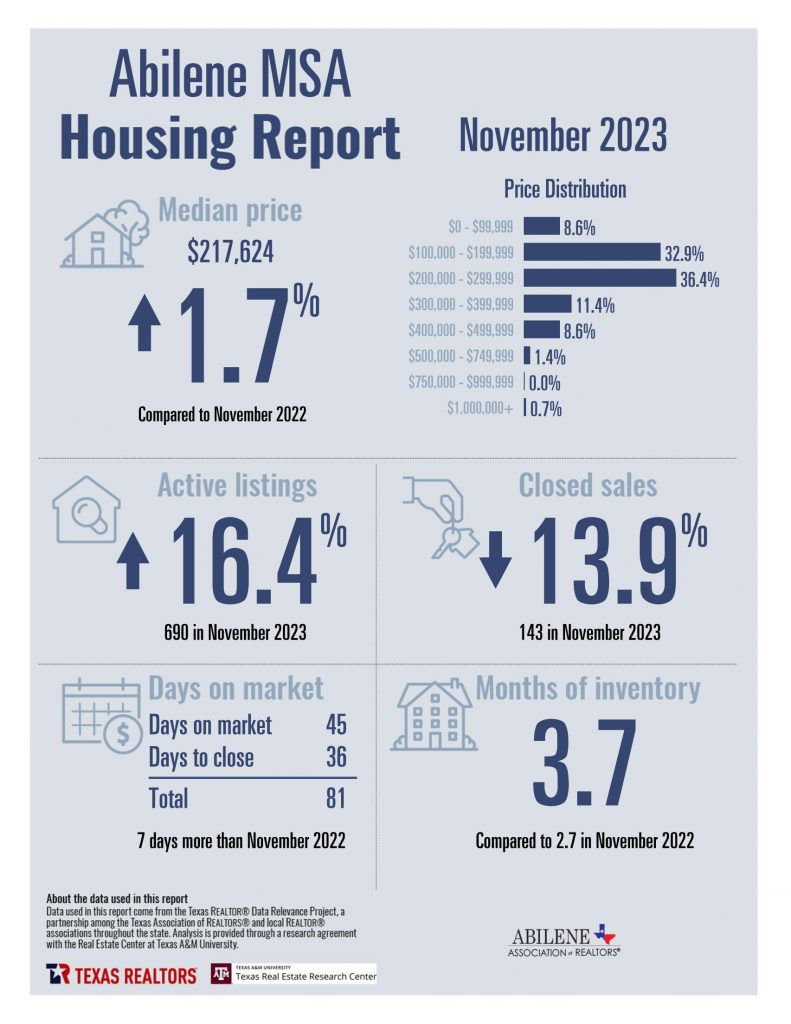

Abilene Housing Insights: November 2023

In the dynamic landscape of Abilene’s housing market, November 2023 brings a breath of fresh air, especially with the notable relief in mortgage rates. Let’s delve into the latest updates shaping the real estate scene in Abilene.

Mortgage Rates Take a Dive: The Federal Reserve’s decision to maintain steady rates and the promising economic outlook have ushered in a positive change for homebuyers. The announcement of three anticipated rate decreases in 2024 has already seen mortgage rates drop by a full point, settling back under the 7% mark. This trend is expected to persist into Spring 2024, providing a much-needed boost to the real estate market.

Market Correction and Median Prices: November reveals a notable correction in the market. With the “lock-in” effect of mortgage rates, buyer demand is starting to rebound after a significant dip caused by peak interest rates. Interestingly, this correction coincides with one of the lowest median sales prices observed in the last two years. As interest rates continue their downward trend, the real estate market anticipates further stabilization.

Homebuyer Preferences: A significant shift is evident in homebuyer preferences, emphasizing the need for updated and modern homes. New construction homes have gained substantial market share over the past three years. Even with a potential sacrifice in space, buyers increasingly prioritize the comfort and convenience of a modern, move-in-ready home.

Top Features on Buyer Wishlists: According to insights from Better Homes and Gardens magazine, capturing the preferences of over 40 million readers, the following features stand out as the most exciting in homes:

- Outdoor Spaces: Whether it’s a spacious backyard, inviting porch, cozy patio, or scenic balcony, buyers crave living spaces that extend beyond the interior.

