Abilene Housing Insights: October 2024

As we step deeper into Q4, the latest October 2024 statistics reveal trends that buyers, sellers, and real estate professionals alike should watch closely.

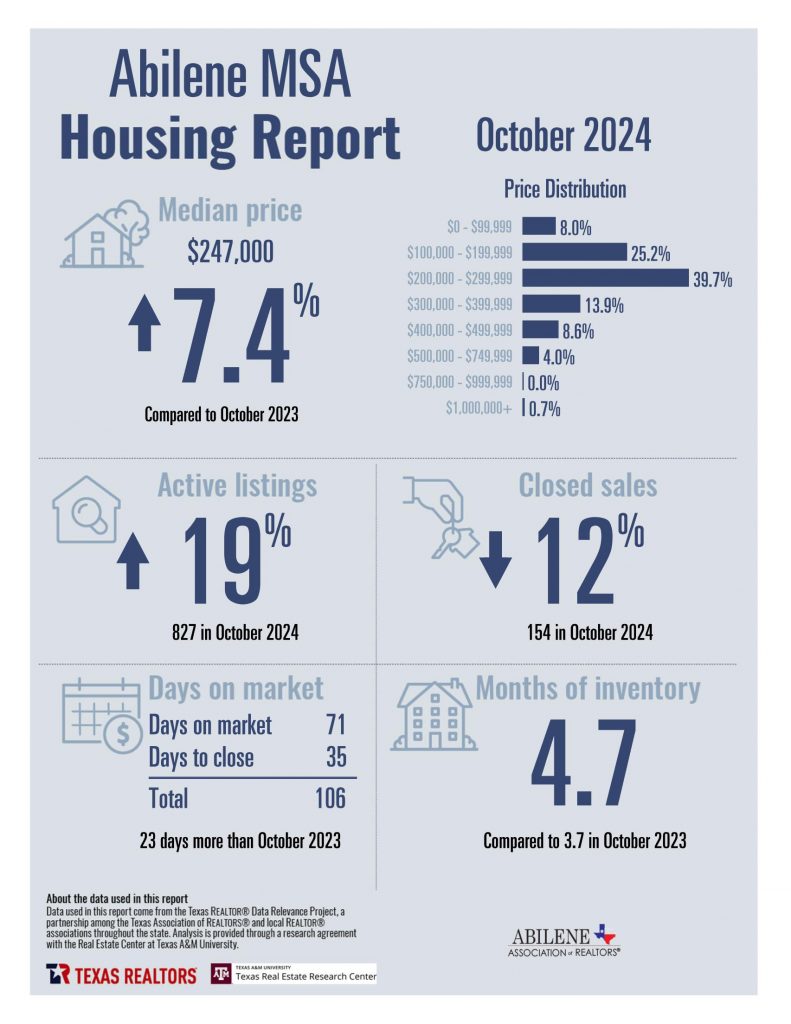

By the Numbers:

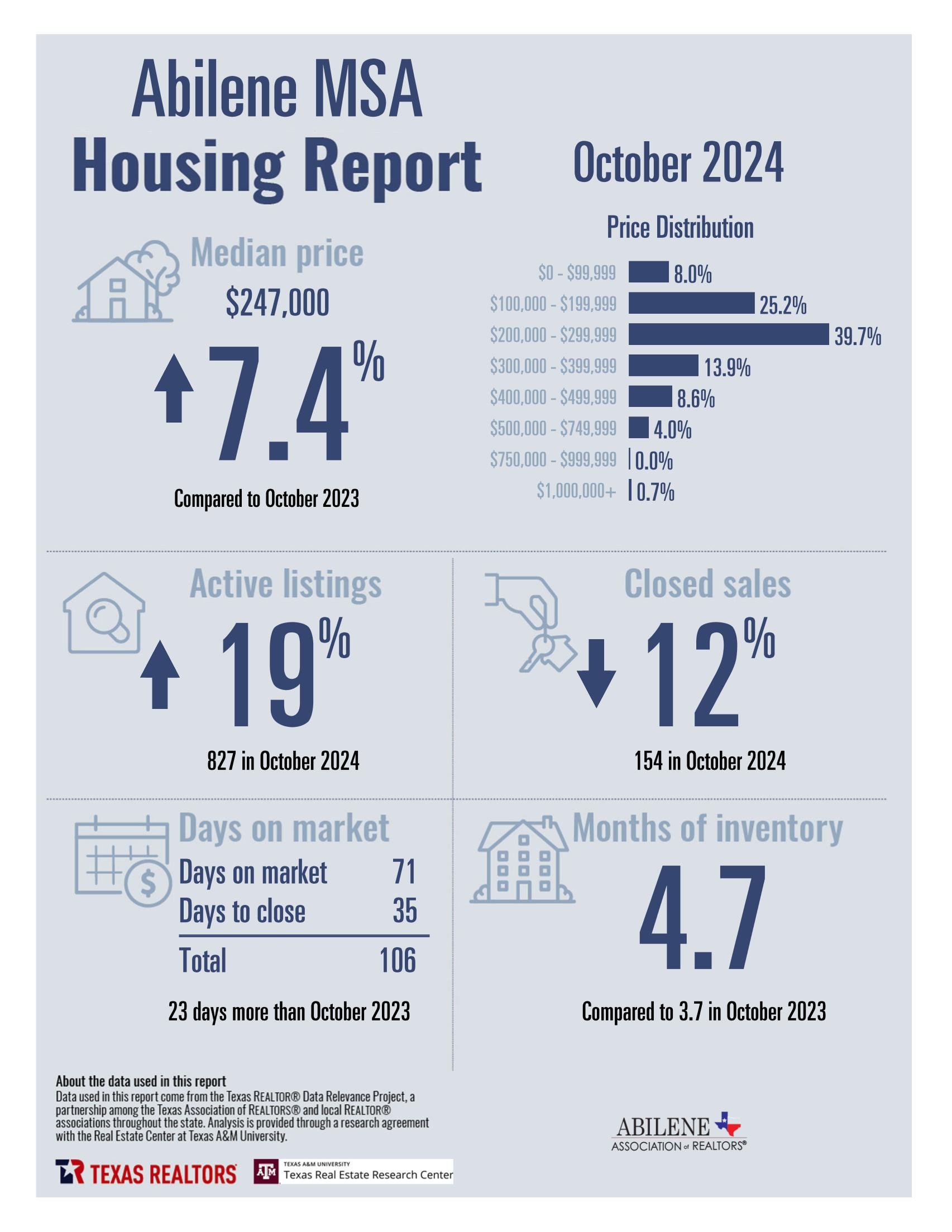

- Median Home Price: $247,000, up 7.4% compared to October 2023. This growth reflects the consistent demand for quality homes in the Abilene area.

- Active Listings: Inventory has increased by 19%, with 827 active listings available in October. This rise could mean more choices for buyers entering the market.

- Closed Sales: Dropped 12% compared to the same time last year, totaling 154 sales for the month.

- Days on Market: Homes spent an average of 71 days on the market and 35 days to close—marking a total of 106 days, 23 more than October 2023.

- Months of Inventory: Increased to 4.7 months, compared to 3.7 months in October 2023. This indicates a slight shift toward a more balanced market.

Key Takeaways:

The steady rise in median home prices suggests the Abilene market remains robust, driven by demand even amid national uncertainties. However, the decline in closed sales reflects buyer hesitation in the face of rising interest rates and lengthier decision-making timelines.

Mortgage Rates Continue to Climb:

Nationally, mortgage rates have been a hot topic, and their impact can be felt here in Abilene. The National Association of Realtors (NAR) reports the average 30-year fixed-rate mortgage currently sits at 6.78% as of November 14, 2024. While this is a slight decrease from last week, rates remain high compared to the historically low levels seen in recent years. For buyers, this translates to higher monthly payments and impacts overall affordability.

Lawrence Yun, NAR’s Chief Economist, predicts that rates could trend downward in 2025 as inflation eases and the economy stabilizes. While relief may be on the horizon, buyers and sellers should prepare for continued fluctuations in the near term.

What This Means for Buyers:

With inventory on the rise, buyers have more options to consider. However, the current mortgage rates underscore the importance of locking in the best financing terms available. Consulting with local lenders and REALTORS who understand the market is key to navigating these changes confidently.

What This Means for Sellers:

For sellers, the rise in active listings means increased competition. Ensuring your home stands out with professional photography, competitive pricing, and strategic marketing is critical. While days on market have increased, homes priced right for their value and location are still moving.

Abilene’s Resilience:

The Abilene market has long been defined by its stability and community-driven appeal. As we’ve seen throughout 2024, our market continues to hold strong even when broader challenges arise. Whether buying or selling, partnering with experienced local professionals ensures you stay ahead of the curve.

Partner With BHGRE Senter, REALTORS:

At BHGRE Senter, REALTORS, we’ve helped Abilene families and businesses navigate the market for nearly 70 years. With expert guidance and a deep understanding of both local and national trends, we’re here to help you find your perfect place. Contact Us today to get started!

Abilene Housing: Q3 2024 Recap

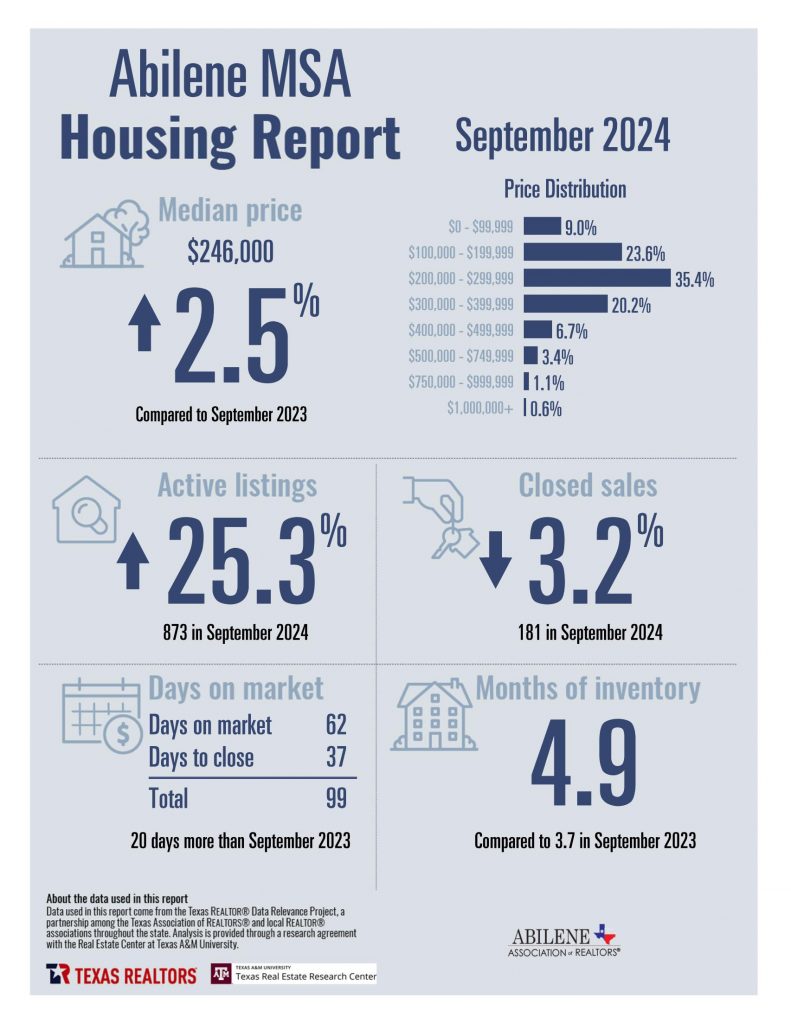

Abilene MSA Housing Market Update: Q3 2024 Recap 🏡

As we move into the final quarter of 2024, let’s take a moment to reflect on the latest housing trends in the Abilene Metropolitan Statistical Area (MSA). Our Q3 data reveals some significant shifts in the local real estate market. Whether you’re buying or selling, understanding these trends is key to making informed decisions.