- Utility Spaces: Practical workspaces, well-designed laundry rooms, pet-friendly features, and ample pantry space are winning hearts.

- Home Offices: In a world embracing remote work, well-lit and creatively designed home offices are increasingly sought after.

- Bonus Buildings: Storage solutions, greenhouses, guest quarters, or pool houses are seen as valuable additions, adding to the overall allure of a property.

Strategic Selling in a Shifting Market: To navigate this evolving market, sellers need to align their offerings with these sought-after features. Dated homes lacking these amenities may face challenges, emphasizing the importance of strategic pricing to compensate for any shortcomings.

As Abilene’s real estate landscape undergoes these transformations, buyers and sellers alike find themselves at the forefront of an exciting chapter, shaped by evolving preferences and the promise of a more stable market in the months to come. CONTACT US if you need guidance and advice to buy or sell.

Exploring Abilene, TX: A Guide for Prospective Residents

Are you considering a move to Abilene, Texas? This vibrant city, nestled in the heart of the Lone Star State, has much to offer. From its educational opportunities to its rich Western heritage, Abilene has a unique character that makes it a wonderful place to call home. Let’s dive into the top five things you should know about Abilene if you’re thinking about making it your new residence.

1. Educational Hub: Abilene is proud to be an educational hub, hosting three major institutions of higher learning—Abilene Christian University (ACU), Hardin-Simmons University (HSU), and McMurry University. Whether you’re pursuing academic excellence or looking to engage with a vibrant student community, Abilene’s universities contribute significantly to the city’s cultural and intellectual vibrancy.

2. Dyess Air Force Base: Dyess Air Force Base is a central part of Abilene’s identity. Located on the west side of the city, the base is not only a critical component of the local economy but also fosters a strong sense of patriotism within the community. The men and women of Dyess contribute to the city’s rich tapestry and underscore its commitment to national defense.

3. Cultural Attractions: Abilene boasts a diverse array of cultural attractions, making it a haven for art and history enthusiasts. The Grace Museum, housed in a historic building, showcases contemporary art and exhibits on local history. The National Center for Children’s Illustrated Literature (NCCIL) is a unique gem, celebrating the artistry found in children’s books.

4. Western Heritage: For those who appreciate Western heritage and cowboy culture, Abilene offers a range of events and attractions. The Western Heritage Classic is a celebration of ranching traditions, while the West Texas Fair & Rodeo, one of the oldest fairs in the state, provides an immersive experience into cowboy culture and history.

5. Friendly Community: Abilene is renowned for its warm and welcoming community. The city’s friendly atmosphere, combined with a cost of living that’s below the national average, makes it an appealing destination for families and individuals alike. Whether you’re attending local events or exploring the city’s parks, you’ll likely find yourself embraced by the genuine hospitality of Abilene residents.

In conclusion, Abilene, TX, offers a blend of educational opportunities, cultural richness, and a strong sense of community that makes it an attractive place to live. If you’re considering a move to this charming city, you’re in for a delightful blend of Texan warmth and diverse experiences. Welcome to Abilene!