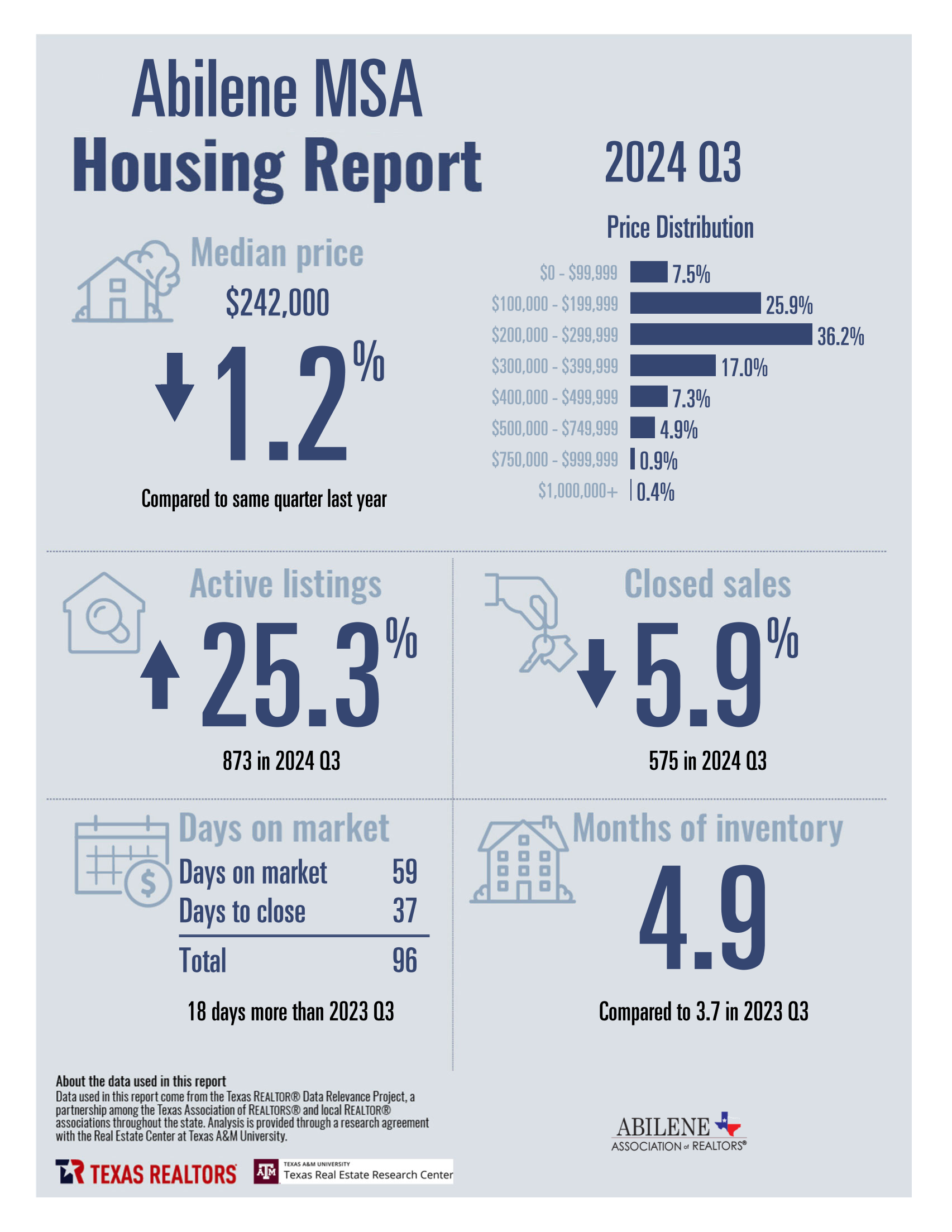

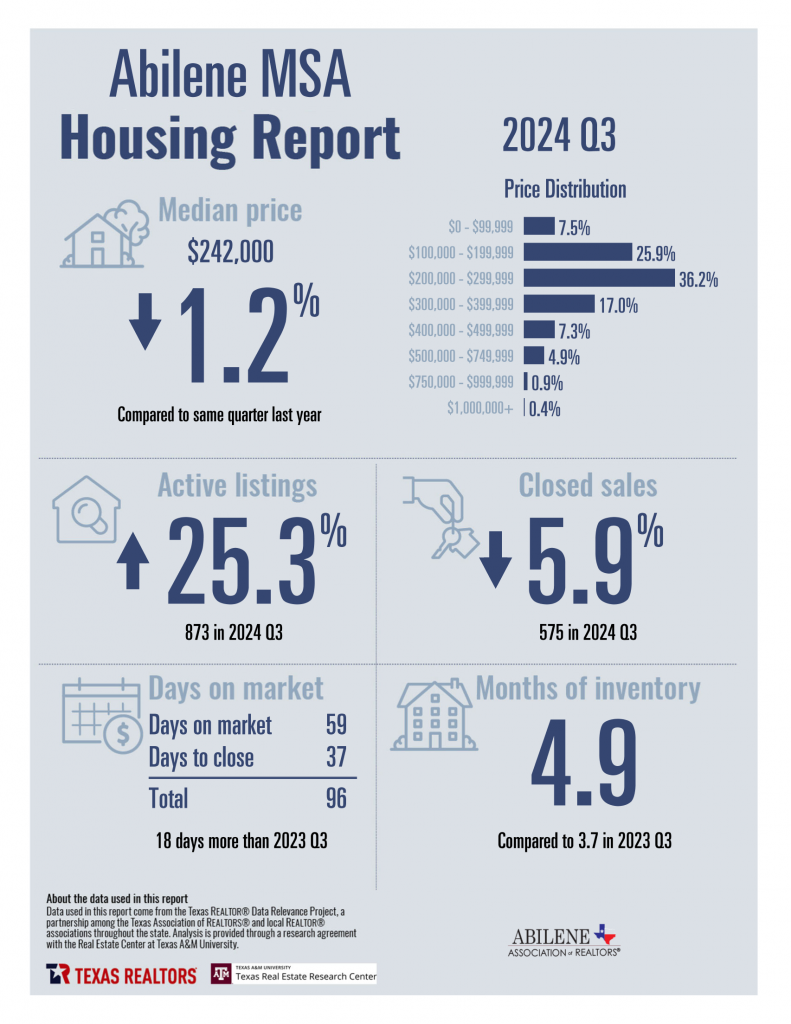

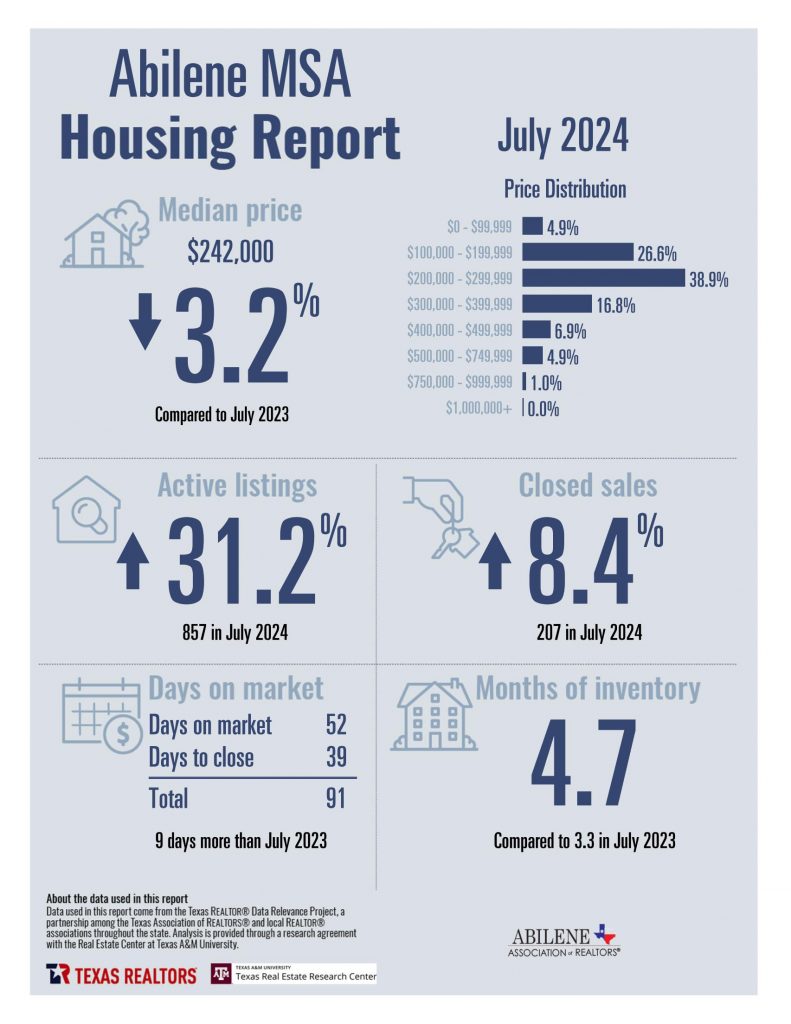

1️⃣ Median Price Slightly Decreases

The median home price for Abilene in Q3 was $242,000, marking a 1.2% decrease compared to the same period last year. While prices are slightly lower, it’s still important to note that this remains a competitive market with varying opportunities in different price ranges.

2️⃣ Active Listings Skyrocket

One of the most noticeable changes this quarter has been the dramatic increase in available homes. Active listings are up by 25.3%, bringing the total to 873 listings in Q3. This is fantastic news for buyers who have been facing low inventory levels over the past few years. Sellers, however, need to be more strategic with pricing and marketing as competition intensifies.

- July: We started noticing this trend in July, when inventory levels began their steady climb.

- August: By August, the pace of new listings further emphasized a shift towards a more balanced market.

3️⃣ Closed Sales Decline

In contrast to the growing inventory, closed sales dropped by 5.9%, with a total of 575 closed transactions. This aligns with what we’ve been seeing across the country as buyer demand has cooled, likely due to fluctuating interest rates and buyer caution in a changing market.

4️⃣ Days on Market & Time to Close Lengthen

Homes are taking longer to sell. The average days on market jumped to 59, and the total time to close now sits at 96 days — 18 days longer than this time last year. While this may feel discouraging to sellers, it’s an opportunity for buyers to take their time finding the right home.

5️⃣ Months of Inventory Nears 5 Months

We are now at 4.9 months of inventory, a significant jump from the 3.7 months in Q3 2023. This places us in a more balanced market, with opportunities for both buyers and sellers. If inventory continues to grow, we could see further shifts favoring buyers as we move into Q4 and beyond.

- September: By the time we reached September, the inventory had reached record levels for 2024, setting up a promising close to the year.

What’s Next for Abilene’s Housing Market?

The data from Q3 paints a picture of a market in transition. While prices have slightly decreased, the significant rise in inventory gives buyers more options and negotiating power. Sellers need to adapt to this changing environment, and it’s crucial to work with a REALTOR® who understands how to navigate this market.

For more in-depth insights into the specific months and how trends evolved, check out our detailed blogs for July, August, and September.

Want personalized advice on what these stats mean for you? Contact Us at BHGRE Senter, REALTORS® for a free consultation!

Abilene Housing Insights: September 2024

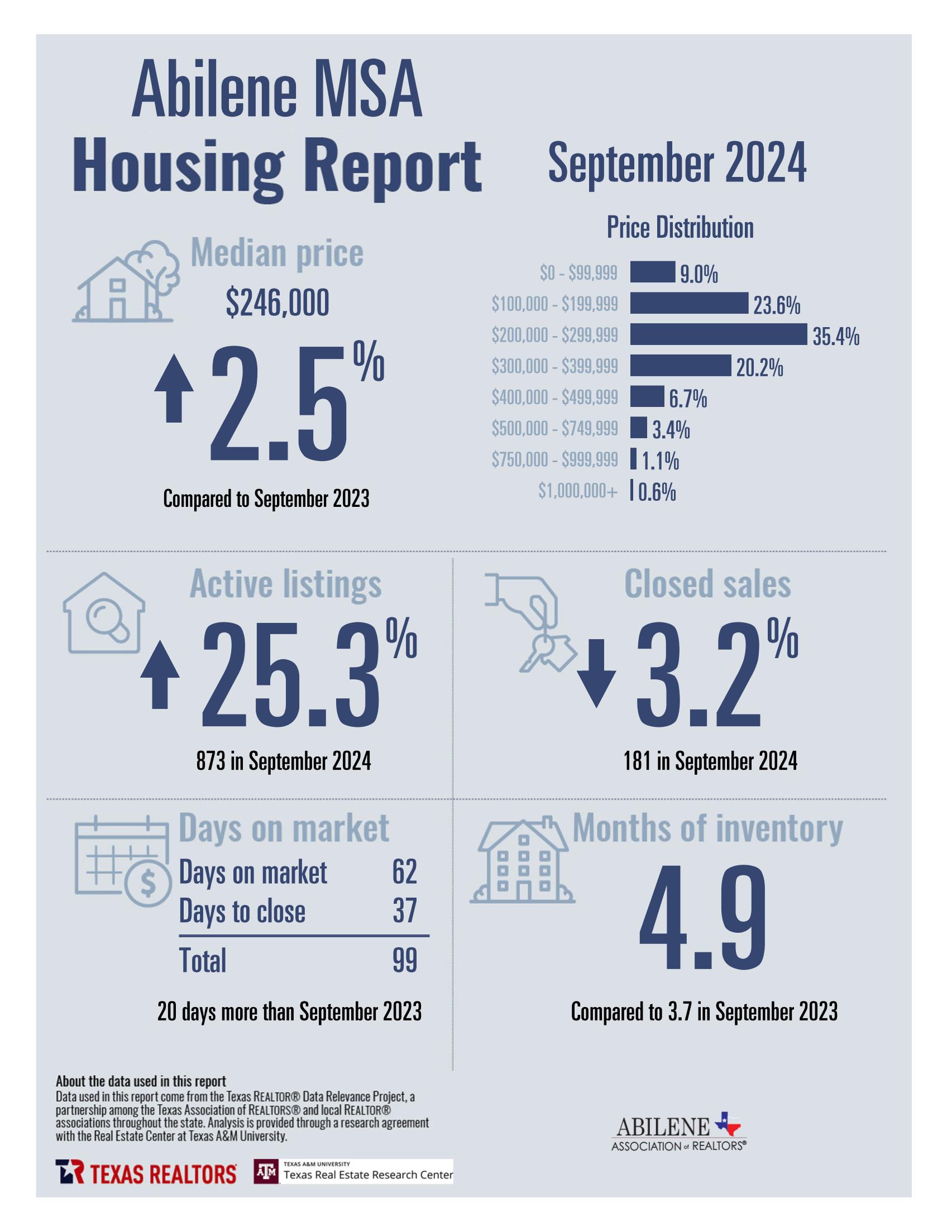

As we head into the fall months, Abilene’s housing market continues to evolve, and both buyers and sellers are seeing opportunities. Here’s a breakdown of what we’re seeing in the local market as well as insights from national trends.

Inventory Levels: What’s Happening?

Inventory levels in Abilene have reached new highs, climbing from 3.9 months back in March 2024 to 4.9 months in September. This increase in supply is due to both a rise in listing activity and a slowdown in buyer demand. While it may sound like a challenge, this shift represents a more balanced market, giving buyers more options and time to make decisions, while also signaling to sellers the need for strategic pricing and expectations.

If you’ve been hesitant to make a move, now is a great time to reassess whether buying or selling fits your needs. Our expert team at BHGRE Senter, REALTORS® is here to help guide you through these changes and ensure you have all the information necessary to make the right decision for your unique situation.

National Mortgage Rate Insights

Understanding the larger economic factors affecting mortgage rates is crucial for anyone buying or selling. Here’s a summary of the key points from recent articles and expert insights:

- Mortgage Rates, October 2024: While mortgage rates have fluctuated throughout the year, they are currently more than a full point lower than this time last year. According to the National Association of REALTORS® (NAR), despite some upward pressure on rates recently, there’s hope that we’ll continue to see a decline as we close out 2024. Current forecasts predict mortgage rates to hover around 6% by year’s end, potentially dropping to 5.8% in 2025 .

- Key Takeaway: Mortgage rates may not be as low as we saw in 2020-2021 (when they dipped below 3%), but they are still much better than recent highs. Many homeowners are refinancing, while buyers are still finding opportunities.

Fed’s Influence on Mortgage Rates

There’s a common misconception that the Federal Reserve directly sets mortgage rates. In reality, while the Fed influences rates, mortgage rates largely follow the yield on 10-year Treasury bonds. This year, mortgage rates have fluctuated due to expectations around the Fed’s decisions, but have settled into a more predictable range. While 3% mortgage rates are likely a thing of the past, the current outlook suggests that rates will hover between 5.5% and 6% as we move forward into 2025 .

Jobs Data and Its Impact on Housing

The U.S. job market is showing signs of softening, which could impact future rate cuts. According to Lawrence Yun, NAR’s chief economist, a weaker job market often leads to lower rates. The September jobs report showed an average monthly addition of 116,000 jobs over the last quarter, which signals a slowdown in economic growth. However, the impact on home prices may be minimal as long as interest rates continue to drop, keeping homes within reach for most buyers .

In Summary: Opportunities in a Balanced Market

While 2022 and 2023 were heavily skewed toward sellers, 2024 is offering a more balanced market. Buyers have more time and inventory to choose from, while sellers are adjusting to market conditions that require careful pricing strategies. Whether you’re buying, selling, or just curious about the market, it’s a good time to explore your options.

Ready to take the next step? Contact us at BHGRE Senter, REALTORS® for a free consultation today.

Sources:

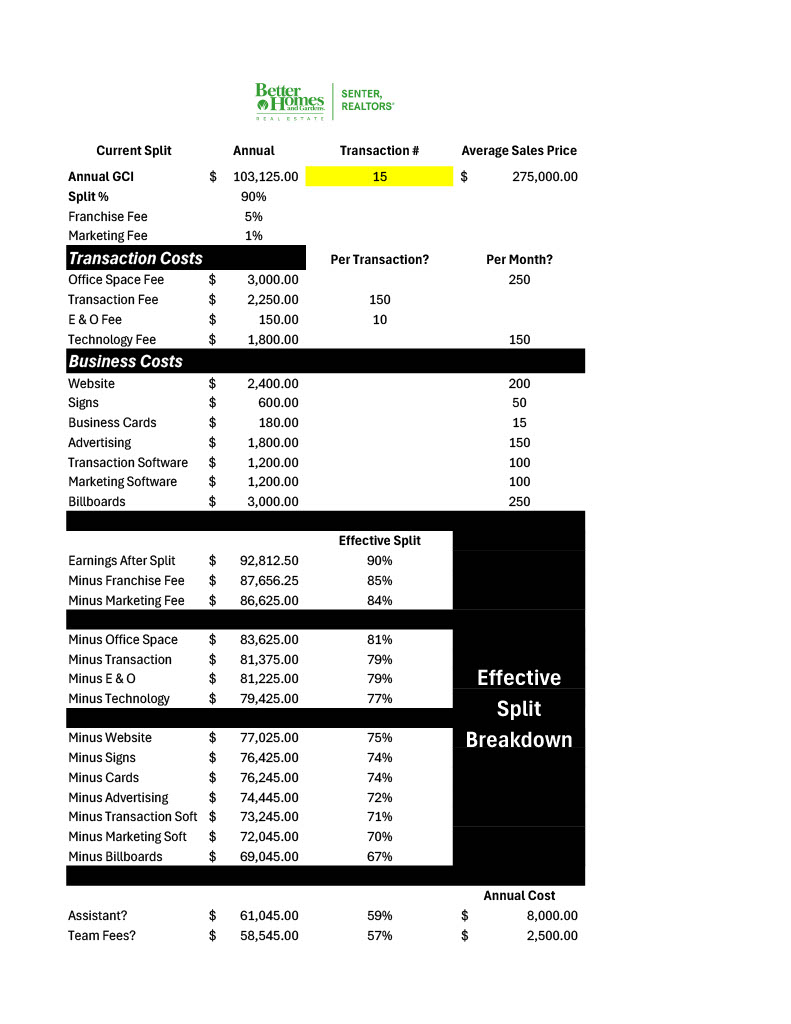

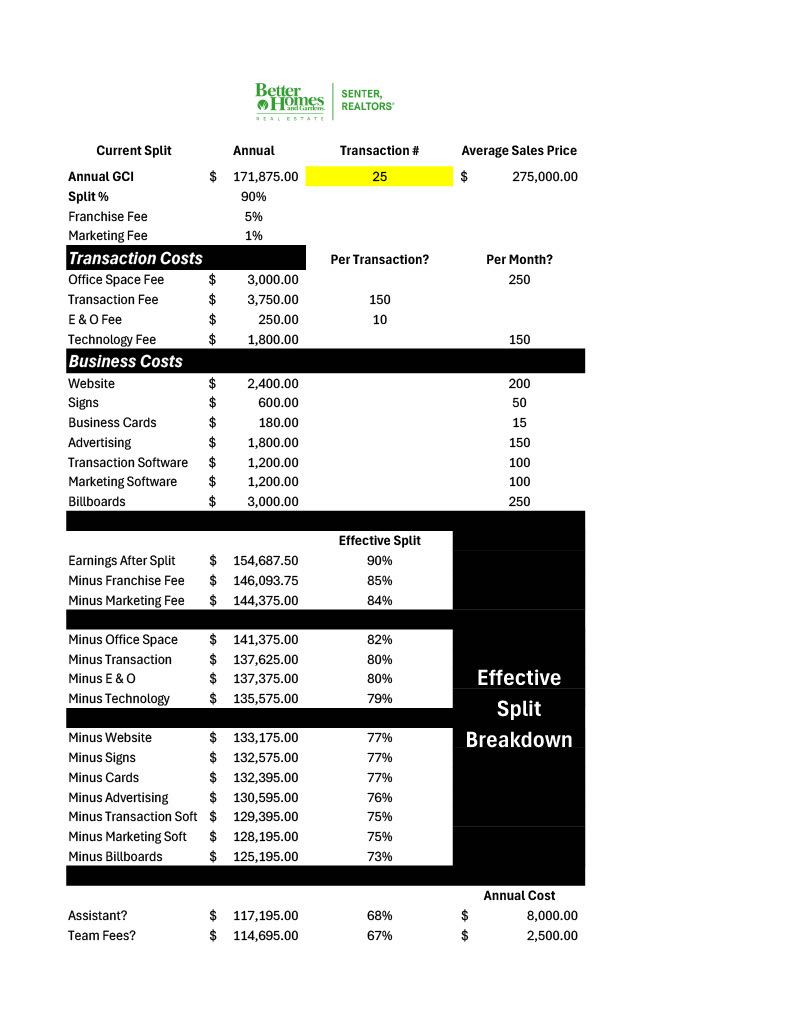

High Commission Splits: A Realistic Breakdown

It’s no secret that many brokerages love to advertise high commission splits to attract new agents. On the surface, these offers can seem too good to be true — and, in many cases, they are. While a 90% split may sound like an excellent deal, the reality is often much more complex.

Here’s the truth: being a REALTOR® comes with costs — whether you’re covering them yourself or the brokerage is supporting you. From signs, CRM, and business software to advertising, websites, transaction coordination, and office fees, the expenses add up quickly.

Breaking Down the Real Costs

Let’s take a closer look at how these flashy high commission splits can get broken down with everyday expenses. In the example below, you’ll see two scenarios where an agent completes 15 transactions annually and another where the agent closes 25 transactions.