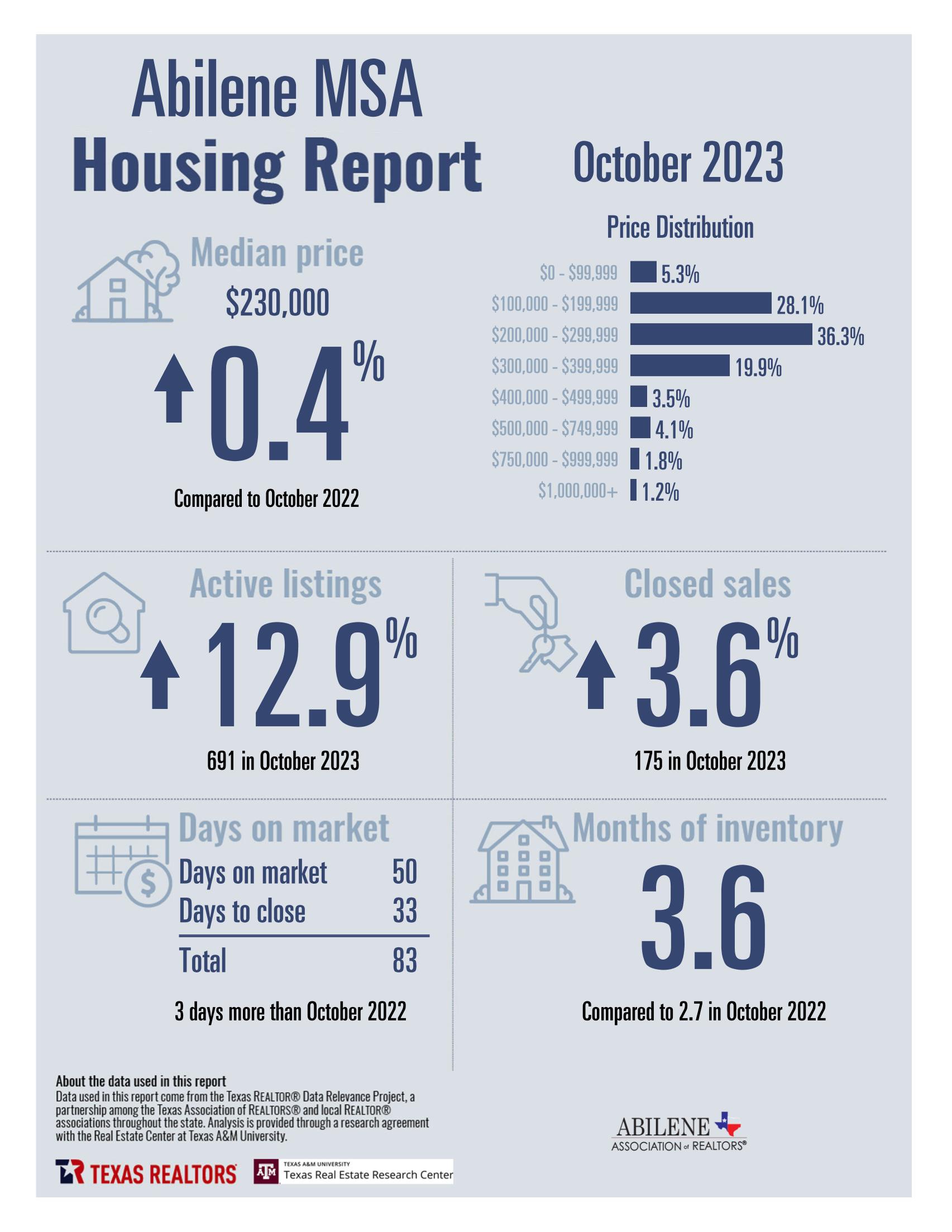

Abilene Housing Insights: October 2023

As we gather to celebrate Thanksgiving, let’s reflect on the state of the real estate market and look ahead to what November holds.

As we gather to celebrate Thanksgiving, let’s reflect on the state of the real estate market and look ahead to what November holds.

Mortgage Rate Relief:

October brought a slowdown in the real estate market, primarily due to the impact of mortgage rates. However, there’s good news on the horizon. Positive signals from the Federal Reserve have led to an overall market improvement, including a significant drop in mortgage rates. This trend is expected to persist, offering relief to buyers as we head into Spring 2024.

Post-Holiday Surge?

Traditionally, the holiday season tends to usher in a slower pace for real estate. However, this year might see a twist. With pent-up demand and improved market conditions, there’s potential for a more robust December and a strong start to Q1 2024. While we don’t foresee mortgage rates dipping below 6%, a mid-6 percent range is plausible by spring.

Buying Amidst Falling Rates:

As mortgage rates decline, buyer demand is likely to rise. The sweet spot, however, is that prices are expected to continue their annual increase at a moderate 3-5%. Sellers are offering concessions, and prices are in a favorable position for buyers. The key takeaway? If it aligns with your goals, now is a good time to buy. However, if waiting makes more sense for your situation, there’s no imminent market shift that would justify missing out on the right opportunity.