The breakdown shows how easily the high split can be whittled down once you account for expenses like office space, marketing, technology, and more. The numbers reveal that an effective split may end up significantly lower than the advertised one. And let’s be honest — these expenses are probably underestimated!

The breakdown shows how easily the high split can be whittled down once you account for expenses like office space, marketing, technology, and more. The numbers reveal that an effective split may end up significantly lower than the advertised one. And let’s be honest — these expenses are probably underestimated!

Time is Your Most Valuable Asset

But expenses aren’t just about money. There’s another cost that’s often overlooked: time. Every minute you spend managing the administrative aspects of your business — whether it’s creating marketing materials, updating listings, managing leads, or handling transaction paperwork — is time that could be spent building client relationships and closing deals.

While these tasks are essential to running a real estate business, they often distract from the core of what agents should be doing: serving their clients.

At BHGRE Senter, REALTORS®, we alleviate those burdens for you. We cover a wide range of costs, from advertising and transaction coordination to technology platforms and office expenses. This means you can spend more time doing what you do best: helping clients achieve their real estate goals.

Maximizing Your Commission with Support

By joining a brokerage like BHGRE Senter, REALTORS®, you’re not just getting a commission split — you’re gaining a comprehensive support system designed to maximize your efficiency and success. Our model ensures that you’re not buried under the weight of endless expenses, and our systems allow you to reclaim your most valuable asset: time.

So the next time you hear about an impressive commission split, remember that the number on paper isn’t the whole story. Make sure you’re factoring in the hidden costs — and consider how much more you could take home with the right support.

Ready to grow your business with a brokerage that truly has your back? Contact Us at BHGRE Senter, REALTORS® today to learn how we can help you take your real estate career to the next level!

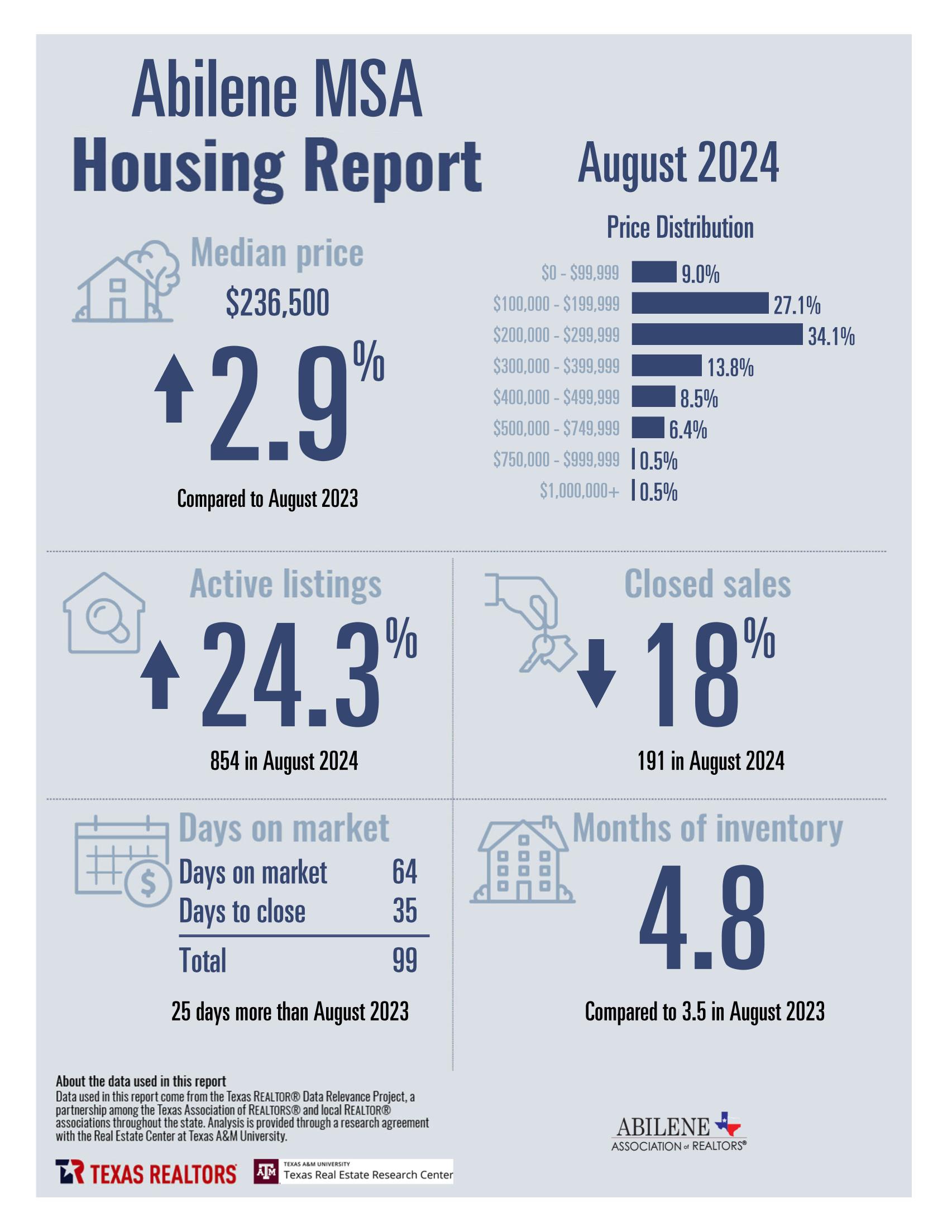

Abilene Housing Insights: August 2024

Another inventory record has been hit this month as we continue to see lower buyer demand in the market. Following the trend of the last several months, buyer demand has been tempered by persistently high interest rates. Additionally, as the early fall months often coincide with back-to-school season, real estate activity tends to slow down during this time. However, there’s reason to be optimistic about an uptick in October and some moderate improvement in the September stats as well.

Inventory and Buyer’s Market Conditions

Currently, we are solidly in a buyer’s market. As we inch closer to 5 months of inventory based on current demand, sellers need to be strategic in pricing their homes and responding to the market. One of the most important things for sellers to keep in mind is that it can take 90+ days just to get a home under contract in this environment. Proper pricing, presentation, and flexibility are crucial in maintaining competitiveness.

Interest Rates and Buyer Opportunity

On a positive note, interest rates have pulled back significantly in recent weeks, and small reductions are expected as we approach the end of the year. This could create renewed interest from potential buyers, particularly those who were previously hesitant due to rising rates.

Let’s dive into some of the latest insights from the National Association of REALTORS (NAR) and what leading economists are predicting for the months ahead.

Instant Reaction: Mortgage Rates – September 12, 2024

By: Jessica Lautz The average 30-year fixed mortgage rate from Freddie Mac fell to 6.20% this week, down from 6.35% the week prior. At 6.20%, a monthly mortgage payment on a $400,000 home with 20% down would be $1,960. For buyers with 10% down, the monthly payment would be around $2,205.

Positive Takeaways:

- Interest rates are down 1.59% from their peak in October 2023, offering a significant saving for buyers.

- A $400,000 mortgage today would save you $341 monthly, or $4,092 annually compared to last October’s rates.

- Inflation is at its lowest level since February 2021, and the Federal Reserve is expected to cut the Fed Funds rate imminently.

Challenges:

- Despite the expected rate cuts, mortgage rates may not decrease further, as these cuts have already been accounted for in the current market.

- While mortgage applications have increased, nearly 47% of these applications are refinancings, not new home purchases, signaling continued caution from potential buyers.

Instant Reaction: Jobs Report – September 6, 2024

By: Lawrence Yun The net monthly job additions averaged 116,000 over the past three months through August, which is a relatively light figure. This could suggest the potential for job losses if the economy faces an unexpected downturn. However, the good news is that the Federal Reserve is expected to cut interest rates as early as mid-September, with more rate cuts anticipated in 2025.

The average mortgage rate is already reflecting these anticipated cuts, currently sitting at 6.3%, down from the 7-8% levels we’ve seen over the past 18 months. FHA and VA loans are seeing rates even lower, under 6%.

What This Means for the Housing Market:

Historically, a weakening job market does not necessarily mean a drop in home prices or sales—especially if it’s accompanied by falling interest rates. With over 90% of the workforce still employed and many considering their jobs secure, falling mortgage rates could exert more influence on the housing market than employment numbers. This could be the case once again if rates continue to drop, spurring homebuyer activity.

Conclusion

In summary, while we are still navigating a buyer’s market, there are promising signs on the horizon. Interest rates are gradually easing, providing an opportunity for buyers who have been waiting on the sidelines. Sellers, however, must remain proactive in pricing their properties correctly and adjusting to market conditions as we move into the fall season.

As always, BHGRE Senter, REALTORS is here to help you navigate these shifts in the market—whether you’re looking to buy or sell. With decades of local expertise and a full-time commitment to our clients, we are ready to provide you with the guidance you need for success.