Steady Inventory, Informed Decisions:

With reasonably healthy inventory levels and a balanced market, there’s no indication of extreme shifts akin to the COVID era. Whether you’re considering buying or selling, the advice remains consistent: do it when you’re ready. Our team of dedicated REALTORS is here to guide you through the market nuances, providing personalized advice based on your unique circumstances.

Closing Thoughts:

As we express gratitude this Thanksgiving, consider reaching out to us for a chat about the real estate landscape. Your goals are our priority, and we’re here to help, whether you’re eyeing a property or contemplating a sale. Call us anytime — your real estate journey is our expertise.

Wishing you a warm and joyful Thanksgiving!

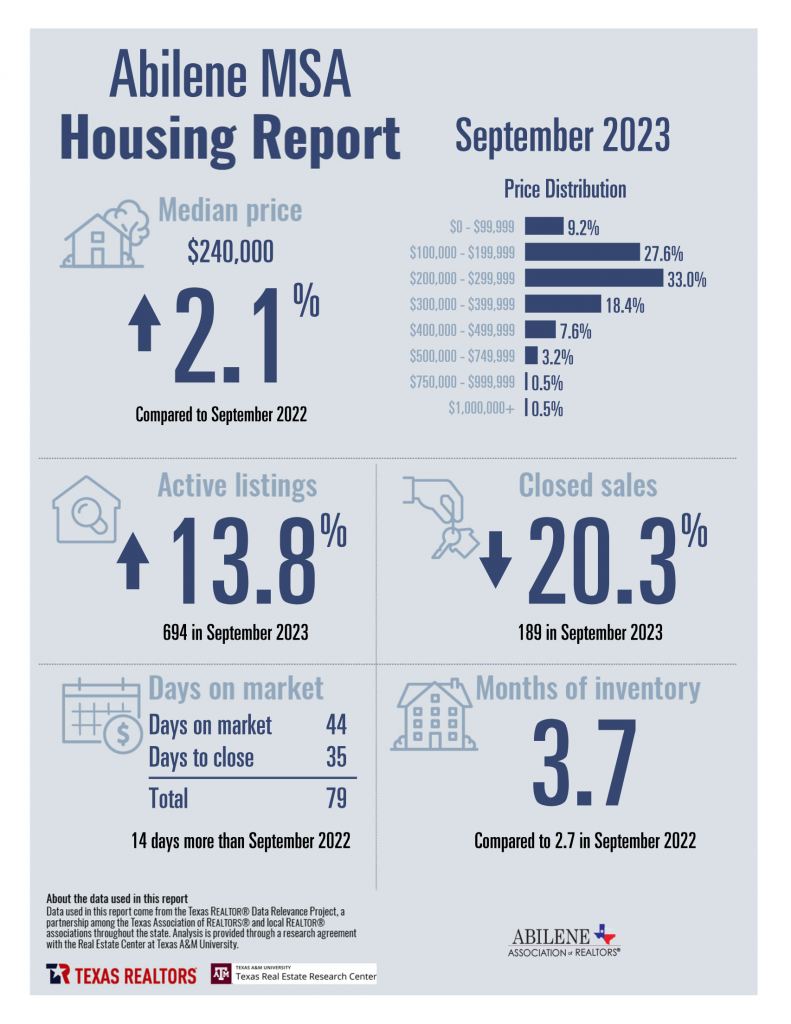

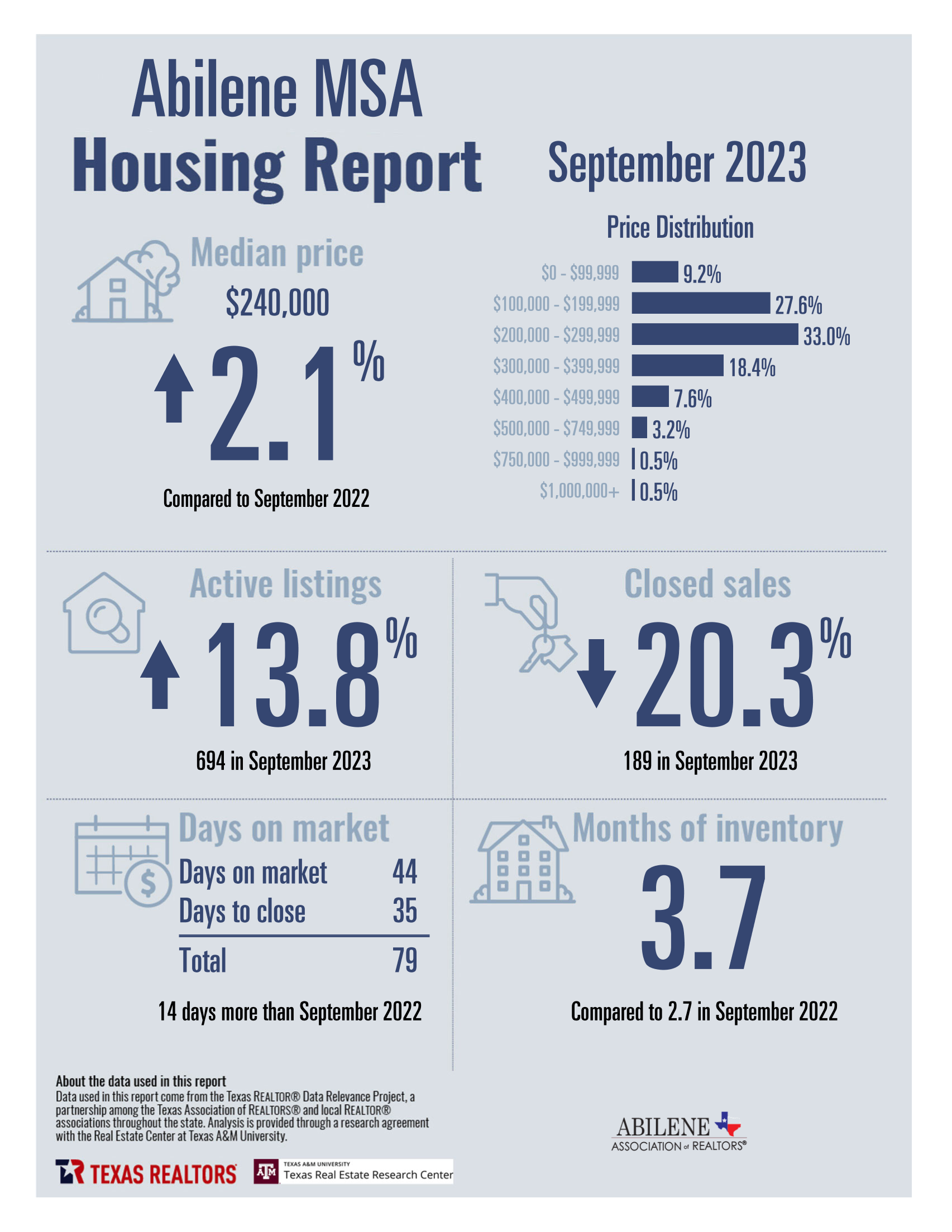

Abilene Housing Insights: September 2023

It’s time to take a close look at the current state of the Abilene housing market. The past year has brought both challenges and opportunities, with shifting interest rates and home prices impacting the landscape. In this article, we’ll explore some of the key trends that are shaping the Abilene housing market and what they mean for buyers, sellers, and homeowners.

The Burden of Rising Interest Rates

One of the dominant forces influencing the Abilene housing market right now is the relentless climb of interest rates. While many anticipated a gradual retreat, we’ve observed quite the opposite. Interest rates have surged past the 7.5% mark, a level not seen in quite some time. The impact is substantial, especially for potential homebuyers. Those who are currently homeowners face a dilemma: they’d like to move to a new home, but the financial calculus between their existing low-rate mortgage and the potential higher costs in a new home doesn’t make sense. While we have seen interest rates in this range before, and indeed much higher, home prices were also substantially lower at that time as well.

Inventory and Pent-Up Demand

Currently, the housing market is blessed with what’s considered a relatively healthy inventory. This inventory is vital because when interest rates finally do start to recede, we’ll likely see a surge in demand. The pent-up demand from hesitant buyers waiting for more favorable rates will enter the market, and inventory will play a crucial role in meeting that demand.