If you’re considering making a move, give us a call today! Let’s make the most of the current market conditions together.

How Collaboration, Not Competition, Benefits Our Clients

Why We Don’t Do Property Management—and Why It Matters

At BHGRE Senter, REALTORS, we often get asked why we don’t offer property management services. The answer is simple: We’re committed to providing the absolute best service to our clients, and we believe that specializing in real estate sales—residential and commercial—is how we do that.

One of our core philosophies is authenticity—being exactly who we say we are and delivering an uncompromising experience. This means knowing where our expertise lies and where it doesn’t. Property management requires a different skill set and infrastructure, and while many REALTORS might try to take on anything that comes their way, we believe that approach can dilute the quality of service. Instead, we stay true to our calling by focusing on what we do best: buying and selling properties.

The REALTOR’s Calling: Putting Clients First

Our real estate license is more than just a qualification—it’s a responsibility. The National Association of REALTORS calls us to put our clients’ needs above our own, and we take that seriously. Accepting work outside of our expertise doesn’t serve our clients. Unfortunately, too many licensees attempt to take on roles they aren’t fully equipped for in an effort to stay competitive. But at BHGRE Senter, we believe that professionalism means knowing when to say no.

If we aren’t the best fit for your needs, we won’t hesitate to connect you with someone who is. This is not about passing on a deal—it’s about delivering the service our clients deserve.

Collaboration Over Competition

One of the greatest benefits of our approach is the strong relationships we’ve built with property management firms here in Abilene. Instead of competing with them, we collaborate. When clients come to us seeking property management, we confidently refer them to trusted partners who excel in that area. In turn, many of these partners refer clients to us for real estate transactions, ensuring that everyone—most importantly, the client—gets the dedicated, expert service they need.

This philosophy extends beyond property management. Whether it’s a residential agent referring to a commercial expert, or a commercial agent connecting a client with a property manager, our focus is always on collaboration. The unfortunate truth is that when agents stretch beyond their core competencies, the client often suffers. We refuse to let that happen.

Upholding Our Standards for Nearly 70 Years

At BHGRE Senter, REALTORS, we are dedicated to upholding the high standards of our profession. We’ve been a trusted part of the Abilene community for nearly 70 years, providing exceptional service in real estate sales. If your needs extend beyond our expertise, you can still call us! Our referral network—developed over decades and strengthened by our franchise partnership with Anywhere Real Estate, the largest real estate franchiser in the world—ensures that you’ll always be connected with the right professionals.

Our commitment to our clients is unwavering. If you need guidance in residential or commercial real estate, we’re here for you. And if property management is what you need, we’ll point you in the right direction—because that’s what you deserve.

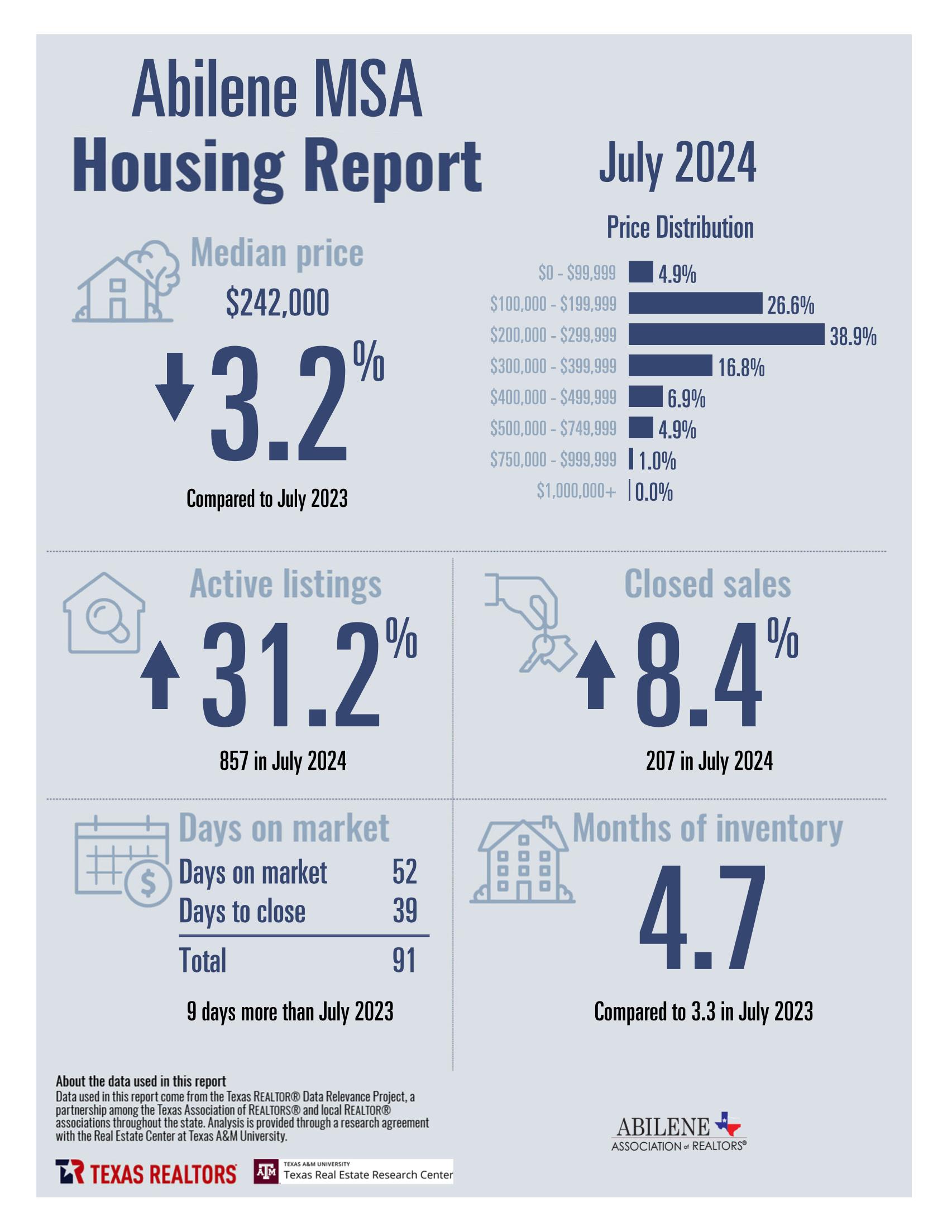

Abilene Housing Insights: July 2024

Rising Inventory Levels

Rising Inventory Levels

Inventory levels in Abilene continue to rise, increasing options for buyers across various price ranges. While higher interest rates were still a factor for much of July, we began to see a pull-back towards the end of the month, which continued into August.

Sales Trends & Market Comparison

It’s important to note that home sales were up in July 2024 compared to July 2023, but context is key. July 2023 saw a significant drop in sales, and although July 2024 showed improvement, the numbers were slightly down from June 2024. This signals a market that is still finding its footing.

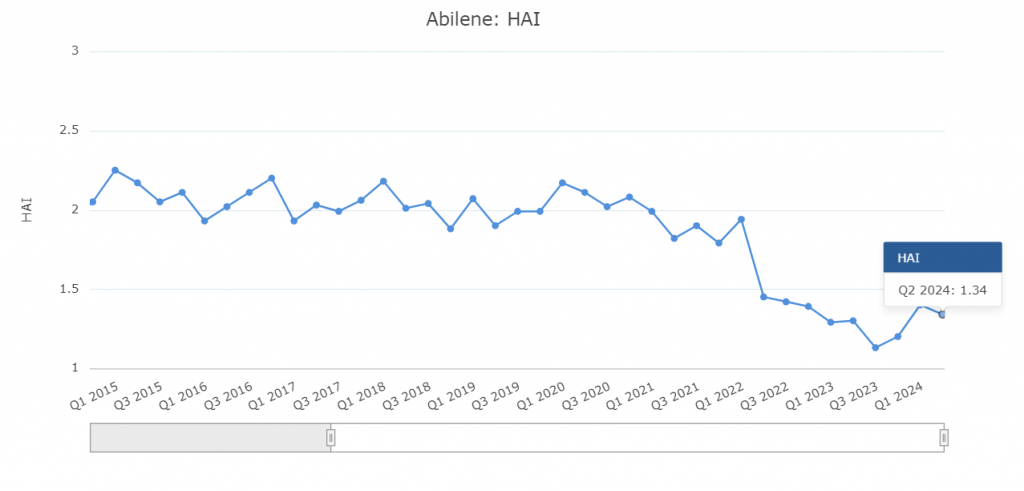

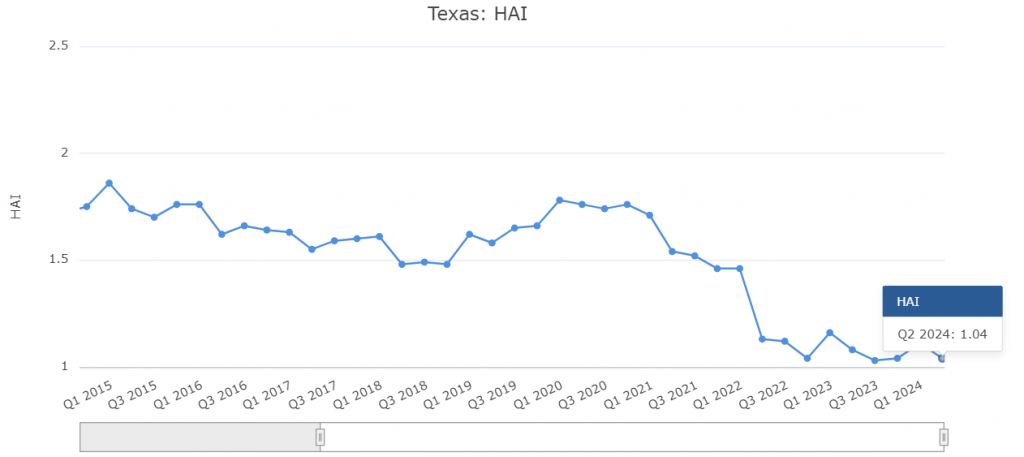

Housing Affordability

Housing affordability is gradually improving but remains a challenge. Throughout 2024, affordability has tempered buyer demand, with property prices, insurance costs, and taxes being the main factors. Sellers should be aware of this trend when pricing their homes.

Seller Concessions & Buyer Assistance

Seller concessions continue to remain high in most price ranges. Buyers needing closing cost assistance can reliably expect to receive support from sellers. This is a strong advantage for buyers navigating today’s market.

New Construction vs. Pre-Owned Homes

The supply of new construction housing remains strong. Sellers in the pre-owned market should be mindful of how their property compares in terms of features and pricing. Price reductions are becoming common, particularly among overpriced pre-owned homes. Now more than ever, receiving expert guidance from a skilled listing agent is crucial.

Interest Rates & Economic Insights

Let’s dive into some insights from NAR economists on interest rates and what to expect moving forward.

Instant Reaction: Mortgage Rates (August 8, 2024)

By Jessica Lautz

- Facts: The 30-year fixed mortgage rate from Freddie Mac dropped to 6.47% this week, down from 6.73% last week. At this rate, with 20% down, a monthly mortgage payment on a $400,000 home is $2,016. This is $285 less per month than in October 2023 when rates were 7.79%, saving homeowners $3,420 annually.

- Positive: This week’s mortgage rates are the lowest since May 2023, marking the biggest one-week drop in nine months. Mortgage applications are on the rise, presenting an opportunity for buyers who had been waiting on the sidelines.

- Negative: While this drop in rates is positive, it’s just one aspect of housing affordability. Home prices remain high, and the rates provided are a weekly average.

Instant Reaction: CPI (August 14, 2024)

By Lawrence Yun

- Inflation Trends: Inflation is calming, setting the stage for the Federal Reserve to begin cutting rates in September. Consumer prices rose by 2.9% in July, with expectations to reach the desired 2% in the coming months. The Fed has indicated it may begin cutting rates as inflation nears 2%, rather than waiting for it to hit that target.

- Shelter Costs: Shelter costs have decelerated to 5.0%, still high but trending down, thanks to a temporary oversupply of new apartment units. However, auto insurance has skyrocketed, up 19% from last year, which could negatively impact property insurance costs.

- Rate-Cutting Cycle: The rate-cutting process is expected to continue through 2025, with six to eight rounds likely. The new normal for mortgage rates may settle around 6%, a notable change from pre-COVID levels of around 4%.

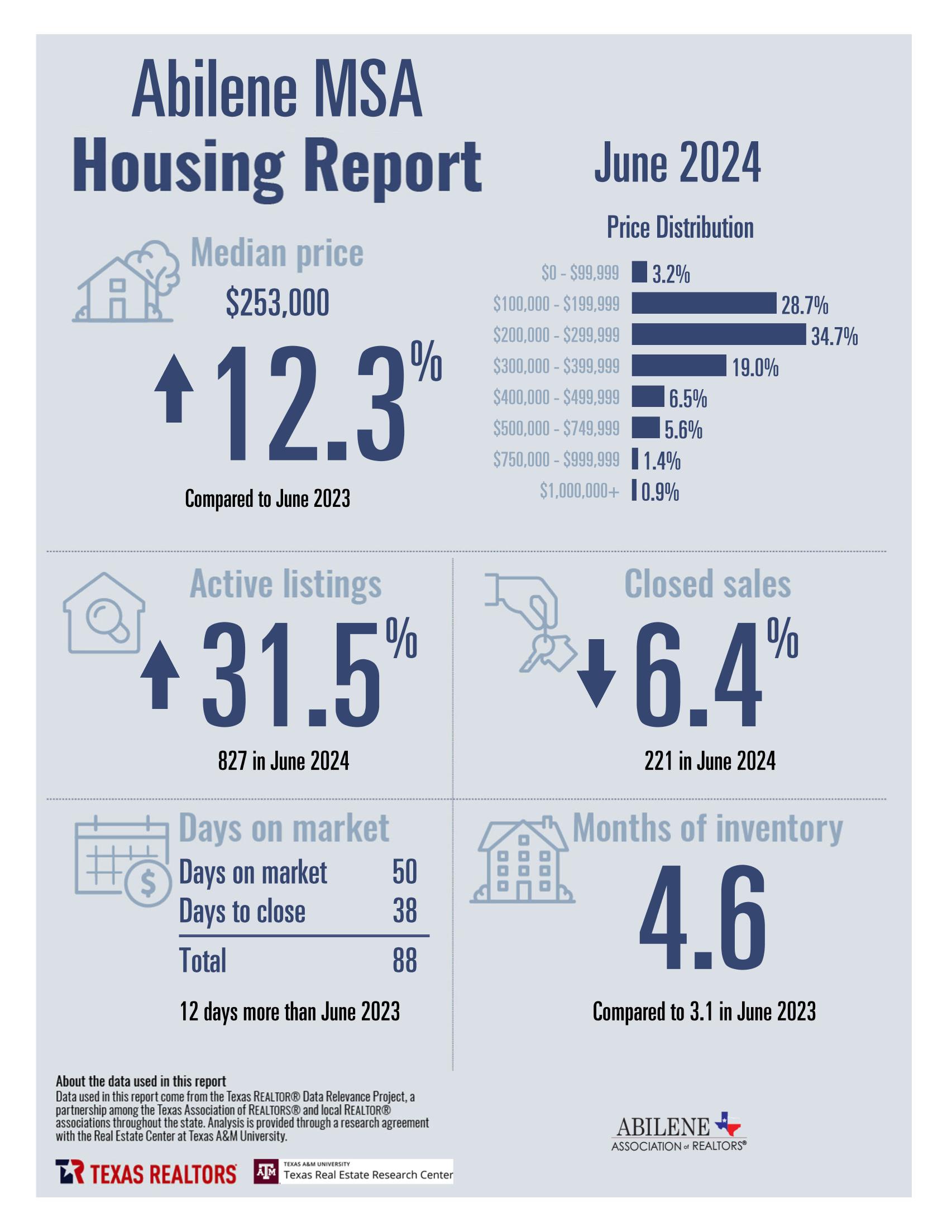

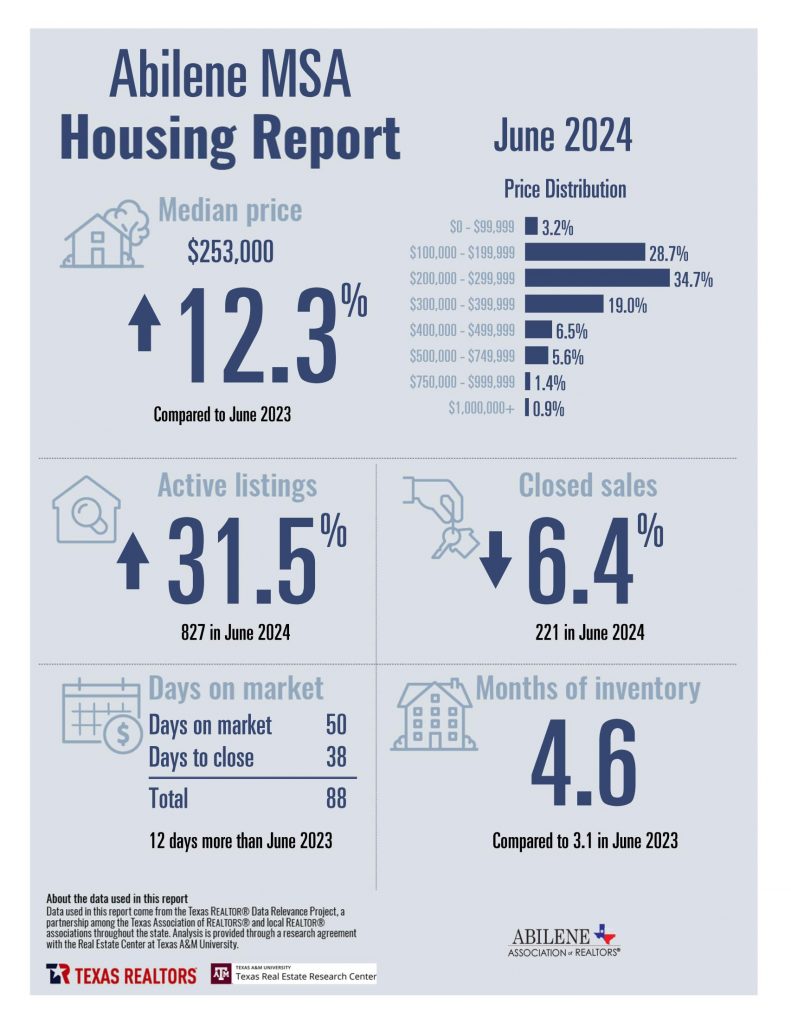

Abilene Housing Insights: June 2024

As we wrap up the first half of 2024, let’s take a closer look at the Abilene housing market trends and key insights from top economists at the National Association of REALTORS®.