Home Prices and the Path Forward

Home prices in Abilene have been relatively stable throughout the year, which aligns with many expectations. However, we anticipate that home prices will gradually return to a more historical norm, increasing by approximately 3% per year. This will be especially true if lower interest rates reignite buyer demand.

A Buyer’s Market with Opportunities

At present, Abilene is experiencing what can be classified as a buyer’s market. If you have the means and intent to buy a property, there are deals to be had. Seller concessions are at their highest point in years, providing buyers with valuable advantages, all while prices have remained largely unchanged from 2022.

Future of Mortgage Rates

Looking ahead to 2024, while it’s expected that mortgage rates will be more favorable, it’s unlikely that we’ll ever see the exceptionally low 3-4% interest rates that characterized the market in the past. Long-term, buyers who secure homes with higher interest rates should prepare for a future with rates ranging between 5-6%. The pandemic-era rates are unlikely to return, but favorable opportunities still exist for those who act strategically.

Conclusion

Navigating the housing market in Abilene, especially with the current state of interest rates, can be a complex endeavor. For personalized advice and tailored guidance, we encourage you to reach out to our team of experts. With decades of experience in the real estate industry, we are here to help you make well-informed decisions that align with your unique situation and aspirations. Whether you’re a first-time buyer, a seller, or a homeowner looking to refinance, our team is committed to providing the expertise you need to thrive in this ever-changing market.