Market Trends:

- Inventory Levels: We’ve seen a steady rise in inventory from 3.7 months and 684 total listings in January to 4.6 months and 827 total listings in June.

- Sales Activity: Year-over-year, sales have dipped by approximately 7% compared to 2023.

- Price Movements: Home prices have increased by 7-8% in most price ranges.

- Time to Close: The average time to close has been hovering around 90 days for several months now.

Looking Ahead: While significant changes are not anticipated in the immediate future, better terms may be on the horizon. Here’s what some of the leading voices in real estate economics are saying:

Lawrence Yun, Chief Economist at NAR:

- New Apartment Units: The completion of new apartment units reached a 50-year high in June, leading to a halt in rising rents in many cities. Interestingly, rents have decreased in cities like Austin, Nashville, Charlotte, and Phoenix due to an oversupply of rental units.

- Future Concerns: New multifamily housing starts are currently at a 10-year low due to high financing costs and low rent growth, which might lead to a rental housing shortage in the future. Single-family housing completions were above 1 million, but new starts were below this mark. Lower interest rates could potentially increase housing supply and lower future housing inflation.

Jessica Lautz, VP of Demographics and Behavioral Insights at NAR:

- Mortgage Rates: The 30-year fixed mortgage rate from Freddie Mac dropped to 6.89% recently from 6.95%. At this rate, with a 20% down payment, a monthly mortgage payment on a $400,000 home is $2,105; with a 10% down payment, it is $2,369.

- Inflation Insights: The CPI has retreated, with shelter costs showing slower gains. Fed Chair Jerome Powell indicated a potential path to lowering the Fed Funds rate if inflation continues to cool. However, Powell also noted that we likely won’t see the ultralow rates of the past decade return, meaning buyers waiting for historically low mortgage rates might be waiting for a long time.

Conclusion: As we navigate through 2024, the Abilene housing market continues to show resilience despite national trends. Whether you’re buying, selling, or investing, staying informed and working with experienced professionals like those at BHGRE Senter Realtors can make all the difference. Let’s keep an eye on these trends and insights as we move forward! Contact Us if you need assistance with your real estate goals today.

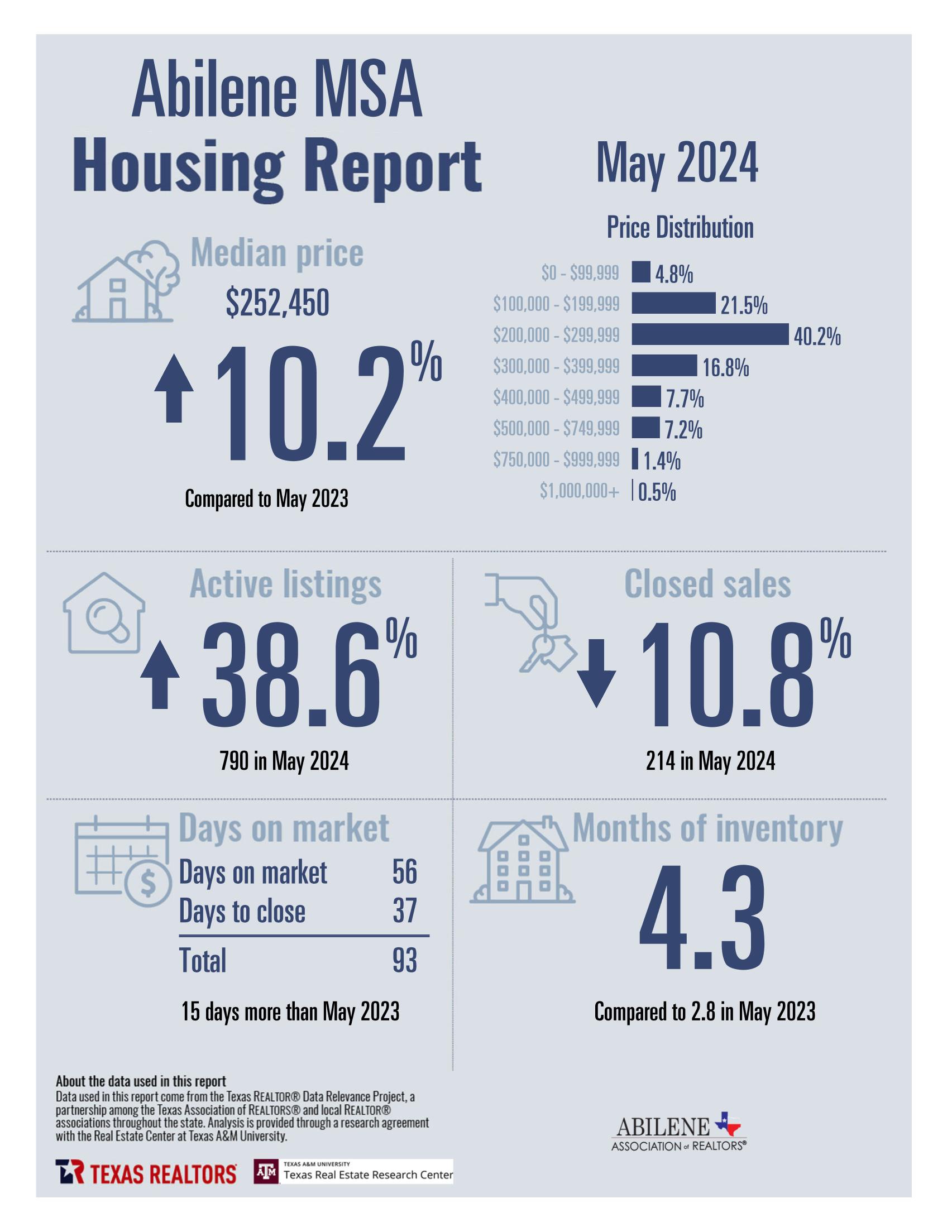

Abilene Housing Insights – May 2024

Welcome to our latest housing market update for Abilene. As we dive into the data from May 2024, we’ll explore the trends and shifts that are shaping the local real estate landscape. Plus, in celebration of National Homeownership Month, we’ll reflect on the importance of owning a home and how it impacts our community.

Inventory Continues to Soar

The inventory in Abilene is on the rise, with active listings up almost 40% compared to last year. This increase has brought the market to 4.3 months of inventory, marking the highest level we’ve seen in over five years. For buyers, this means more options and a less stressful purchasing process, as the high inventory levels provide a more relaxed environment.

Price Reductions and Stable Property Prices

While we’re seeing a significant number of price reductions, the overall property prices have remained mostly static. The median sales price is up 10% compared to May of last year. However, when we look at the broader data, we notice only a small 3% rise in prices year-over-year. This slight increase is expected, considering the sales prices remained mostly flat throughout 2023. Despite the large amounts of price reductions, the sold data shows very minor adjustments in the final deals year over year.

Affordability and Seller Concessions

Housing affordability remains a challenge, but it has become the new normal. Sellers are adjusting to the market dynamics, offering substantial price reductions and concessions. Buyers can benefit from these high levels of seller concessions, making it a favorable time for those looking to purchase a home in Abilene.

National Homeownership Month

June is National Homeownership Month, a time to celebrate the joys and benefits of owning a home. Homeownership is a cornerstone of the American Dream, providing stability, building wealth, and fostering strong communities. At BHGRE Senter, we are dedicated to helping our clients achieve their homeownership goals. Our decades of experience and full-time commitment to our profession and clients ensure that we are the constant you can count on in this ever-changing market.

Let Us Guide You

The real estate market is always evolving, but our commitment to our clients remains steadfast. Whether you’re buying or selling, our team at BHGRE Senter is here to guide you with expert knowledge and personalized service. Let us help you navigate the current market conditions and find the perfect home for you and your family.

Thank you for trusting us with your real estate needs. If you have any questions or need assistance, please don’t hesitate to reach out. Happy National Homeownership Month from all of us at BHGRE Senter!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link