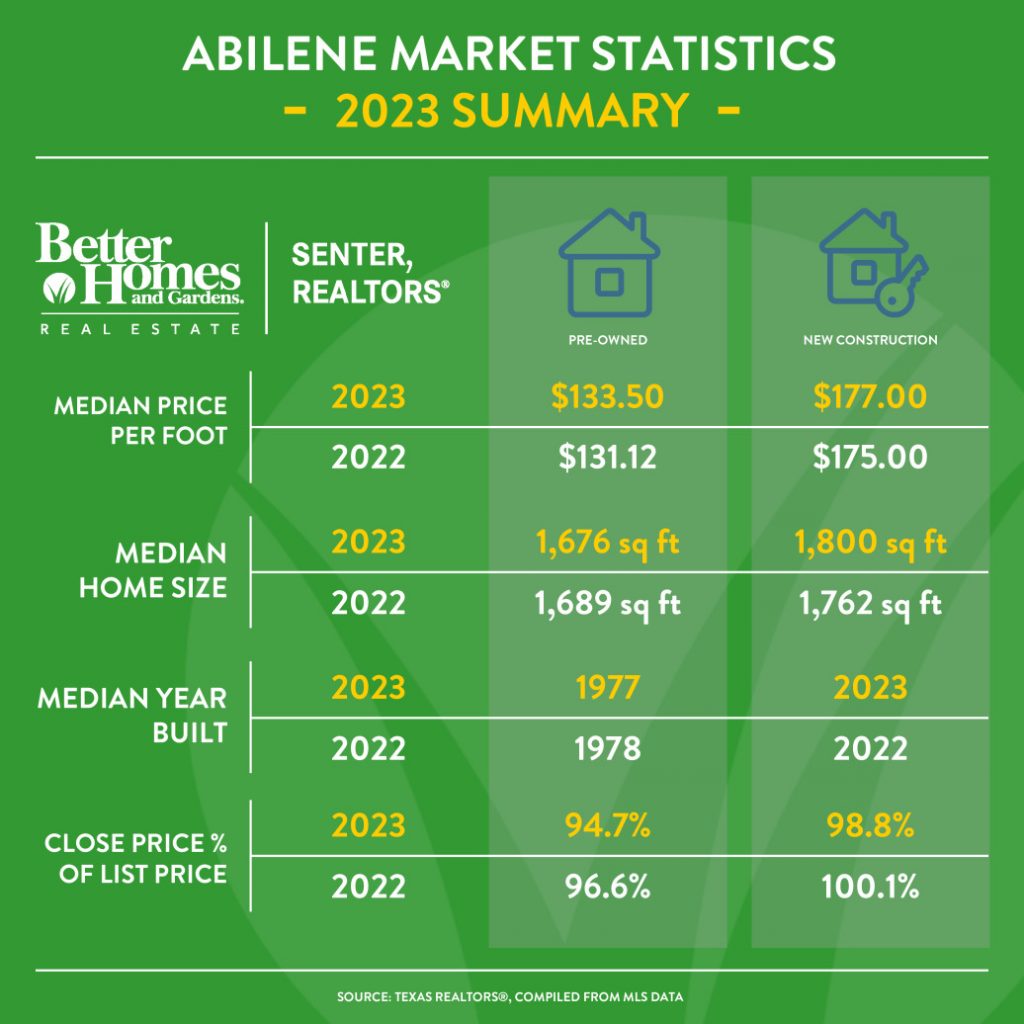

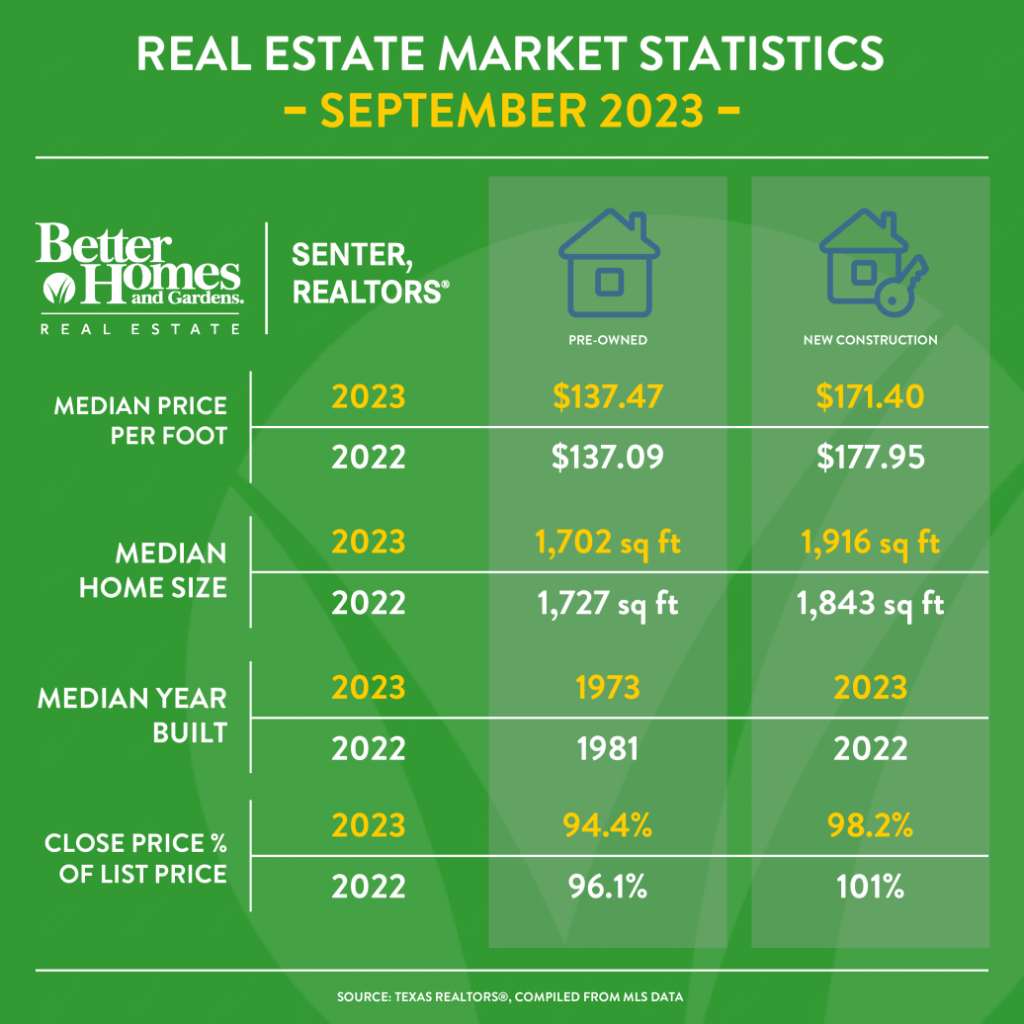

Pre-Owned vs New Construction

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link